Nifty Intraday Analysis for 01st February 2025NSE:NIFTY

Index closed near 23510 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

24000 Strike – 77.38 Lakh 23500 Strike – 45.10 Lakh

23800 Strike – 20.21 Lakh

Put Writing

23000 Strike – 60.63 Lakh

23500 Strike – 50.05 Lakh

23300 Strike – 49.94 Lakh

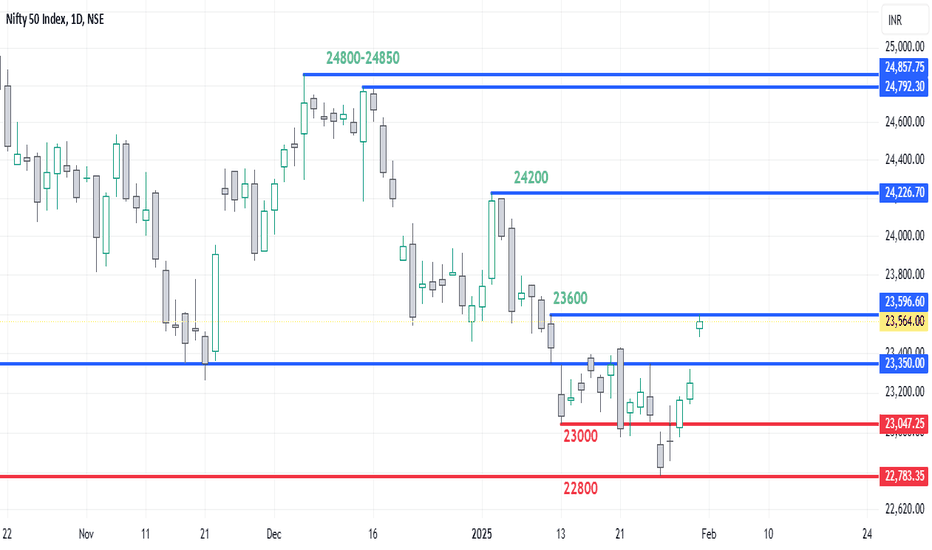

Index has resistance near 23675 - 23725 range and if index crosses and sustains above this level then may reach near 23900 - 23950 range.

Index has immediate support near 23300 – 23250 range and if this support is broken then index may tank near 23050 – 23000 range.

Volatility expected on Budget day with a big swing on either side based on perceived market outcome.

Support and Resistance

Banknifty Intraday Analysis for 01st February 2025NSE:BANKNIFTY

Index closed near 49585 level and Maximum Call and Put Writing near CMP as below in February Month contract:

Call Writing

50000 Strike – 7.20 Lakh

49000 Strike – 3.81 Lakh 49500 Strike – 3.38 Lakh

Put Writing

49000 Strike – 10.19 Lakh

50000 Strike – 5.78 Lakh

49500 Strike – 4.14 Lakh

Index has resistance near 50000 – 50100 range and if index crosses and sustains above this level then may reach near 50600 – 50700 range.

Index has immediate support near 48900 - 48800 range and if this support is broken then index may tank near 48400 - 48300 range.

Volatility expected on Budget day with a big swing on either side based on perceived market outcome.

Finnifty Intraday Analysis for 01st February 2025NSE:CNXFINANCE

Index closed near 23220 level and Maximum Call and Put Writing near CMP as below in February Month contract:

Call Writing

23000 Strike – 0.42 Lakh

23200 Strike – 0.28 Lakh

23500 Strike – 0.22 Lakh

Put Writing

23000 Strike – 0.51 Lakh

23200 Strike – 0.20 Lakh

23100 Strike – 0.19 Lakh

Index has resistance near 23400 - 23450 range and if index crosses and sustains above this level then may reach near 23650 - 23700 range.

Index has immediate support near 23000 – 22950 range and if this support is broken then index may tank near 22800 – 22750 range.

Volatility expected on Budget day with a big swing on either side based on perceived market outcome.

