Crude MCX if break 5450 then temporary bottom formation done How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Futures market

XAGUSD if break 30.45 then short term buy signal active How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Silver if break 89950 then short term buy signal active How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Gold mcx no buy signal so will break low and make fresh new lowHow to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

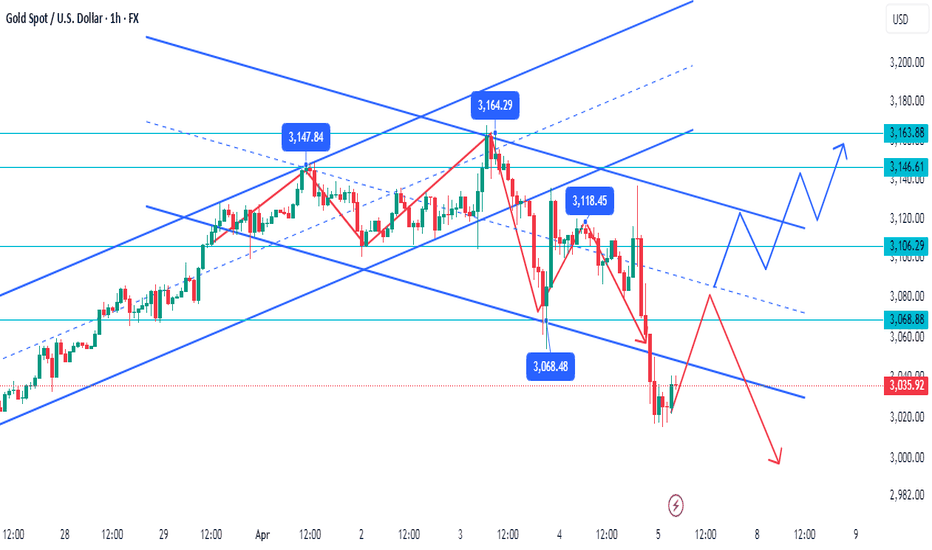

XAUUSD stil no buy signal so will break Friday's low and makenewHow to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Gold 4.6 AnalysisThe recent plunge in gold does not mean that it has reached its peak, but is affected by the liquidity crisis caused by the global market crash, rather than the top signal of gold itself. A similar situation occurred last year, so this plunge is not surprising. Whenever gold falls, there are always people who speculate that it has reached its peak, but in fact, the operation methods of the market leaders have led to this situation. They have completed the escape and bottom-fishing actions faster than retail investors.

The conditions for gold to reach its peak are not short-term market fluctuations, but world peace, economic recovery, and international cooperation between major countries. The current game is mainly concentrated between China and the United States. The competition between these two major economies has an important impact on the trend of gold. Gold has become a financial instrument in this context. The fluctuation of the market is the result of the alternation of long and short forces. The market essentially presents a cycle of prosperity and decline, alternation of yin and yang, and resurrection from death.

Regarding the future trend, although there may be further lows next week, the short trend may have been completed, so it is likely to rebound at the beginning of next week before a new downward band will be opened. Therefore, it is recommended to pay attention to the opportunity of pullback when operating, and avoid chasing shorts and chasing longs. If the gold price rebounds to the 3065-3075 area, you can consider shorting; if it falls to around 3000, you can try to rebound.

At present, the short-term trend of gold is bearish. The daily chart shows a big negative line falling and breaking through the short-term moving average. On the 4-hour chart, the Bollinger Bands open downward and the K-line shows a downward trend. The gold market has fluctuated violently recently. It first rose rapidly to 3136, and then fell back quickly, breaking the previous day's low. The current price has fallen back to around 3053, and gold may continue to adjust in the short term. The 3000 mark is a key support level. If it breaks through, it will further open up the downward space.

