XAUUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD XAUUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

Xauusdsell

XAUUSD/GOLD DAY SELL PROJECTION 16.05.25📉 Sell Setup Overview:

Pattern Identified:

4H Evening Star — a bearish reversal pattern indicating potential downside.

Trade Setup:

Entry Zone: Around 3,219.970

Stop Loss: Above 3,235.984

Targets:

TP1 (Take Profit 1): Around 3,170.000 (Golden Ratio 0.618 zone)

TP2: Around 3,121.724 (near Support 2)

Technical Zones:

Breakdown + Retest zone highlighted in yellow (indicating confirmation of bearish reversal).

Golden Ratio (0.618) support/fib zone — used as a significant level for TP1.

Support 1 and Support 2 are drawn as potential price stalling or reversal zones.

XAU/USDBearish Trade Setup Supply Zone Rejection to Target $3050Trend Overview

📉 Downtrend in Play

Price has reversed from the peak near $3,354

Currently trading below the 70 EMA (📍$3,299.86)

Forming lower highs – indicating bearish momentum.

Key Zones & Levels

🔶 Supply Zone (Resistance)

📍 $3,290.72 – $3,353.41

Strong selling pressure expected here

Possible short entry if price gets rejected

🟦 Support Zone (Previous Support)

📍 Around $3,254 – $3,210

Price has previously bounced here

🎯 Target Point (Take Profit)

📍 $3,050

Clear support level – used as a profit target

Trade Setup – Bearish Bias

🟩 Entry Point

📉 Sell near $3,290.72 (inside supply zone)

🛑 Stop Loss

❌ Above $3,354.69 (above resistance line)

✅ Take Profit

💰 Target $3,050

⚖️ Risk-Reward Ratio

Approx. 1:3 – Favorable for short trades.

Summary

🔍 Watch for a rejection in the supply zone

💼 Setup is ideal for short sellers

📊 Downtrend is supported by structure and EMA

XAUUSD/GOLD WEEKLY SELL PROJECTION 10.05.25From easing tariffs to strong labor data, multiple factors are shaping gold's short-term corrections. Gold prices fall as US jobs data beats expectations and trade talks ease global tension. Spot gold slips from record highs amid China's holiday, but long-term support remains strong

XAUUSD/GOLD 1H SELL PROJECTION 08.05.25Bearish setup on XAUUSD (Gold vs. USD) with a strong indication for a potential short/sell opportunity based on several technical signals:

Key Observations:

Three Black Crows Pattern:

Clearly marked and highlighted on the chart.

This is a classic bearish reversal pattern indicating strong selling pressure.

Break of Neckline:

The price has broken below a previously established neckline area, confirming bearish momentum.

Support Becomes Resistance:

The neckline zone (~$3350.880) is now acting as resistance after the breakdown, further validating the short setup.

Target Levels:

Support S1 around $3330.

Support 2 near $3311.354 – likely the final target area for the sell projection.

Stop Loss Zone:

Clearly marked at $3362.631, above the broken support (now resistance).

Summary:

Entry Zone: Around current price (~$3344)

Stop Loss: $3362.63

Take Profit Zones:

TP1: ~$3330 (Support S1)

TP2: ~$3311.35 (Support 2) bearish setup on XAUUSD (Gold vs. USD) with a strong indication for a potential short/sell opportunity based on several technical signals:

Key Observations:

Three Black Crows Pattern:

Clearly marked and highlighted on the chart.

This is a classic bearish reversal pattern indicating strong selling pressure.

Break of Neckline:

The price has broken below a previously established neckline area, confirming bearish momentum.

Support Becomes Resistance:

The neckline zone (~$3350.880) is now acting as resistance after the breakdown, further validating the short setup.

Target Levels:

Support S1 around $3330.

Support 2 near $3311.354 – likely the final target area for the sell projection.

Stop Loss Zone:

Clearly marked at $3362.631, above the broken support (now resistance).

Summary:

Entry Zone: Around current price (~$3344)

Stop Loss: $3362.63

Take Profit Zones:

TP1: ~$3330 (Support S1)

TP2: ~$3311.35 (Support 2)

XAUUSD/GOLD WEEKLY PROJECTION 27.04.25Rise of the DXY (US Dollar Index) since March.

US Tax exemptions for some products.

Slower imposition of new taxes.

Technical Chart Summary:

Pattern: Head and Shoulders (classic bearish reversal setup).

Key Zones:

Selling Zone: Identified between Resistance R1 and Triple Top area.

Resistance Levels:

R1 near 3359–3400

Major resistance at around 3480–3500 (All-Time High zone).

