SOLUSD.P trade ideas

Solana (SOL) Analysis & Long Trade Plan – May 2025Solana ( CRYPTO:SOLUSD ) has re-emerged as one of the strongest Layer-1 blockchain plays, continuing its impressive recovery and adoption since the FTX fallout. With major ecosystem developments, lower fees, and blazing-fast throughput, SOL is now more than just an "Ethereum killer"—it’s a key pillar of the next wave of decentralized apps.

🔍 Current Technical & Fundamental Snapshot

Price: ~$151 (as of May 1, 2025)

Market Cap: ~$71B

24h Volume: ~$2.1B

Rank: Top 5

TVL: Over $4.2B

NFT & DeFi growth: Rapid expansion on platforms like Jupiter, Drift, and Tensor

Ecosystem Catalysts:

Firedancer validator client nearing launch (scaling & security upgrade)

Breakpoint 2025 announcements expected soon

Ongoing migration of dApps from Ethereum due to gas costs

📈 Chart Overview (Weekly Timeframe)

Trend: Bullish

Support Zones: $147, $145

Resistance Zones: $165, $195

Structure: Forming higher lows and higher highs since 9th April 2024

RSI: 63 – no signs of overbought yet

Volume: Healthy on green candles, strong accumulation

🎯 Long-Term Trade Plan (Q2–Q4 2025)

✅ Entry Zones:

DCA Zone: $150–$155

Aggressive Buy: $145 retest (if market pulls back)

🎯 Targets:

TP1: $165

TP2: $195

TP3: $260 (previous ATH zone)

TP4: $320 (expansion based on 1.618 Fibonacci)

❌ Stop-Loss:

Close daily candle below $138 with volume (invalidates structure)

🧠 Risk-Reward Outlook

R:R from $152 to $195 = 1:3

Macro Bull Scenario to $260 = >1:7.5

Probability Adjusted Expectation: High, due to strong ecosystem use and dev activity

📌 Final Thoughts

Solana has proven its resilience, fixing past outages and seeing revived interest from both developers and institutions. With token unlocks behind us, clean funding rounds, and real user activity, SOL remains a solid long-term crypto play for 2025.

⚠️ Not financial advice. Always DYOR and manage your position size properly.

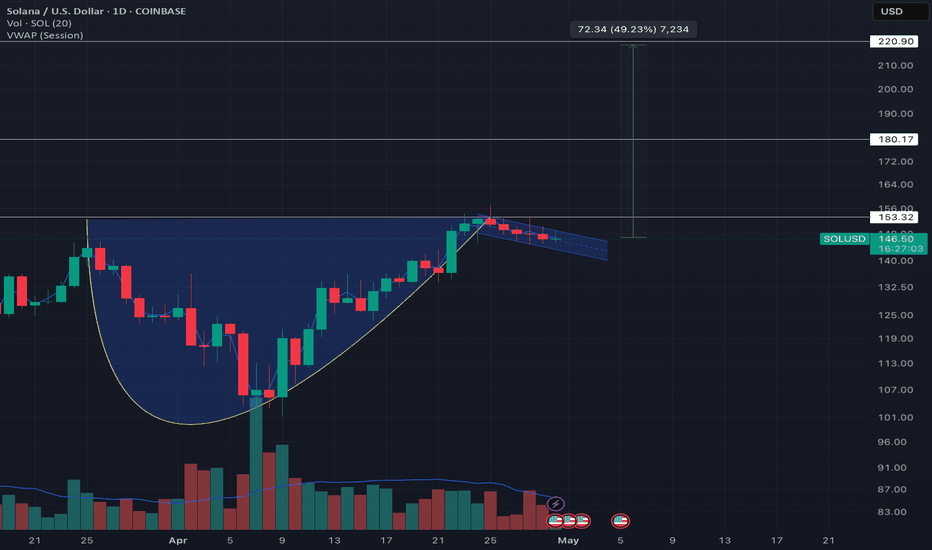

Solana Might Rally Towards $220 Solana is currently forming a classic cup and handle pattern on the daily chart, which, when confirmed, is a strong bullish continuation setup.

The cup formed over several weeks with a rounded bottom and volume decreasing midway through the base, which aligns with traditional pattern behavior.

The current handle is consolidating as a downward-sloping bull flag. Volume is gradually tapering off during the handle — again, a textbook characteristic suggesting sellers are losing steam.

A daily candle close above ~$153.30 on solid volume would confirm the breakout.

