Futures market

Gold (XAU/USD) Intraday Buy Setup – Demand Zone Reversal with 3.Timeframe: Appears to be intraday (possibly 5-15 minutes).

Indicators:

EMA 30 (red): Showing recent bearish momentum.

EMA 200 (blue): Positioned above, indicating a longer-term bearish trend.

Candlestick Pattern: After a steep drop, price shows signs of consolidation and potential reversal.

📌 Trade Setup (Long/Bullish Bias)

Entry Zone: Around $2,963.2

Price is expected to pull back into this purple demand zone before moving up.

Stop Loss (SL): $2,956.1

Placed below the support zone to limit downside risk.

Take Profit (TP / Target Point): $2,988.2

A previous supply zone near the EMA 30, where selling pressure could return.

📊 Risk-Reward Ratio

Risk: $2,963.2 - $2,956.1 = $7.1

Reward: $2,988.2 - $2,963.2 = $25

RRR (Reward-to-Risk Ratio): ~3.5:1

This is a solid ratio, suggesting a high-potential trade if the setup plays out.

📈 Bullish Scenario

Price pulls back into the demand zone (entry).

A bullish candlestick confirmation or wick rejection could trigger a buy.

Target is the previous structure + EMA zone.

XAUUSD Analysis – Bullish Momentum After FOMC Minutes | Gold OutTechnical Outlook:

• Resistance Levels: $3,085 (current zone), $3,135.69 (next key zone), $3,160

• Support Levels: $3,059.69 (previous breakout), $3,020, $2,980

• Price is holding strong above the previous resistance, now acting as support.

• A clean bullish structure is forming, with higher highs and higher lows on the 1H chart.

Trading Plan:

• Bullish Bias Above $3,059: As long as price holds above this key zone, bulls remain in control.

• Break & Close Above $3,085: Can push the price toward $3,135 and $3,160.

• Invalidation: A break below $3,059 could signal a fake breakout and lead to a pullback toward $3,020.

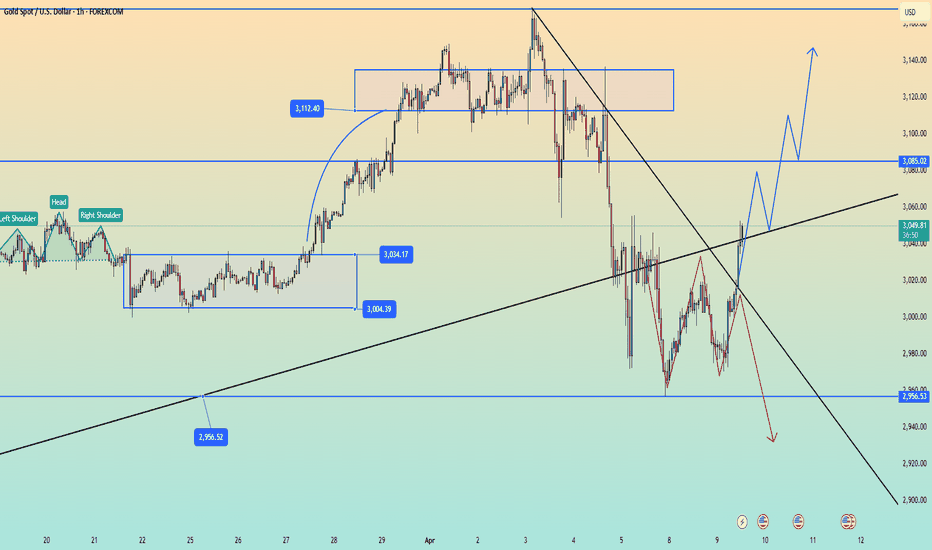

GOLD COMEX OUTLOOK FOR APRIL MONTHGOLDCMX:

Gold Comex (SPOT) is trading in Uptrend, as from the chart above you can see Trendline formation and Exact around trendline Gold Comex on 7th April 2025 took Support around 2950- 2956 $. Till Gold Comex is holding above trendline one should Not short sell gold and continue to hold Gold on the Long side.

Gold bulls return strongly, can they continue?The gold market is currently in the mid-term adjustment stage of the bullish trend, and the technical side shows three typical characteristics: first, the price has built a standard shock box in the range of US$2955-3055; second, the daily Bollinger Bands continue to narrow to a bandwidth of US$23, a new low in nearly a month, indicating a significant contraction in volatility; most importantly, the 4-hour level has begun to show the embryonic form of a head and shoulders bottom pattern, with the left shoulder at US$2970, the head at US$2955, and the neckline at US$3055. This technical structure suggests that the market is brewing a breakthrough, but a major catalyst is needed to confirm the direction.