In general, gold is currently in a weak pattern and may continue to be under pressure to fall in the short term. Next week, pay attention to the support level in the 3050-3054 area. If the price rebounds to the 3060-3070 area, you can consider shorting. The important support level is 3000. If the price falls below 3000, it will continue to fall, otherwise it may rebound.

Gold price 3005-3010 can be considered for longGold price 3005-3010 can be considered for long

The current support level of gold price is 3005, and the current extreme support level is 2945

As shown in the figure:

3005 is already in the middle of the increase

With the big drop, gold prices fluctuate violently, investment risks increase, and repeated pull-ups of 30-50 points have become the norm.

The conventional 5-10 point stop-profit and stop-loss are obviously no longer applicable to the current market

We need to make changes

As volatility increases, market reversals are also accelerating.

Then the acumen, patience, and concentration of trading are all great tests.

Next, we follow the principle of symmetry + the law of conservation of energy and volume.

The important support level for the decline of gold prices should be set at: 3005, followed by 3015.

If it falls below 3005, the next support level will obviously go to 2945.

So the gold price may continue to fall sharply next week and enter a wide range of fluctuations.

The game between major powers will eventually come.

Operation suggestions:

Buy: 3015---limit price (aggressive)

Buy: 3005---limit price (conservative)

Buy: 2950---limit price (sound)

Long strategy: participate if there is an opportunity, continue to wait and see if there is no opportunity.

Sell: 3075---limit price (sound)

Sell: 3060--limit price (conservative)

Sell: 3045--limit price (aggressive)

Short strategy: participate if there is an opportunity, participate with a light position if there is no opportunity.

Be sure to control the order ratio and set the corresponding stop loss according to the order volume.

How to Use RSI+Bollinger Bands Together for High-Probability Title:

How to Use RSI + Bollinger Bands Together for High-Probability Trades 🎯📈

⸻

If you’re looking for a simple yet powerful way to spot high-probability trades, combining RSI and Bollinger Bands is a great method — especially for beginners.

Let’s quickly understand how each tool works and how to use them together:

⸻

What is Bollinger Bands?

• Bollinger Bands are made up of three lines:

• Middle Band (20-period simple moving average)

• Upper Band (Middle Band + 2 standard deviations)

• Lower Band (Middle Band - 2 standard deviations)

• The bands expand when volatility increases and contract when volatility drops.

• When price touches the Upper Band, it could signal overbought.

• When price touches the Lower Band, it could signal oversold.

Think of the bands like elastic boundaries — price tends to return to the middle after stretching too far.

⸻

What is RSI (Relative Strength Index)?

• RSI measures the strength (momentum) of price movements.

• RSI moves between 0 and 100:

• Above 70 = Overbought (buyers getting exhausted)

• Below 30 = Oversold (sellers getting exhausted)

• Between 30-70 = Neutral

RSI helps to identify when a trend might reverse.

⸻

How to Combine Them for Trades:

For Buy Setups:

• Price touches or crosses below the Lower Bollinger Band

• RSI is near or below 30 (oversold)

For Sell Setups:

• Price touches or crosses above the Upper Bollinger Band

• RSI is near or above 70 (overbought)

The combination increases the reliability of reversal signals. Always confirm with price action or candlestick patterns before entering.

⸻

Real Example (XAU/USD Chart):

• Price touched the Lower Bollinger Band.

• RSI dropped near 35 (almost oversold).

• Result: A good bounce opportunity was created shortly after.

⸻

This method works very well on assets like Gold (XAU/USD), Bitcoin (BTC/USD), Nifty50, and more.

Simple, visual, and highly effective for beginners who want structured setups!

⸻

Found this helpful? LIKE ❤ & FOLLOW ➕ for more trading education and powerful strategies every week!

⸻

#RSI #BollingerBands #PriceAction #TechnicalAnalysis #TradingEducation #ForexStrategy #LearnTrading #BeginnersGuide #TradingTips

XAU/USD Holding Above $3,050 – Breakout or Pullback Next?XAU/USD Update 📊

Gold just touched $3,061 and is now hovering around $3,056. Price is holding within the ascending channel, showing signs of consolidation.