XAUUSD/GOLD WEEKLY PROJECTION 20.04.25Buying Zone around the 1.618 Golden Ratio (3435.255) – A classic Fibonacci extension target indicating a strong potential reversal or take-profit zone.

Price Movement Forecast:

Price is expected to test the Immediate Support (S1) and bounce back.

Resistance levels: R1, then R2 & New ATH (All-Time High).

Take Profits (TP1 & TP2): Clearly marked targets for bullish momentum continuation.

Candlestick Patterns:

Fake Bearish Spinning Top

Bullish Marubozu

Fake Bearish Harami

These patterns typically suggest false bearish signals and continuation of the uptrend.

XAUUSD/GOLD WEEKLY PROJECTION 13.04.25Trend: Price is following a clear bullish trend channel.

Bullish Indicators:

"Three White Soldiers" candlestick pattern suggests continued bullish momentum.

"Bounce back area" suggests a buying opportunity after a dip.

Price Targets:

Target Price 1: Around 3,200–3,240

Main Target Price: Near 3,293

Support Zones:

Support S1: ~3,184

Support S2: ~3,140

Resistance:

Immediate Resistance: Just below the target price zone.

"Gold Price Rejection Setup – Trendline + Resistance Combo"XAU/USD 1H Chart Analysis 🪙📉

🔹 Trendline 📐

* Descending trendline marked by 3 touches

* Shows consistent bearish pressure

* Price is respecting it—watch for rejections

🔹 Resistance Area ⛔

* Blue zone between $3,014 - $3,025

* Strong supply zone—price failed to break it before

* Potential reversal zone if price touches again

🔹 Entry Point 🎯

* Suggested short entry at $3,014.29

* Just under resistance + near trendline

* Great spot for catching a downward move

🔹 Stop Loss ⚠️

* Placed at $3,025.13

* Above resistance = smart protection

* Keeps risk under control if breakout happens

🔹 Target Point 💰

* Take-profit marked around $2,964.45

* Down at a key support level

* Clean risk-to-reward around 1:5 (sweet setup!)

🔹 Moving Average (DEMA 9) 📈

* Dynamic resistance (line hugging candles)

* If price closes below, confirms bearish move

Summary ✅

This setup is a classic trendline + resistance short. You're betting on price respecting resistance and heading lower.

Bias: Bearish 🔻

Entry: $3,014.29

SL: $3,025.13 🛑

TP: $2,964.45 ✅

XAUUSD 1H SELL PROJECTION 08.04.25Instrument: Gold Spot / U.S. Dollar (XAUUSD)

Timeframe: 1 Hour (1H)

Current Price: ~$2,995.25

Projection Date: April 8, 2025

Analysis Type: Bearish/Sell Projection

📊 Technical Elements:

🔹 Trend Analysis:

A 1H downtrend is marked with a descending trendline.

Price previously broke a key support zone, retested it (now acting as resistance), and is expected to drop again.

🔹 Trade Setup:

Entry: Near current price ($2,995.25)

Stop Loss: Above Resistance R1 at $3,010.27

Take Profit Targets:

TP1: At Support S1 (~$2,980)

TP2: At Support S2 (~$2,957)

📈 Indicators:

📍 Stochastic Oscillator (5, 3, 3):

Reading: 79.61 (green) and 80.17 (red)

Interpretation: Just above 80 → Overbought Zone

Signal: Potential reversal downwards

📍 Relative Strength Index (RSI - 14):

Value: 44.84

Interpretation: Below neutral 50, not oversold

Signal: Bearish momentum building

🧠 Conclusion / Strategy:

The chart suggests a short/sell setup for XAUUSD.

The price has retested the broken support (now resistance) and formed a rejection candle at the trendline.

Indicators support a potential downward move (Stochastic overbought + RSI weak).

Targeting lower supports for potential exit points.

XAUUSD Next Move 2800 ? 🪙 FUNDAMENTALS:

✅China on Friday struck back at the U.S tariffs imposed by Trump with a slew of counter-measures including extra levies of 34% on all U.S. goods and export curbs on some rare-earths, deepening the trade war between the world's two biggest economies.

✅ More than 50 nations have reached out to the White House to begin trade talks since Trump rolled out sweeping new tariffs, top officials said on Sunday as they defended levies that wiped out nearly $6 trillion in value from U.S. stocks last week.

✅ Federal Reserve Chairman Jerome Powell said tariffs increased the risk of higher inflation and slower growth, highlighting the difficult path ahead for policymakers at the U.S. central bank

________________________________________

🔍 4H Hour Timeframe Analysis

📊 Trend & Price Action :

• Previous Trend: Clear uptrend inside a rising channel (marked by red lines).