Midnifty Intraday Analysis for 01st February 2025NSE:NIFTY_MID_SELECT

Index closed near 11930 level and Maximum Call and Put Writing near CMP as below in February Month contract:

Call Writing

12000 Strike – 3.11 Lakh

12500 Strike – 2.54 Lakh

11900 Strike – 1.24 Lakh

Put Writing

11500 Strike – 3.09 Lakh

11500 Strike – 2.08 Lakh

12000 Strike – 1.77 Lakh

Index has immediate resistance near 12100 – 12150 range and if index crosses and sustains above this level then may reach 12275 – 12325 range.

Index has immediate support near 11800 – 11750 range and if this support is broken then index may tank near 11550– 11500 range.

Volatility expected on Budget day with a big swing on either side based on perceived market outcome.

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:7RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:7 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

Persistent Systems: Bull Run with Breakout Potential Topic Statement: Persistent Systems is on a strong bull run, showing resilience to the market correction, with a wedge pattern signaling a potential breakout.

Key Points:

1. The stock receives heavy support near the 180-day moving average, making it a good entry point.

2. Candlesticks are forming a wedge pattern, indicating a big directional move upon breakout.

3. The price faces heavy resistance at the ₹6500 level.

4. Company reported a 30% profit growth QoQ.

Nifty Intraday Analysis for 31st January 2025NSE:NIFTY

Index closed near 23250 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

23200 Strike – 24.68 Lakh 23500 Strike – 23.14 Lakh

23300 Strike – 18.79 Lakh

Put Writing

23000 Strike – 30.76 Lakh

23200 Strike – 25.64 Lakh

23300 Strike – 15.59 Lakh

Index has resistance near 23300 - 23350 range and if index crosses and sustains above this level then may reach near 23450 - 23500 range.

Index has immediate support near 23100 – 23000 range and if this support is broken then index may tank near 22850 – 22800 range.

Banknifty Intraday Analysis for 31st January 2025NSE:BANKNIFTY

Index closed near 49310 level and Maximum Call and Put Writing near CMP as below in February Month contract:

Call Writing

49000 Strike – 7.10 Lakh

50000 Strike – 6.30 Lakh 49500 Strike – 3.38 Lakh

Put Writing

49000 Strike – 9.39 Lakh

48000 Strike – 4.98 Lakh

48500 Strike – 3.83 Lakh

Index has resistance near 49900 – 50000 range and if index crosses and sustains above this level then may reach near 50500 – 50600 range.

Index has immediate support near 48850 - 48750 range and if this support is broken then index may tank near 48400 - 48300 range.

Finnifty Intraday Analysis for 31st January 2025NSE:CNXFINANCE

Index closed near 23135 level and Maximum Call and Put Writing near CMP as below in February Month contract:

Call Writing

23000 Strike – 0.24 Lakh

24000 Strike – 0.12 Lakh

23100 Strike – 0.07 Lakh

Put Writing

23000 Strike – 0.27 Lakh

22500 Strike – 0.09 Lakh

33100 Strike – 0.03 Lakh

Index has resistance near 23250 - 23300 range and if index crosses and sustains above this level then may reach near 23475 - 23525 range.

Index has immediate support near 23000 – 22950 range and if this support is broken then index may tank near 22800 – 22750 range.

Midnifty Intraday Analysis for 31st January 2025NSE:NIFTY_MID_SELECT

Index closed near 11795 level and Maximum Call and Put Writing near CMP as below in February Month contract:

Call Writing

12500 Strike – 1.22 Lakh

12000 Strike – 1.10 Lakh

11800 Strike – 0.86 Lakh

Put Writing

11500 Strike – 2.54 Lakh

10500 Strike – 1.38 Lakh

11000 Strike – 1.30 Lakh

Index has immediate resistance near 11975 – 12025 range and if index crosses and sustains above this level then may reach 12125 – 12175 range.

Index has immediate support near 11700 – 11650 range and if this support is broken then index may tank near 11550– 11500 range.