That level also aligns with previous local highs, making it a key resistance zone.

Once confirmed, the pattern implies a measured move target near $220, derived from the depth of the cup.

Stop-loss could be a close below the previous local lows.

What do you think of this setup? Would you enter on the breakout or wait for a retest?

SOL - Getting ready for Big Breakout.Price has taken double bottom support. Price rejection from second resistance line is getting reduced. Any up move from BTC, SOL will give bigger breakout for sure. So trend will follow in whichever side price breaks the lines. I think not much downside can be seen in SOL since it has fallen from 250 levels to this low. SOL is next to BTC and ETH right now and its widely used. Price is at very attractive levels keeping ETF approvals in few weeks or 2 months this year. SOL is also one of the coins for strategic reserve.

Solana 4H Swing Long Entry Setup - Solana is currently trading at 128.8$

- Solana is trying to shift its market structure to bullish, and this will be confirmed once we see a flip above 136-139$

- Solana on a 4H TF is trying to build a consolidation base which should eventually lead to a larger expansion

- Solana and the whole crypto market is currently waiting for a bullish catalyst in order to move higher

- We have 4 central banks speaking this week all eyes on what Jerome Powell will comment and this will dictate the price action for the upcoming weeks.

- Manage risk properly and don't over risk

SOLUSD ANALYSISSolana (SOL/USD) is in a consolidation phase within a range on the H4 timeframe, repeatedly taking support from its 200 EMA. This suggests a potential breakout scenario. 🚀

Possible Trade Setups:

Breakout Above the Box (Bullish Scenario)

If SOL/USD breaks the resistance of the consolidation range with strong volume, it could trigger an upward momentum.

Targets: Measure the height of the box and project it upwards.

Confirmation: Look for a candle close above the range + increased volume.

Breakdown Below the Box (Bearish Scenario)

If SOL/USD breaks below the support of the box and the 200 EMA, it may lead to strong downward movement.

Targets: Similar to the bullish scenario, measure the box’s height and project it downward.

Confirmation: A candle close below the range with strong volume.

Key Things to Watch:

✅ Volume increase on breakout.

✅ Retest of the breakout level (flip of support/resistance).

✅ Market sentiment and BTC movement (as SOL is correlated).

I just spot bough 100% SOLBanana Zone commence?

Interest rates will lower next year.

I just could not be in stables right now. It just did not seem right.

I don't have the time to be day trading, although I have recognized set ups that I may take the time to trade during trending days. Pullbacks end with small bodied candles which provide tight SL scalp opportunities. Impulsive days may have 3 or 4 pullbacks and breakout setups before the price action does wide shakeout, double bottom patterns. Solana in the intraday also tends to end trends with diagonals, up or down. Break out and retests are very common especially at the beginning of trends. I have noticed I also tend to have a bearish bias at all times, and my eyes have been trained more for bearish setups. The bullish retests tend to be more volatile, I have noticed.

Perhaps I will spot sell at a future date. In a couple weeks even. I do not expect the next month to see parabolic action. I anticipate consolidation, but that is my bearish mindset talking. I am not bullish enough?

The boxes set context to the chart. Its a copy paste of the current pullback.

Solana Next Target is 202, 251 USD.. Triangle Pattern BreakoutSolana has formed a Triangle Pattern and Breakout, with the Next Target at 202 USD and a Final Target of 251 USD. Take advantage of this Great Opportunity to Earn a Potential Profit of +45% ROI and Overall +74%ROI. Check my Previous Analysis below, already reached the first Target at 174 USD with (+20% Profit).

This is a Long-Term Analysis, it's important to follow Trend continuation techniques.

I want to help People Make Profit all over the World.

PREVIOUS ANALYSIS : Before & After,

Solana Price Prediction: A Bullish Pattern FoundSolana is currently facing a resistance block that is preventing it from advancing. However, an intriguing bullish pattern's neckline is on the verge of breaking, which could potentially trigger a significant rally. Technical analysis suggests that this breakout might even lead to new all-time highs, driven by bullish momentum.

Recent chart analysis has added to the optimism surrounding Solana, indicating that it is forming a bullish pattern known as an "inverted head-and-shoulders." The cryptocurrency's recent performance has pushed it above the 200-day, 50-day, and 20-day moving averages.

At the time of writing, SOL is priced at $153.14 and appears to be struggling at the pattern's neckline. If Solana can successfully close and maintain its position above the $160 resistance level.