• Recent Price Movement: Price broke down below the ascending channel, signaling trend weakness or possible reversal.

• Strong bearish candles show increased selling pressure recently.

📉 Key Technical Levels:

• Support Zone: Around $2,979–$2,957 (green and grey lines) — price bounced here, showing buyer interest.

• Resistance Zone: Around $3,057–$3,077 — a previous support zone now acting as resistance after the breakdown.

• Moving Averages:

o Red Line (likely 50 EMA): Recently broken down, now acting as dynamic resistance.

o Blue Line (likely 200 EMA): Around $2,990, price tested and bounced — this is often a key support in a trend.

🧠 Interpretation:

• Price broke structure (channel and EMAs), signaling a shift from bullish to bearish bias.

• The bounce from the 200 EMA and support zone suggests a potential short-term retracement or consolidation.

• If price fails to reclaim $3,057–$3,077, sellers may re-enter.

________________________________________

🔍 15-Minute Timeframe Analysis

📊 Trend & Price Action:

• Sharp intraday recovery from the low of around $2,957 to the current $3,033.

• But price is now facing resistance from a supply zone (highlighted in red).

• You’ve marked an Order Block (OB) around $3,125–$3,140 — a zone where institutional selling might have started.

📉 Key Levels:

• Resistance Zones:

o $3,076 (blue line) – likely 200 EMA, strong resistance.

o $3,057–$3,076 – supply area and previous breakdown zone.

o Order Block (OB) near $3,125–$3,140 – strong institutional resistance zone.

• Support Zones:

o $3,000, $2,978, and $2,957 – these are lower supports where price previously bounced.

🧠 Interpretation:

• Short-term, the price is retracing from a heavy drop.

• Watch how price behaves at $3,057–$3,076:

o Rejection = possible short setup.

o Break & close above = retracement could continue toward OB ($3,125).

• The OB is a potential reversal zone, where price could get heavily rejected if tested.

________________________________________

📌 Beginner Takeaways:

Trend is weakening – the uptrend broke, and the market is forming lower highs and lower lows.

Price is trying to recover from key support zones but facing resistance overhead.

Volume is increasing near support — shows interest from buyers but not a confirmed trend reversal yet.

The Order Block is a great place to watch for reversal trades (supply zone = potential sell).

________________________________________

✅ Suggested Actions for Practice:

Mark key support/resistance zones on your own chart to develop your structure-reading skills.

Scenario 1: Short if price rejects at $3,057–$3,076 zone.

Scenario 2: Long only if price closes above $3,077 and holds support.

Observe how price behaves near moving averages and OB zones

.

________________________________________

👉 Always follow TP/SL to protect your capital and maximize profits!

Disclaimer: This is for educational purposes only.

Always trade responsibly and manage your risk effectively

XAUUSD/GOLD WEEKLY PROJECTION 06.04.25April 10 – China to impose 34% tax on US goods

→ Trade tension increases risk-off sentiment, potentially lowering gold prices if USD strengthens.

US Manufacturing Tax (NO - 37%)

→ Negative manufacturing data or tax burden could weaken USD sentiment but also stir market uncertainty.

BRICS exploring an alternative currency (moving away from USD)

→ Could signal reduced demand for USD-backed assets like gold in the long term.

XAUUSD/GOLD 1H SELL PROJECTION 02.04.25When the central bank raises interest rates, this is known as monetary tightening. The currency becomes stronger and “worth” more. In practice, it is possible to buy more gold metal, a tangible asset, for the same amount of money. The result is a fall in the price of gold.

XAUUSD/GOLD 4H SELL PROJECTION 28.03.25Trendline Resistance: The price is projected to reverse after reaching this resistance level.

Sell Entry: Positioned near the trendline resistance, anticipating a downward move.

Take Profit (TP) Levels:

TP 1: First target near the Support S1 level.

TP 2: Second target near the Support S2 level.

Stop Loss (SL): Positioned above the trendline resistance in a red zone to limit risk.

Breakout Zone Retest: Potential price action area before further movement.

Parallel Trendline: The price is moving within a channel, and a possible break could indicate further downside momentum.

4-hour price projection for XAUUSD (Gold vs. US Dollar) on MarchKey Observations:

Current Market Price:

The price is around $3,046.450 at the time of analysis.

The high and low of the period are $3,053.485 and $3,045.005, respectively.

Technical Analysis & Patterns:

Rising Wedge Pattern has been identified.

A Bullish Engulfing Candlestick has formed, indicating potential upward momentum.