Analysis of key time and space nodes

From the perspective of time, the Asian session on Wednesday (02:00-14:00 GMT) needs to closely observe the breakthrough of the short-term resistance of US$3025, especially in conjunction with the volume analysis to confirm the effectiveness of the breakthrough. Entering the US session (14:00-22:00 GMT), the market focus will shift to the competition for the double top resistance of US$3055, which is often accompanied by increased volatility caused by data shocks. It is particularly noteworthy that the minutes of the Federal Reserve meeting will be released early Thursday morning (02:00 GMT), which is likely to become a key catalyst to break the current deadlock.

Key positions for long and short games

Through multi-time frame analysis, we have identified the following key positions:

Short-term level: $3025 is a bullish attack signal, and $2980 is a bearish defense line

Mid-term dimension: $3055 is a trend confirmation level, and $2955 is a bullish and bearish watershed

Long-term perspective: A breakthrough of $3150 will open up new upside space, while a loss of $2900 may trigger a trend reversal

Based on the current technical structure, the following trading strategies are recommended:

Main strategy (long layout):

Position building range: $2990-2995 (Fibonacci 50% retracement level)

Stop loss setting: $2982 (double protection below the previous low + integer level)

Target system:

The first target is $3025 Yuan (short-term profit-taking point)

The second target is $3055 (confirmation point of pattern breakthrough)

The ultimate target is $3100-3150 (trend extension zone)

Auxiliary strategy (breakthrough follow-up):

After breaking through $3025 in the Asian session, wait for a retracement to $3015 to add 2%

When the US session breaks through $3055, you can chase 3% more positions

Use a 30-point moving stop loss to protect existing profits

Risk warning and management should focus on the following risks:

Policy risk: If the Fed minutes release hawkish signals, it may suppress gold prices

Data risk: US economic data exceeding expectations may trigger a technical correction

Liquidity risk: Asian session false breakthrough and US session volatility increase

Technical risk: A breakout of the $2955 low may trigger a programmed sell

XAUUSD XAUUSD Insights

Scenario 1: Bounces at 1D Order Block with pullback to the Double Bottom pattern.

Scenario 2: If it fails to bounce at the 1D Order Block, we might see it going down to 2728 level where we see an inverted Head and Shoulders Pattern before going up again and making a new all time high.

GOLD MARKET OUTLOOK Continuation of Bearish Structure Ahead FOMC🟡 GOLD MARKET OUTLOOK – Continuation of Bearish Structure Ahead of FOMC

The market continues to follow the bearish view we’ve held since the start of the week. As of today, price action is forming a descending triangle pattern toward the tip on M30–H1, within a compression zone between a declining trendline and a minor rising trendline.

🔍 Zooming out, the broader chart context shows a clear bear flag formation, and I remain biased toward a further drop into the 294x–293x zone in the coming sessions.

⚠️ Tonight’s US session brings the FOMC meeting, which may trigger high volatility and liquidity sweeps toward unfilled zones below current price. Be cautious!

📌 As long as price fails to break above 3075, there’s no confirmed shift in trend.

The 307x zone remains a key level for sellers — if unbroken, panic selling may intensify and buyers will remain sidelined.

🧠 Global equities are seeing a light rebound — led by late US session gains and some recovery in Asia & India today — but this seems more like a dead-cat bounce than true capital inflow.

→ Remember: CPI & PPI data are still due this week, so don’t rush to FOMO.

🧭 Key Technical Zones: 🔺 Resistance: 3026 – 3045 – 3074

🔻 Support: 2974 – 2957 – 2944 – 2930

🎯 Trade Plan: 🔴 SELL ZONE: 3044 – 3046

SL: 3050

TP: 3040 – 3036 – 3032 – 3028 – 3024 – 3020 – 3010 – 3000

🟢 BUY ZONE: 2976 – 2974

SL: 2970

TP: 2980 – 2984 – 2988 – 2992 – 2996 – 3000

💡 The market remains sensitive — stick with the dominant trend and don’t chase emotional trades.

Always follow your TP/SL rules and be patient — let the market come to you.

Stay safe & trade smart,

— AD | Money Market Flow

Gold bulls are back on the offensive againThe current gold market presents a pattern of "mid-term adjustment in the main bullish trend", with three key technical features: the rhythm of "high in the Asian and European sessions and fall in the US session" was formed at the beginning of the week; the price fluctuated and consolidated in the range of 2955-3055; the volatility shrank significantly, and the Bollinger Band daily line narrowed to the lowest level in nearly a month.