Possibly then, it could pave the way for a push towards retesting its yearly highs around $210. This potential move would represent a substantial gain from current levels and could reignite interest in the altcoin.

The broader cryptocurrency market has been showing signs of recovery from recent lows, thanks to recen BTC push towards $66000. This sentiment may provide additional support for Solana’s upward momentum, ahead too.

As investors seek opportunities in the rebounding market, SOL’s approach to the key resistance level has positioned it as a focal point for traders and enthusiasts.

Solana Long Term Analysis- Solana is currently trading at 146$

- Solana is building up a strong base where I easily see Solana purging 200$

- Solana from a Spot Accumulation perspective is sitting at a very bargained price if you are still fiat then add 50% Sol here

- From a swing trade perspective Solana can easily yield 20% from its current price and go up to 163-178$

- Solana's fundamentals are strong so in a major bull run you can expect Solana to easily move up to 500%

- Solana tops all the crypto when it comes to transactions

- Solana also tops all the cryptos when it comes to meme coins listing

- After considering all these points, please avoid becoming overly optimistic and thinking that Solana at this price is the only great option, so you should invest all your funds. Instead, consider adding 50% of your desired investment size here and wait for a significant price drop. If the price doesn't drop further, you can still benefit from the 50% you've invested and let it reach your financial goals.

Solana Swing Long Update - Solana is currently trading at 147.6$

- Solana is up 15% from my call out

- Solana can easily purge 160$ and above

- There are 2 paths that Solana can follow first where we see it retracing back to 135-140$ and the moving above with more strength, second path where we see it moving up to 160$ without a stop and the retrace back

- I will wait for Solana to revisit 135-140$ and that's where my first point of interest lies

Breakout Point Is Not So Far Anymore In SOL Price

Zooming out to the daily time frame, it's evident that the declining trend line is just above the current SOL price. A breakout here could indicate a significant upward movement.

Since SOL and many other altcoins often follow Bitcoin's sentiment and actions, if Bitcoin can return to its previous local high of just over $65,000 and surpass it, the bull market could resume, and altcoins might start to rally.

The potential bull run targets for SOL before the end of the year are $160, $200, and $260. However, if SOL drops below $120, it could be at risk, likely due to a simultaneous decline in Bitcoin. Given Bitcoin's strong fundamentals and positive sentiment, optimism remains high.

Solana Swing Spot Long Setup - Solana is currently trading at 127.2$

- Solana is at a perfect spot to be accumulated for Spot buys if you are looking to accumulate cryptos that will bounce back first

- Solana is also standing strong because a lot of memes are getting launched on Solana's also making Solana's price less volatile

- Accumulation Zones - 108-125$

- SL - 10-15%

Solana On 5-Day Losing Streak: Can Bulls Make A Comeback? Solana On 5-Day Losing Streak: Can Bulls Make A Comeback?

Solana has been in a free fall, after suffering bearish pressure near the psychological level of $160.

The social sentiments have started to improve indicating a possible recovery in the price.

Solana (SOL) price has been on a free fall for the last five intraday sessions losing nearly 15%. Moreover, except for the buying sessions, this has been a bearish dominated month for Solana.

SOL price performance highlights a 22% loss in the asset's value this month. At the time of writing, Solana was exchanging hands close to $138.5 recording a nearly 1.08% loss in intraday.

Let's analyze and try to figure out whether Solana could break this losing and recover in the next week?

Social Sentiments Highlight Increasing User Engagement

Despite the losing trend in the recent sessions, the analysts noted an important development in on-chain metrics: social metrics. The social metrics include social dominance, social volume, and activities on social media platforms.

As per the analysts, the social dominance as well as social volume curve has improved in the recent sessions indicating the rising engagement of Solana on the social media platforms like X (Formerly known as twitter), Telegram etc.

Moreover, the other social metrics twitter follower curve hints a positive growth of nearly 2000 users a week. The increasing engagement of the users over social media often reflects a positive impact on the asset price most of the time.

Moreover, Solana boasts a market capitalization close to $64.67 Billion placing it at the 5th in the crypto space. The transaction volume has dropped to $2.19 Billion losing 9% a day. Currently, the volume to market cap ratio at 3.42% suggests low volatility in the crypto.

Can Solana Continue to Slide Towards $130 Level?

The recent selling pressure has widened the losses incurred this month again. Solana experienced a tough month induced with volatility. The price started off August with a sharp decline from $180 level to $110 level. Thereafter, the bulls then turned aggressive and the price recovered back till $163. Again the bearish forces dragged the price close to $140 level.