Break and Retest Strategy:

The chart suggests a breakout zone retest while respecting the trendline before further upward movement.

Key Levels:

Resistance 1: Around $3,054.264.

Target Price 1: Between $3,054 - $3,070.

Resistance 2 & Trendline Resistance: Near $3,076 - $3,080.

Stop-Loss: Set at a weekly low around $3,025 - $3,016.

Price Projection:

Expected price movement suggests a pullback to support levels before continuing its bullish trajectory.

A potential move toward $3,076+ is anticipated.

This chart analysis suggests a buying opportunity, with key resistance levels to monitor for profit-taking.

XAUUSD 4H BUY PROJECTION – March 18, 2025This chart presents a bullish projection for Gold (XAU/USD) on the 4-hour timeframe, indicating a potential buying opportunity based on trend analysis and key levels of support and resistance.

Key Components of the Analysis:

Uptrend Confirmation:

The price is moving within an ascending channel marked by two parallel blue lines.

The 4H parallel trendline suggests a continuation of bullish momentum.

Possible Buy Zone:

The chart highlights a potential buying area around the trendline, where price may pull back before resuming the uptrend.

Support & Resistance Levels:

Support S1: Around $3,015, where buyers might step in.

Resistance R1: Around $3,030, which could act as the first hurdle for price movement.

Resistance R2: Near $3,053, serving as a major target for bullish movement.

Target Prices:

Target Price 1: Around $3,030 (first take-profit level).

Target Price 2: Around $3,053 (second take-profit level).

Stop Loss:

Set at approximately $2,997, below key support, to limit downside risk.

Market Structure & Price Action:

The chart indicates higher highs and higher lows, confirming an uptrend.

A possible W pattern (double bottom) suggests a strong bullish breakout.

Trading Plan Summary:

Buy Entry: Around the support/trendline zone.

Take Profit Levels: First at $3,030, second at $3,053.

Stop Loss: Below $2,997 to manage risk.

15-minute (15M) analysis of XAU/USD (Gold vs. USD) with a "W" paHere's a breakdown:

W Pattern Formation: A bullish reversal pattern has been identified.

Entry Point: The price has broken above the resistance zone, confirming the pattern.

Stop-Loss (SL): Placed below the recent low at 2,985.73.

Take Profit (TP) Targets:

TP1: Around 2,994 (Resistance R1).

TP2: Around 3,002.02 (Resistance R2 & All-Time High).

The projected path suggests a breakout and retest of Resistance R1 before pushing towards TP2.

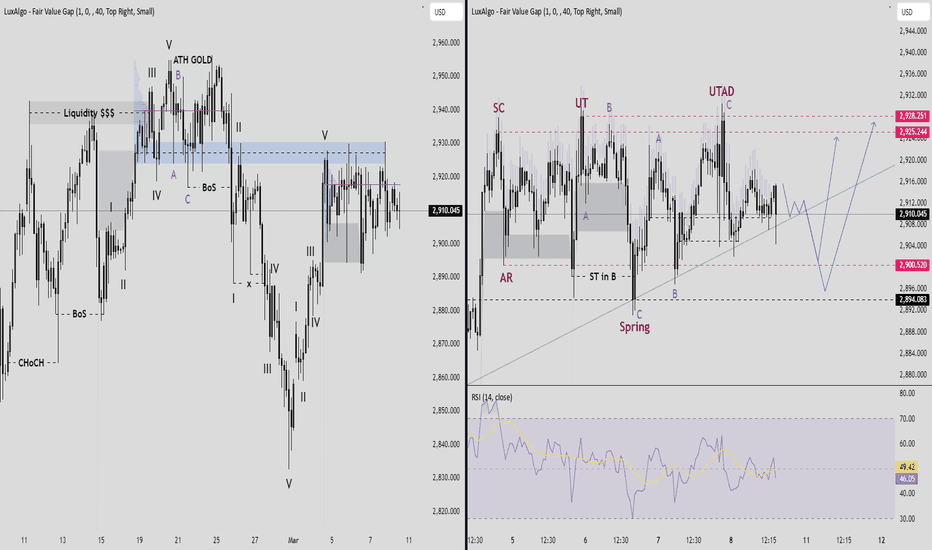

XAUUSD H2 : Analysis GOLD!📈 #BUY GOLD: 2893/2890

Stoploss: 2885 / Target: 2940

📉 #SELL GOLD: 2944/2947

Stoploss: 2952 / Target: 2920

Analysis: If Gold price runs into offers, immediate support is seen at the 2850 psychological barrier as the 21-day SMA at 2911 gives way.

The demand area near 2835 could be a tough nut to crack for sellers.