In terms of key forms, 2955 formed a three-pin bottom, and the 4-hour chart began to show the embryonic form of a head and shoulders bottom, with 3055 as the key breakthrough point. From Wednesday to Thursday, the Federal Reserve minutes and CPI data will be released, and the historical volatility shows that the probability of a change in the market is 68%. The liquidity gap in the Asian session is prone to false breakthroughs.

Short-term signal: Breaking through 3030 is a bullish signal, and falling below 3000 is a bearish signal. Mid-term signal: Standing firm at 3055 is a trend confirmation, and falling below 2955 is a bearish signal. Long-term signal: Breaking through 3150 is a structural change, and falling below 2900 is a bearish signal.

Trading strategy: Long positions are arranged in the range of 3015-3020, with a stop loss of 3007, and the target prices are 3055, 3100, and 3150. If it breaks through 3030, increase the position at 3020 and move the stop loss up to 3015; when it breaks through 3055, the long position does not exceed 2%, and a moving stop loss is used.

Key operating tips: Pay attention to data shocks after 20:30 in the US market. The first position accounts for 3%, and after breaking through 3030, increase the position by 2%, and the total risk is controlled within 2%. The order adopts an OCO combination, and a breakthrough order + callback order is set. Before the release of major data, keep a position below 30%, and the breakthrough transaction needs to wait for 15 minutes of K-line closing confirmation to avoid false breakthrough traps.

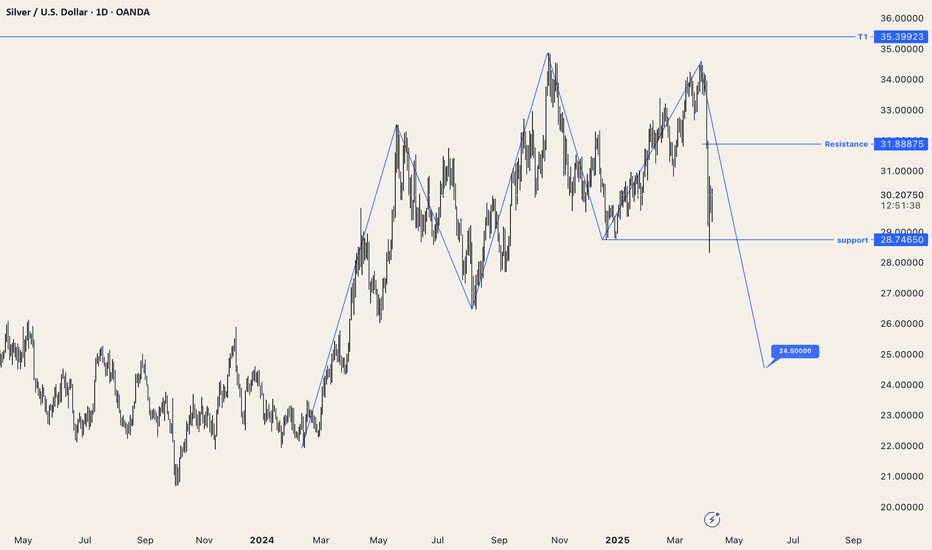

XAG: Silver projected for a fall till 24.50

Bearish invalidation if the price doesn't close, confirms the close below $28.75, and breaks the resistance level of 31.8875.

Right now it's a wait-and-watch scenario. Trade for sell will be active either on rejection of resistance or break-down of support

"Gold Price Rejection Setup – Trendline + Resistance Combo"XAU/USD 1H Chart Analysis 🪙📉

🔹 Trendline 📐

* Descending trendline marked by 3 touches

* Shows consistent bearish pressure

* Price is respecting it—watch for rejections

🔹 Resistance Area ⛔

* Blue zone between $3,014 - $3,025

* Strong supply zone—price failed to break it before

* Potential reversal zone if price touches again

🔹 Entry Point 🎯

* Suggested short entry at $3,014.29

* Just under resistance + near trendline

* Great spot for catching a downward move

🔹 Stop Loss ⚠️

* Placed at $3,025.13

* Above resistance = smart protection

* Keeps risk under control if breakout happens

🔹 Target Point 💰

* Take-profit marked around $2,964.45

* Down at a key support level

* Clean risk-to-reward around 1:5 (sweet setup!)

🔹 Moving Average (DEMA 9) 📈

* Dynamic resistance (line hugging candles)

* If price closes below, confirms bearish move

Summary ✅

This setup is a classic trendline + resistance short. You're betting on price respecting resistance and heading lower.