From a technical standpoint, Solana price has lost the support of important key moving averages of 20, 50 and 200 days exponential moving averages indicating weakness. On the lower side, the $140 level may act as an immediate support which if breached may allow sellers to dominate till the next support of $130 level.

At the time of writing, both the RSI and 14 day SMA line had stepped down below the mean line of 50. Moreover, a bearish crossover of both the lines was observed indicating a possible bearish trend continuation.

Solana (SOL) experienced a significant decline, losing nearly 15% over the last five sessions and 22% this month. Despite the bearish trend, social metrics show positive growth, with increased social media engagement.

The whole month has been volatile for Solana, dropping from $180 to $110, then recovering to $163 before falling again. From a technical perspective, SOL has lost support from key moving averages of 20, 50 and 200 day EMAs. Currently, the price was hovering near $140 as immediate support and may slide towards the $130 if bulls fail to defend. Both RSI and 14-day SMA indicate a potential bearish continuation.

Solana (SOL) Possbile liq$ grabSolana (SOL)

For the past six months, Solana has been stuck in a flat trend and recently made a lower low. This is not bullish and is rather concerning for anyone hoping for higher levels. The price also closed the week with a 9% loss.

While support at $130 has held well to date, this does not guarantee that it will be tested again in the future. Even if the trend is flat, the price action leans bearish, which could see bears return.

Looking ahead, unless the overall market sentiment improves, Solana will struggle to rally again. The current resistance is at $164.

Decoding, The Next Possible Outcome In Solana Price

Indeed, the giant-Solana had a robust fundamental, with strong community interest, but the price has been struggling at a specific supply.

The last experienced a more than 1000% surge from $18 on September 2023 to $209 by March 2024. Despite the various attempts of bears, the SOL had a robust demand area of $120, and over time, it showed its robustness and remained intact.

Over the larger frame, the price structure had earlier displayed a descending triangle breakout with a breach of the dynamic falling trendline from July 13th, 2024. But, this pattern was on the brink of getting nullified as the price showed uncertainty by declining up to critical support at the $160 mark and coinciding 50-day EMA band.

The level has become a deciding factor for the pattern's usefulness; once it rebounds successfully, then the highs could be attained. But, on the contrary scenario, if $160 happens to be breached below with increased bear dominance, the price could hit lows.

The Indicators showcased that the price has been above 50-day, and 20-day EMA bands. The fall has built a bearish cross above the zero line, where the histogram was at negative 1.99.

Meanwhile, the RSI has breached the median line, which flashed at 48.35. The overall indicators depict the bearish dominance increasing, where bulls are mildly conscious, supporting the price to be sustained. Thus, it brings uncertainty in SOL prices. Investors and traders should stay cautious (DYOR).

Therefore, if bearishness exceeds, then bears could eye support at $145 and $135. However, the resistance for the flip conditions is at $175 and $190.

Solana Price Structure Analysis Over Daily Chart!

According to Tradingview, an all-time low was achieved by December 29th, 2022, where the low was $8.00.

Comparitively to that low, the current price, as of writing has traded more than 1900% higher on the daily chart. However, the all-time high was registered on November 6th, 2021, where the high was $260. Comparatively, the current price has traded nearly 37% lower than its ATH.

At press time, the Solana (SOL) price traded at $162.28, with an intraday advancement of 2%, nearly 17% of this week, and 32.5% over the past two weeks.

The SOL has been showing a strong demand zone of $120, and over time, it proved unbreachable, as, despite the bearish sentiment before, the support zone remained intact.

Over the broader picture, the price action appears to have formed a descending triangle, where the $120 support zone acted as a lower border, and dynamic trendline resistance acted as the upper border of the triangle.

Based on the bullish thrust, it's expected to reach $170, which seems to be the upper border resistance, the larger momentum could pierce the upper border, and the break out could pop out.

Where the price would retest the supply at $200, at first, and beyond this would run for recapturing the lost territories back.

Indicators Perspective Of Solana (SOL) Over Daily Chart!

As per the daily chart, the indicators mostly remain optimistic for its price, as the asset is showing bullishness and the rising potential price has jumped from 50-day and 200-day EMA's, and it remained above under the direct influence of the buyer's surge.

Meanwhile, the MACD has displayed a strong bullish crossover, with a growing histogram at 3.24, where the MACD line is at 4.29, and the signal line is at 1.04. The RSI is increasing gradually, signifying that the Solana asset is gaining traction and moving above a median line at 63.63.