🟢 Bullish Scenario: If buyers defend this level, we could see another push toward $3,100+, with $3,153 still in play as a key resistance.

🔴 Bearish Risk: A break below $3,050 - $3,020 could trigger a deeper correction toward $2,980, where stronger demand may step in.

📉 Watching price action closely—let’s see how it reacts from here! 🚀

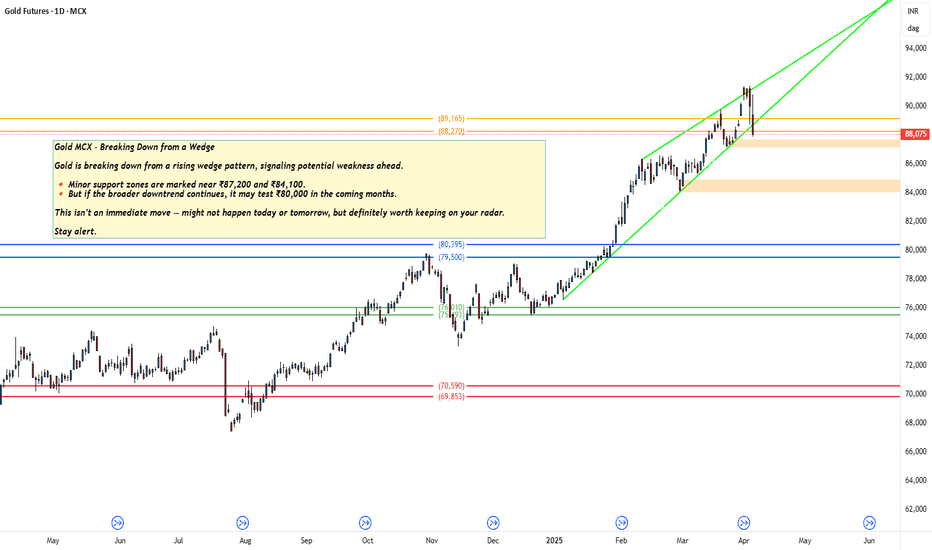

GOLD1!Gold MCX – Breaking Down from a Wedge

Gold is breaking down from a rising wedge pattern, signaling potential weakness ahead.

🔸 Minor support zones are marked near ₹87,200 and ₹84,100.

🔸 But if the broader downtrend continues, it may test ₹80,000 in the coming months.

This isn’t an immediate move — might not happen today or tomorrow, but definitely worth keeping on your radar.

Stay alert.

GOLD CRASHES HARD — BUT THE BIG SHORT VIEW WAS ALREADY 🟡 GOLD CRASHES HARD — BUT THE BIG SHORT VIEW WAS ALREADY IN PLAY

Gold dropped — and dropped even harder than expected.

But for those following closely, this wasn’t a surprise.

From the start of April, we had been watching for signs of reversal after gold kept printing new ATHs. The candlestick behavior on the higher timeframes was already hinting at exhaustion — and today’s move validated that broader view.

🔍 Why I’ve Been Calling for a BIG SHORT — Not Just in Gold

This isn’t just about XAUUSD.

Zoom out and you’ll see the signs across the board:

US, EU, and Asian stock markets are in a steep decline

Crypto is stagnant, with no new capital inflow and little investor interest

And gold — after a historic run — is now facing intense profit-taking pressure, especially under growing geopolitical and global trade risks

In this environment, many investors are moving to cash and staying on the sidelines.

📉 DXY: A Potential Comeback?

The USD Index (DXY) has been heavily sold off in recent months.

But if you look closely — it's now testing a multi-year support zone that's held strong for nearly 3 years.

AD’s view?

If this level holds — and if recent tariff policies + international pressure from Trump continue — we could see a real USD recovery in the coming weeks.