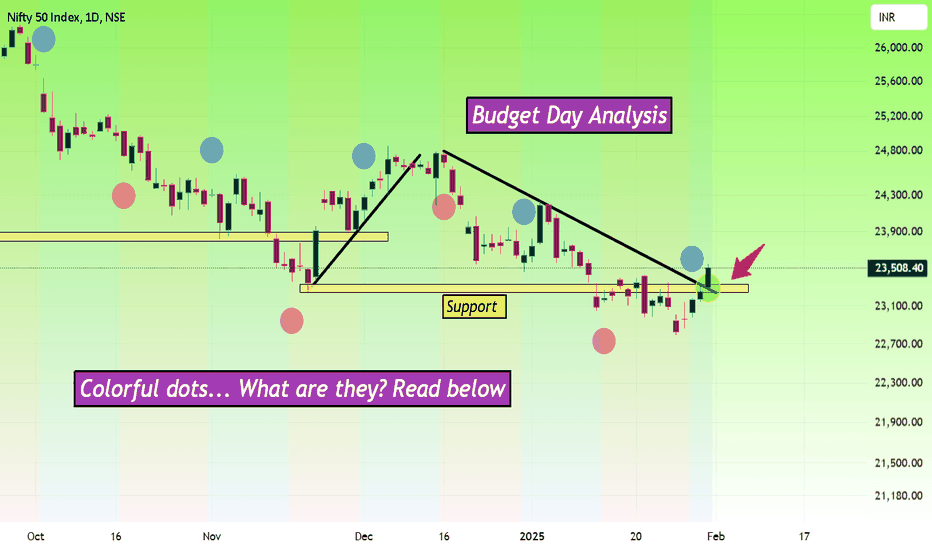

Budget Day Analysis - NiftyHi guys, price is at important bullish zone as of now. It has taken support and broke the trend line resistance. Also price has formed a strong bull candle. So what will happen tomorrow?

Now trend deciding zone is 23500. Sustaining this zone is important to be bullish.

Lower time frame shows, price has sustained above the channel resistance.

Please note price will be volatile during budget. If you have less experience, just watch instead of trading.

Buy above 23520 with the stop loss of 23480 for the targets 23560, 23600, 23660, 23720 and 23760. Sell below 23400 with the stop loss of 23440 for the targets 23360, 23320, 23280 and 23240.

Always do your own analysis before taking any trade.

Colorful dots... what are they? Mood phase indicator in TradingView. Check it. 😀

BankNifty levels - Feb 01, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

Nifty levels - Feb 01, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

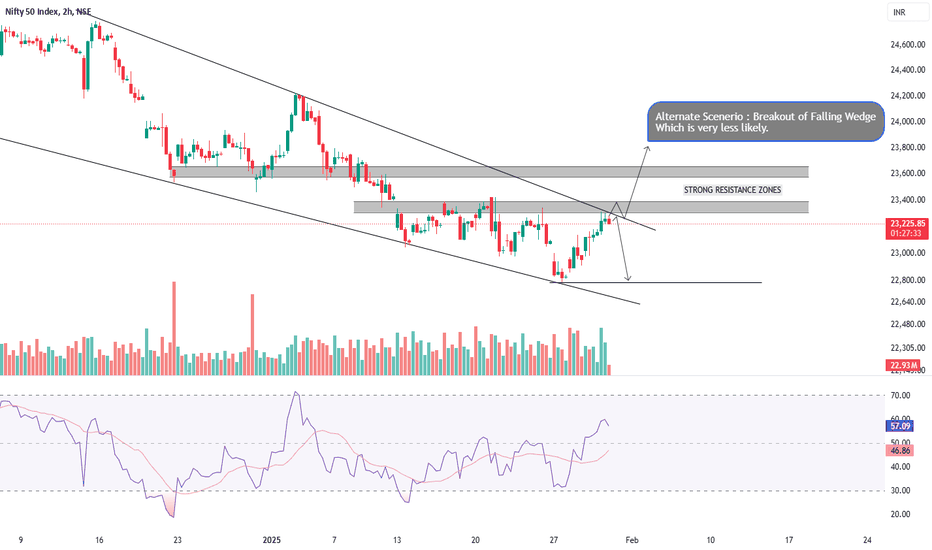

NIFTY 50 - BEARISH TREND WITH RESISTANCE ZONES AHEADSymbol - NIFTY50

CMP 23260

The Nifty50 is currently in a downtrend and is trading within a falling wedge pattern, indicating potential for a bearish move in the near future. At present, the index is trading at a resistance zone, specifically between 23260-23300, with additional resistance zones positioned further upwards. Given these technical factors, there is a strong expectation for a sell-off from the current levels. The downside targets are expected to be around the lows that were formed a few days back, which are near the 22800 level and possibly lower.