Price Forecast Of Solana!

If the price keeps on bulging above, then the price could meet the interruptions at the $180.0 and $190.0 mark. On the contrary, if the price fails to jump, and breaks $155 support, then the price could reach $140, as well.

Solana’s Popcat Nears $1 Billion Market Cap After Hitting ATHPopcat has emerged from the convergence of internet memes and cryptocurrency. The meme coin depicts a playful feline, and it serves as inspiration for this digital asset, which has captured the attention of investors and crypto enthusiasts as it tallies a new milestone.

Popcat Scales The Crypto Food Chain

Popcat has been showing a big deal of resilience since it made a foray into the memecoin space in 2020. Fast forward four years, the token tallied an incredible 180% growth in value in 30 days.

The coin achieved an all-time high of $0.7542 in 24 hours, up roughly 30%. This latest achievement puts the memecoin at the top of the cryptocurrency hierarcSolana’s Popcat Nears $1 Billion Market Cap After Hitting ATH

Solana (SOL) Price to Continue 16% Rally With Bullish CuesSolana’s

SOLUSD

price has good things ahead of it since the altcoin has been performing well for the past two weeks.

The investors are also betting on a price rise, which is evident in the funding rate, as they aim beyond $150.

Solana Sees Positive Cues

Solana’s price benefits from the broader marker bullish cues, which is evident in the Relative Strength Index (RSI). The RSI has entered the zone above the neutral line for the first time in a month, marking a significant shift in market sentiment.

This recent change is largely attributed to a prevailing bullish market trend, which has been driving up prices. The surge in Solana’s price has been a key factor in fueling this newfound optimism and boosting investor confidence

Solana Price Crashes Below $130: Crypto Investors In Panic?Solana Price Crashes Below $130: Crypto Investors In Panic?

Solana price crashed below the $130 level breaking the dynamic support of 200 day EMA.

The recent fall in the broader market has triggered a panic among the short term Investors.

Solana has crashed over 39% from its recent high of $208 formed in March 2024.

Solana price has crashed below the psychological $130 level and the weakness in the broader markets have triggered a panic among the short term traders and investors. The price has slumped, breaking the 200 day exponential moving average thus shifting the long term trend into bearish territory.

At the time of writing, the SOL price was exchanging hands close to $126.3 recording a negative intraday development of 1.73%. The price currently hovers near the annual lows which may break if the panic selling resumes.

Transaction Volume Grows, Despite Fall In The Price!

Recently, Solana crashed after failing to gain ground near the psychological $150 level. The strong selling pressure dragged the price near the annual lows of $130. The SOL price is down over 23.7% as of now this month and is at a risk of falling towards the next $100 demand zone.

Moreover, the volume analysis shows that the intraday transaction volume has surged by over 207.21% to $2.24 Billion a day. Correlating it with the price it was observed that the transaction volume has constantly been increasing as the price resumed its fall below the $150 level.

It points to the rising participation of the sellers which may result in a continued selloff. The volume to market cap is low at 3.80% indicating low volatility. Solana ranks 5th in the cryptoverse with a live market capitalization of $58.487 Billion.

Can Solana Crash Towards $100!

The Solana crypto seemed to be under a strong selling pressure at the moment which may trigger a breakdown below the annual support of $125 level. Now, If the bulls fail to establish their presence near the $125 level, then the panic selling may resume towards the $100 level.

From a technical point of view, the price has slipped below the all the key exponential moving average of 20, 50 and 200 days indicating a bearish reversal in the long term as well as short term.

At the time of writing, the RSI line was placed near $30.32 points and that of the SMA line was placed near $36.61. Both the lines were hovering below the mean line indicating weakness over the charts. Moreover, a bearish crossover was observed on the charts indicating a trend continuation.

Conclusion.

Solana price has plummeted below $130, signaling a shift to a bearish trend as it broke the 200-day exponential moving average. Moreover, the intraday trading volume spiked by over 207% to $2.24 billion, aligning with a price drop below $150 and suggesting increased seller activity. Despite low volatility indicated by a 3.80% volume-to-market cap ratio the crypto has been under a strong selling pressure.

The SOL price has fallen near an annual low at $125. Now, if the support at $125 fails, SOL crypto may tumble towards $100. Technical indicators show a bearish reversal, with RSI and SMA lines below their mean, hinting at ongoing weakness and potential trend continuation.