Trump appears to be playing hardball — not just for his own benefit, but strategically for the U.S.

His aggressive trade moves are forcing nations to reconsider tariff terms. And in the short term, that puts Trump in a position of power — globally.

🤔 The Fed’s Dilemma

Even as Trump escalates trade pressure, the Fed remains cautious.

They’ve held back from rate cuts — waiting for clearer outcomes from these global negotiations.

All eyes are now on Trump’s next moves — and how other major economies will respond.

🔮 Strategy Moving Forward

Many investors are still in risk-off mode, hoarding cash and waiting for further declines.

AD still expects further downside in gold next week, alongside a potential short-term bounce in DXY.

→ After that, once the trade talk dust settles, we could very well see Gold resume its climb, while USD retests major supports on the D1 timeframe.

📌 I’ll be back with a full weekly outlook tomorrow, but for now — absorb this Gold/USD landscape and build your strategy for the new week.

Stay sharp & protect your capital.

— AD | Money Market Flow

NFP XAUUSD ANALYSIS 58 PTS -TP -3178- WORLD CLASS ACCURACY ??XAUUSD STRONG BUY ZONE ABOVE 3120

There is no resistance upto 3178

current mkt price 3111

Wait for active zone

Buy above 3120

Stoploss…….3103………17 points

Target1…………3135……….15 points

Target2…………3168……….48 points

Target3… Risk………………..3178...58 points

Disclaimer - This level only for education purpose. Do ur own analysis

Gold is undergoing a drastic shakeout. Can the bears take the inAfter the breakout in the previous upward trend of gold continued. The price and the 2830 low began to form a new upward trend. After three highs in 4 hours, the price also reached the 3168 line. Subsequently, this week and the high were violently washed, and the rise and fall of both long and short positions were expanded to 100 US dollars. The current price is supported by the 3000 line, which is also the long-short dividing line formed by the rising trend line. If this position is broken, gold may fall to 2956.

The resistance of 3085 above is suppressed. If this position is broken, gold will continue the bullish trend.

Overall, although gold has been violently washed at high levels, the overall bullish trend pattern has not been broken. The operation is still based on low-multiple ideas.

Gold operation suggestions: when the price falls back to the 3000-3020 area, long orders are arranged in batches, and the stop loss is broken below 2982 as the stop loss basis. The upward targets are 3050, 3065, and the break above 3085 continues the bullish trend.

For short positions, it is recommended to participate in short-term short positions when the price rebounds to the 3060-3070 area under pressure, and use the stop loss as the basis for breaking through 3085. The downside targets are 3034, 3020, and breaking below 3000.

GIFT NIFTY ELLIOTT WAVE COUNT starting from the low of 4TH MARCH 2025 in 1 hour TF, GIFT NIFTY shows clear 5 WAVE IMPULSE and time wise double correction in form of WXY.after completion of correction new impulse is also clearly visible which is 1ST WAVE OF 3RD WAVE. 3RD WAVE can go up to 23500-23800 as per fib extension but for that 22800 is major resistance,and after that 230000 is psychological level of resistance. GAP in.tradingview.com UP OPENING AND SUSTAIN ABOVE THAT LEVEL WILL OPEN MORE UPSIDE LEVELS. CHART PATTERN SHOWS INVERSE HEAD & SHOULDER OR FLAG&POLE PATTERN.

Gold 3000 bullish and bearish watershedMarket Status Analysis

The gold market showed a correction trend this week. The continuous decline of the big negative line made the short-term trend bearish, but from the overall pattern, it is still too early to assert that the trend has reversed. The current market is at a critical technical node, and the long and short sides are fighting fiercely near the important support level.