From a broader perspective, the Nifty50's technical structure suggests that further downward movement is likely as the price faces resistance and struggles to break above key levels. Therefore, traders should be cautious of any bullish reversal in the immediate term and instead focus on potential downside targets.

Key resistance levels to watch are near 23260-23300, with additional resistance higher up. Support is anticipated at the 22900-22830 level and below. Given the current pattern and resistance zone, a short-term bearish outlook seems more probable, with a potential continuation of the downtrend.

Laurruslabs - Potential Breakout Opportunity🚀 Laurruslabs - Potential Breakout Opportunity

🔑 Early Entry: ₹627.5

💥 ATH Level: ₹725

📊 Positioning & Strategy:

💰 Entry Point: ₹627.5

⚠️ Stop Loss (SL): ₹498 (20.9% downside risk)

🎯 Target 1: ₹725 (15% upside potential)

📈 Positional Target 1: ₹829 (~32% upside from entry)

🌟 Long-term Target: ₹999 (~59% upside from entry)

📍 Key Levels & Action Plan:

Laurruslabs has been in an upward trajectory since April 2023 📈.

It consistently takes support near the 200 DMA, signaling strength in its trend 🔄.

27 Jan 2025 saw a red candle with huge volume 📉, but the stock quickly bounced back 🚀.

The ATH level at ₹725 is key 🔑. A breakout above ₹725 would confirm a 3.5-year resistance breakout and All-Time High.

💡 Action Strategy:

For Safe Traders:

📉 Book partial profits at ₹725 and trail SL to lock in gains 📊.

For Risk-Tolerant Traders:

👀 Watch for a breakout above ₹725. If confirmed with 3-5X volume 📈 and a clean breakout candle, consider adding more 🚀.

🔢 Risk-to-Reward (RR) Calculations:

From Early Entry to Target 1 (₹725):

Upside: ₹725 - ₹627.5 = ₹97.5 (15% upside) 📈

Downside (SL): ₹627.5 - ₹498 = ₹129.5 (20.9% downside) ⚠️

Risk-to-Reward Ratio (R:R): 1:0.72 (Risk is higher than reward here, so position sizing is key 🧑💼)

From Early Entry to Positional Target (₹829):

Upside: ₹829 - ₹627.5 = ₹201.5 (32% upside) 📈

Downside (SL): ₹627.5 - ₹498 = ₹129.5 (20.9% downside) ⚠️

Risk-to-Reward Ratio (R:R): 1:1.56 (Better reward for the risk taken ✅)

From Early Entry to Long-Term Target (₹999):

Upside: ₹999 - ₹627.5 = ₹371.5 (59% upside) 📈

Downside (SL): ₹627.5 - ₹498 = ₹129.5 (20.9% downside) ⚠️

Risk-to-Reward Ratio (R:R): 1:2.87 (Excellent reward for the risk taken 🎯)

⚠️ Risks Involved:

📉 Market Conditions: The overall market is in a LH LL structure, so we are trading against the trend 📊, which adds extra risk 🔥.

🔥 27 Jan 2025 Candle: The red candle with high volume is concerning, but no follow-through happened 📉. The stock bounced back quickly, which we can consider as a shake-out 🌪️.

📏 Position Sizing: Due to the deep stop-loss (20.9%), position sizing is crucial to manage risk effectively ⚖️.

"The stock market is a device for transferring money from the impatient to the patient." — Warren Buffett

💬 Disclaimer:

This analysis is educational and not financial advice. Always do your own research 📚 and consult a professional advisor 💼 before making any trading decisions. Stock market investments are risky, and past performance doesn't guarantee future returns 💡.