Bias: Bearish 🔻

Entry: $3,014.29

SL: $3,025.13 🛑

TP: $2,964.45 ✅

Trade Idea: BUY GOLD (XAUUSD) at 2,993 – Target 3,035🔍 Technical Analysis (1H Chart):

Strong support zone at 2,993 – 2,984 USD:

This area has held well multiple times in recent sessions.

Confluence with the EMA33 low (2,998 USD) acting as dynamic support.

Price previously rebounded from this zone with a noticeable increase in volume.

Structure:

After a pullback to 2,993, the price rebounded to 3,017, indicating bullish demand.

A retracement back to 2,993 would offer a good entry point for a trend continuation buy.

Resistance / Profit Target at 3,035 USD:

This is the most recent local high and aligns with the downtrend line and higher EMA levels.

If price breaks above 3,035, the next potential target zone would be around 3,045–3,050 USD.

🧾 Trade Setup:

Entry: Buy Limit @ 2,993 USD

Stop Loss: Below 2,984 USD

Take Profit:

TP1: 3,031 – 3,033 USD (minor resistance)

TP2: 3,035 USD (major resistance)

🎯 Risk-to-Reward Ratio (R:R): ~1.8 to 2.5 – suitable for intraday or short swing trade setups.

⚠️ Risk Management Tips:

If price doesn't pull back to 2,993 and breaks 3,035 directly, wait for a retest of 3,031 for a breakout-entry strategy.

Keep an eye on upcoming U.S. economic news or Fed events, which could bring volatility.

Adjust stop-loss or secure partial profits during U.S. session for safety.

Gold (XAUUSD) Reversal Setup: Buy Opportunity from Demand Zone t GOLD (XAUUSD)

Timeframe: 30-minute

Indicators:

EMA 30 (Red): 3,000.22

EMA 200 (Blue): 3,042.92

🔍 Price Action & Zones

Current Price: 2,982.27

Support Zone (Demand Zone): ~2,940.27 (highlighted in purple, labeled as STOP LOSS)

Resistance Zone (Supply Zone): ~3,040.17–3,042.92 (labeled as EA TARGET POINT)

📈 Trade Idea (Based on Drawing)

Strategy: Buy from demand zone, targeting supply zone

Entry: Near 2,940.27

Stop Loss: Slightly below 2,940.27

Target: ~3,040.17

Risk to Reward: ~1:2.6 (visually)

📊 EMA Dynamics

Bearish Bias in the Medium Term: Price is trading below the 200 EMA, indicating an overall bearish trend.

Short-Term Weakness: The price has also dropped below the 30 EMA, confirming bearish momentum in the short run.

🔄 Possible Scenario

Price is currently heading back down toward the demand zone, where a bounce is anticipated.

If it respects that zone, we may see a reversal toward the target zone at ~3,040.

If it breaks below 2,940, the setup would be invalidated (stop loss hit).

⚠️ Things to Watch

Rejection or support confirmation at 2,940 zone is key before entry.

Be cautious of continued bearish momentum if economic news or global risk sentiment shifts.

Look for bullish reversal patterns (e.g. hammer, bullish engulfing) at the demand zone for confirmation.

Gold breakout above 3000 favours advance towards 3038 & 3058Gold again dived to 2070 and buyers resurfaced starting bullish momentum to reclaim 3000 psychological zone and currently trading sideways around 3010

As long as 3000 support zone is intact, expect further advance towards next resistance 3038 followed by next leg higher 3058

Note: This upmove is a correctional bounce against the decline and momentum has possibility of fading if 3058 is challenged with rejection.

GOLD ANALYSIS 09-04-2025 Gold is moving inside a tightening price range, indicating that a volatile move is just around the corner. Price is currently hovering near $3,005. A decisive breakout above $3,010 will attract fresh buying and can quickly lift gold toward $3,040, where supply is expected to kick in. On the downside, a breakdown below $2,970 will trigger selling pressure, potentially pushing it down to $2,935.

The market is in a pause after recent sharp moves—this kind of compression usually leads to explosive expansion. Liquidity is getting built on both sides, and smart money is likely waiting for one side to get trapped.

Volume has started drying up slightly, signaling traders are cautious ahead of the breakout. Patience will pay—once price confirms direction, the move will be swift. No need to jump early. Wait for the break, then go for the kill.

Gold Next Target 2800 and What Next Trump's tariffs?🔍 Chart Context (1H and 15M Combined View)

Trend: Bearish overall structure on the 1H timeframe, with lower highs and lower lows.