Technical analysis

Weekly level analysis

The overall bullish structure remains intact, and this week's correction can be regarded as a normal technical correction

The 5-week moving average 3000 mark constitutes an important support, and the 10-week moving average provides additional support

The first negative line after four consecutive positive lines on the weekly line is in line with the characteristics of a healthy technical correction

As long as the key psychological level of 3000 is not lost, the medium-term bullish trend remains unchanged

Daily level observation

The short-term bearish signal of Yin-enclosing Yang appears

Although the price broke below the short-term moving average and pierced the middle track of the Bollinger band, it eventually closed above the middle track

The long lower shadow shows that the low-level buying power is strong

The short-term still has the momentum to pull back and test the 10-day moving average

4-hour cycle characteristics

The Bollinger band opening extends downward, indicating a short-term downward trend

The K-line closed negative continuously, and the bears have a short-term advantage

Focus on the defense of the 3000 integer mark

Key price prompts

Upper resistance: 3042 (initial resistance) → 3058 (key resistance (Strong resistance) → 3072 (strong resistance)

Support level below: 3026 (short-term support) → 3015 (important support) → 3000 (lifeline support)

Operation strategy suggestions

Long-term layout strategy

Ideal position building area: 3015-3020 range

Strict stop loss setting: below 3000

Target price: 3040-3050 area

It is recommended to hold long positions with protective stop loss

Short-term opportunities

Short-term short positions can be considered when rebounding above 3050

Stop loss must be strictly set

Quick entry and exit operation is recommended

Risk control points

If it effectively falls below the 3000 mark, it may trigger a deeper correction

It is necessary to pay close attention to the trend of the US dollar and changes in market risk sentiment

Major economic data may change the current technical pattern

It is recommended to operate with a light position and strictly control the risk of a single transaction

Outlook for the future market

Although there are short-term adjustment signals, gold is still under the control of bulls as a whole. The 3000 integer mark will become a watershed between long and short positions, and if it holds this position, the bullish view will be maintained. Suggestions for investors:

Keep buying on dips above 3000

Pay close attention to the defense of key support levels

Flexibly adjust positions to cope with market fluctuations

Strictly follow risk management principles

GOLD - 1H UPDATEGold dropped nicely today, in a strong impulsive move which normally indicates a reversal. We also saw price touch $3,057, but we did say price also needs to close below that level which it never done. There's 2 possible plays on its next move;

1. Price just carries on dropping lower in the next week as expected.

2. Gold starts to consolidate, creating a 'redistribution schematic' for a bigger sell off. But this could also mean Gold creating 1 more new ATH.

Copper sell given at 890 , huge profit booked at 810 ,sell avoidHow to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Silver sell given at 100150 , today booked at 87000How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance

Silver levels until 30.50 not break sell on rise sell given 33.9How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 11.4% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 21.4% to 23.6% range then early traders can make fresh reversals trade after breaking 1st D 11.4% safe traders can reversal trade after breaking Point D 21.4% to 23.6% range

Targets :

Target T1 : 35.1% to 38.3%

Target T3 : 49.1% to 53.2%

T3: 60.9% to 64.8% is our 3rd Target since this is reversal zone so must book profit if break then take fresh trade again

Target T4 : 76.4% to 79.7%

Next Targets are 100% , 127.2% ,141.4% and final Target 161.8%.

How to take reversal trade :

If price going upside/ downside then then buy or sell levels appear on Chart ( Automatically show when price reach any reversal zone of harmonic projection pattern based .

After showing reversal levels wait for confirmation until 21.4% or 28.3 % level not break if break then exit from current buy / sell trade and take fresh reverse trade buy/ sell .

Trailing SL:

After reach 1st Target trail SL to just above or below cost ( for example we are holding sell trade from 100 1st Target 110 hit then move trailing sl to 104-105 and move SL as price move upside or Downside)

Re- Entry :

For Re-entry in any pull back Point D ( 11.4% ) is used for re-entry then SL recent high or low Point SL ( 0% ) .

Blue Line is 1st support/ Resistance

Green line is 2nd support/ resistance

Red line is 3rd Support/ resistance