Demand Zone spotted________________________________________

📈 NATURAL GAS – Strong Demand Zone Identified, Bulls Eyeing Pullback Entry

📆 Date: June 9, 2025

🔍 Timeframe: 15-Minute

________________________________________

Demand Zone Bounce Possible – Setup Favorable for Pullback-Based Entries

Natural Gas Futures are co

Contract highlights

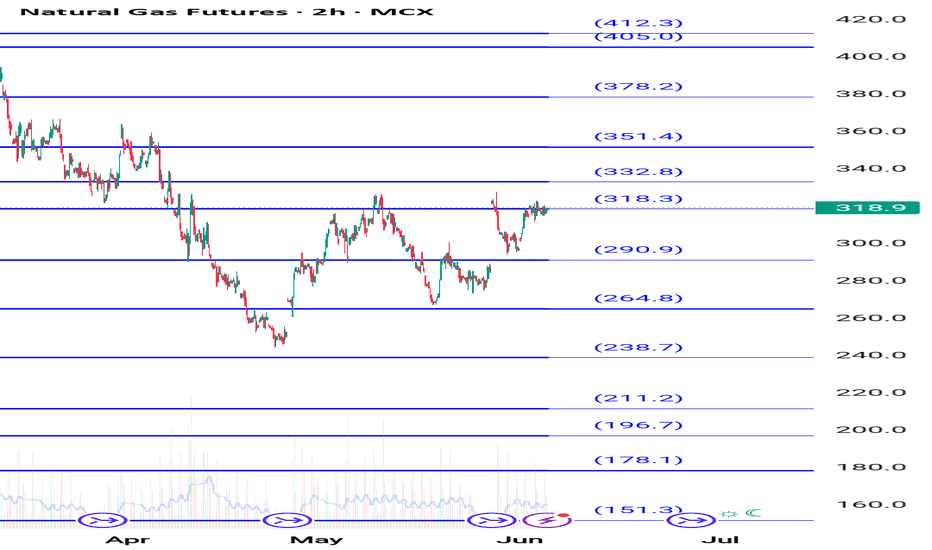

Natural gas 296 to 288 downside fall will come then up move comeHow to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early

Buy the base. Ride the breakout!

CMP: ₹310.20

Buy Zone: ₹309.50–₹310.50

Stop Loss: ₹308.50 (strict)

Targets:

• ₹314

• ₹318

• ₹322

⸻

Technical Thesis

• Demand Zone Reclaim: Price bounced exactly off the previously marked demand block near ₹309. This area has held as support multiple times.

• Volume Spike on Push: Last bullis

Natural gas in tight range 326 to 314 let it break How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early

Natural gas ad expected come down now if break 305 then buy 320 How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early

Natural gas 296 Target hit then bounce buy dip nowHow to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early

Natural gas not giving directional move better to avoid How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early

Natural gas fresh breakout above 326 then 345-60 How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early

Natural gas buy given at 305 Target 319 hit wait for dip buy How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Related commodities

Frequently Asked Questions

The current price of Henry Hub Natural Gas Futures (Dec 2025) is 4.672 USD / MMBTU — it has risen 1.02% in the past 24 hours. Watch Henry Hub Natural Gas Futures (Dec 2025) price in more detail on the chart.

The volume of Henry Hub Natural Gas Futures (Dec 2025) is 11.28 K. Track more important stats on the Henry Hub Natural Gas Futures (Dec 2025) chart.

The nearest expiration date for Henry Hub Natural Gas Futures (Dec 2025) is Nov 25, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Henry Hub Natural Gas Futures (Dec 2025) before Nov 25, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Henry Hub Natural Gas Futures (Dec 2025) this number is 70.58 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Henry Hub Natural Gas Futures (Dec 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Henry Hub Natural Gas Futures (Dec 2025). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Henry Hub Natural Gas Futures (Dec 2025) technicals for a more comprehensive analysis.