Ascending Triangle Pattern in BAJAJ FINANCEChart Analysis & Trade Setup

Stock: Bajaj Finance Ltd (NSE)

Timeframe: 1W (Weekly Chart)

Technical Analysis:

Resistance Zone (Orange Region):

The price has faced multiple rejections in this zone historically.

The stock has now broken above this resistance, signaling a potential breakout.

Support Levels:

Purple Trendline: Long-term ascending trendline acting as dynamic support.

Blue Zones: These levels indicate past significant buying areas.

Breakout Confirmation:

Trade Plan:

Entry: Around ₹7,899 - ₹8,000, post-breakout confirmation.

Stop Loss (SL): Placed at ₹7,600 (below breakout zone).

Target: ₹10,000 (based on breakout projection and past price action).

Risk-to-Reward (RR) Ratio:

Target Gain: ₹2,000 (from ₹8,000 to ₹10,000)

Risk (SL): ₹400 (from ₹8,000 to ₹7,600)

RR Ratio: 5:1 (Favorable trade setup)

Expected Price Movement:

The price is expected to retest the breakout zone around ₹8,000 before moving higher.

If the retest holds, the stock may rally toward ₹9,200 - ₹10,000.

Coal India. Buy the Dip?Stock: Coal India (COALINDIA)

Current Price: ₹385.05

Technical Analysis:

1⃣ Descending Channel: The stock is trading within a descending channel, forming a base with a potential double-bottom pattern.

2⃣Structure: Lower Lows (LL) and Lower Highs (LH). The overall market structure remains weak.

3⃣200-DMA: Stock is trading below its 200-day moving average, indicating caution for bullish momentum.

Trading Plan:

Entry: Above ₹400.30 on a breakout candle backed by 3x-5x volume.

Stop Loss (SL): ₹352.55 (closing basis).

Target Levels:

T1: ₹428.30 (7.00%, R:R 0.8:1)

T2: ₹458.50 (14.55%, R:R 1.6:1)

Positional T1: ₹517.20 (29.20%, R:R 3.7:1)

Positional T2 (ATH): ₹544.30 (36.00%, R:R 4.7:1)

Key Observations:

Dividend Payout: Suitable for long-term investors accumulating during dips.

Weakness Trigger: A weekly close below ₹360 could indicate further downside. Risky traders may short below this level.

RSI: Needs improvement to signal bullish strength.

Momentum Play: Not recommended for short-term traders. Wait for structural change above ₹400.

What to Watch During Breakout?

Volume Surge: Wide-range breakout candle backed by 3x-5x average volumes.

Sustainability: Ensure a close above ₹400 to confirm a breakout.

Disclaimer:

This analysis is for educational purposes only. Always conduct your own analysis and consult a financial advisor before trading. Trade responsibly and manage risks.

UTI Showing signs of reversal. Add to your WL📊 Stock Analysis for UTI AMC

🔘Entry Levels:

Initial Entry (Small Qty): ₹1,260

Fresh Entry: Above ₹1,405 (with a strong breakout and good volume)

Stop Loss (SL):

₹1,133 (below the 200DMA and major support zone)

Target Levels (T):

T1: ₹1,405

T2: ₹1,721

Risk-to-Reward (R:R):

From Initial Entry to T2: Approx. 1:2.6

From Fresh Entry (T1) to T2: Approx. 1:2

🔘Setup Overview

The stock has consistently taken support at the 200 DMA, indicating strong demand at lower levels.

It’s currently consolidating near the ₹1,260-₹1,400 zone, forming a potential breakout pattern.

A breakout above ₹1,405 with high volume can lead to a new bullish rally.

⚠️Risk Considerations

Below ₹1,133, the structure may turn bearish, invalidating the setup.

Ensure the breakout above ₹1,405 is confirmed with strong volume and price action.

🔘Reasons for Risk Level

The 200 DMA support provides a good risk management level.

If the stock breaks down below ₹1,133, it could retest lower levels, indicating a potential trend reversal.

❗️Disclaimer

This analysis is for informational purposes only and should not be considered financial advice. Please conduct your own research or consult a financial advisor before making investment decisions. Trading in the stock market involves risk, and past performance is not indicative of future results.