Trendline: Clearly respected and just recently tested again (price rejected at the trendline on 1H).

POI (Point of Interest): 3,030 – 3,040 zone acting as a strong supply/resistance zone.

📈 Support Levels:

2,978.949 (key demand/support zone).

2,956.129 (major support level).

📉 Resistance Zones:

✅3,020 area (15M minor supply zone, shaded red).

✅3,030–3,040 (POI level on 1H, shaded blue).

✅3,058.437 (major resistance).

🧠 Price Action Insights-1H Chart:

Price attempted to break the descending trendline but was quickly rejected (marked with a circle).

Multiple rejections from POI level suggest strong seller presence.

Strong bearish candle followed that rejection (confirmation of trend continuation).

15M Chart:

Price bounced from support at 2,978

Quick rally back to ~3,004, stalling below the minor supply at 3,020.

Could be forming a lower high (ideal short setup zone).

📌 Trade Setup Idea:

✅ Trade Type: Short (Sell)

🔽 Entry Zones (Sell Limit Ideas):

Aggressive: 3,020 (near the 15M minor supply zone)

Conservative: 3,030–3,040 (POI level on 1H chart)

🛑 Stop Loss:

Above 3,045 (well above POI and trendline breakout level)

🎯 Targets:

TP1: 2,978.949 (recent support, also previous bounce level)

TP2: 2,956.129 (major support level from 1H chart)

TP3 (Optional Swing): Below 2,950 if momentum continues

⚠️ Risk Management Tip (Beginner-Friendly):

Use position sizing based on your risk appetite (e.g., 1–2% of your account per trade).

Avoid entering late if price already breaks past POI or trendline with strong volume.

📌 Key Beginner Takeaways:

You're identifying liquidity zones, trendlines, and structure: excellent progress!

Use confluence (multiple factors aligning) to enter with higher probability.

Practice this setup in a demo account to gain confidence.

👉 Always follow TP/SL to protect your capital and maximize profits!

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

Gold Trading Strategy for 09th April 2025📊 GOLD (XAU/USD) INTRADAY TRADE SETUP

🟢 BUY SETUP

Entry: Buy above the high of the 1-hour candle, only after a confirmed close above 3005.

🎯 Targets:

Target 1: 3015

Target 2: 3025

Target 3: 3035

🛑 Stop Loss: Place SL just below the breakout candle low or based on your risk tolerance.

📌 Reasoning:

A close above 3005 on the 1H timeframe confirms bullish strength.

A breakout with volume may trigger a momentum rally toward the upper targets.

🔴 SELL SETUP

Entry: Sell below the low of a 15-minute candle, only after a confirmed close below 2969.

🎯 Targets:

Target 1: 2956

Target 2: 2944

Target 3: 2933

🛑 Stop Loss: Place SL just above the breakdown candle high or according to your risk profile.

📌 Reasoning:

A close below 2969 on the 15M chart signals short-term weakness.

Bears may take control and push prices down to key support zones.

⚠️ DISCLAIMER: This analysis is for educational and informational purposes only. 📘

Trading involves substantial risk and is not suitable for every investor. 📉

Always conduct your own research or consult with a financial advisor before making any trading decisions. 💼

Gold MCX Intraday Technical Outlook for 9-Apr-25!Here’s your structured Gold MCX Intraday Technical Outlook for 9-Apr-25 (Wednesday):

With 6+ years of sharp experience in commodities trading, I provide high-accuracy intraday setups to help you make informed, confident trades. 🔥

🔥 Boost, Follow, Like, Share if this helped you trade smarter! Drop a comment—I’d love to hear from you. 😊

✅ Day Range Trigger Point: 87648 | ✅ Expected Move: 1091 Points

📈 Buy Above: 88027 | 🎯 Target1: 88322 | 🎯 Target2: 88739

✅ Average Buy Position: 87899 | ⛔ Stoploss: 87664

📉 Sell Below: 87770 | 🎯 Target1: 86974 | 🎯 Target2: 86557

⛔ Stoploss: 88133

📊 Entry Timing Insights:

Before 10:30 AM or after 6:30 PM: Enter as soon as the level breaks.

After 10:30 AM or before 5:00 PM: Try to enter near the stoploss—markets often test these zones.

💡 Pro Tip: Let price retest your level for confirmation. Stick to risk management and follow your plan.

#Gold #MCX #CommodityTrading #IntradayTrading #TechnicalAnalysis #PriceAction #MarketAnalysis #DayTrading #NumroTrader #TradingSignals #TradingTips