Gold's safe haven cools down, gains hit resistanceSpot gold showed a clear downward trend during the trading session on Tuesday, and finally closed at $3,317.06/ounce, a single-day drop of 0.8%. The decline was mainly affected by two fundamental factors: first, the Trump administration unexpectedly softened its stance on auto tariffs, significantly weakening the market's risk aversion demand; second, the US dollar index took the opportunity to rebound, suppressing gold denominated in US dollars. It is worth noting that the market will usher in the release of two key economic data, the US GDP in the first quarter and the core PCE price index in March, on this trading day. These data are likely to redefine the market's expectations for the direction of the Fed's monetary policy.

Technical analysis:

From the daily level, the gold price has formed a bearish engulfing pattern, and the closing price has effectively fallen below the 5-day moving average support. The MACD indicator shows that the momentum is weakening, the red energy column continues to shrink, and the fast and slow lines tend to flatten. The current price is running in the range of 3324-3308, and the previous high of 3343 above constitutes an important resistance, while the psychological level of 3300 below and the 50-day moving average position of 3285 form key support.

The hourly chart shows more operational technical features: the price forms an obvious descending triangle consolidation pattern in the range of 3330-3300. The moving average system shows that the short-term trend is weak, the 5/10 hour moving average forms a dead cross near 3320, and the 20 hour moving average is pressed down to 3325 to form a dynamic resistance. The RSI indicator remains in the neutral area of 40-55, indicating that the market has not yet entered an oversold state. It is particularly noteworthy that the gold price has failed to test the 3330 resistance twice, and the pressure effect of this position deserves special attention.

Trading strategy recommendations:

Under the current technical pattern, it is recommended to adopt the idea of shorting on rallies. The ideal entry range for short orders is 3320-3325, and the stop loss should be set above 3330. The downside target first looks at the 3300 integer mark. If it breaks through effectively, it may further explore the 3285 support level. Special attention should be paid to the price performance during the European session: if the European session continues to be weak, short positions can be considered during the US session; if there is a strong rebound in the European session, it may turn into a volatile pattern, and the trading strategy needs to be adjusted at that time.

For potential long opportunities, it is recommended to remain cautious. Only when the price effectively breaks through the 3330 resistance and stabilizes, the strategy of stepping back to long positions can be considered, with the stop loss set below 3320 and the target looking at around 3343.

Risk warning:

This trading day needs to focus on the US GDP and PCE data released in the evening. If the GDP data is lower than the expected lower limit of 2.3%, it may re-stimulate safe-haven buying; and if the core PCE year-on-year growth rate exceeds 2.9%, it may strengthen the market's expectations that the Federal Reserve will maintain a hawkish stance. In addition, the support strength of the 3300 integer mark needs special attention, and any breakthrough may trigger subsequent trend market conditions.

Summary:

Combining technical and fundamental analysis, gold is weak in the short term, and it is recommended to take shorting on rallies as the main operation direction. However, we need to pay close attention to the possible fluctuations caused by important economic data and the defense of the key support level of 3300. Traders should strictly control risks, and it is recommended that the risk of a single transaction be controlled within 1-2% of the account funds.

Community ideas

TATAPOWER 27% upside possibility in next 5-6 MonthsTATAPOWER 27% upside possibility in next 5-6 Months.

TATA Power Monthly channel seems following 6 months cycle ... Last correction cycle is completed in march now we can expect complete retracement of last fall in next 5-6 months.

LTP - 385

Targets - 490+

Timeframe - 5-6 Months.

Happy Investing.

ETH - FIBO LevelsFibonacci retracement is a popular technical analysis tool used to identify potential support and resistance levels during a price correction or retracement. It is based on the key Fibonacci ratios:

0.236 (23.6%), 0.382 (38.2%), 0.5 (50%), 0.618 (61.8%), and 0.786 (78.6%).

📊 Chart Explanation:

Swing High (Red Arrow)

This is the recent high before the price began to drop.

On this chart, the swing high is marked around 1,843.20 USD.

Swing Low (Green Arrow)

This is the lowest point reached before the price began to retrace upward.

The swing low is around 1,781.37 USD.

Fibonacci Levels Drawn: The retracement levels are calculated between these two points:

0.236 (1,795.96 USD) — Minor resistance/support level.

0.382 (1,804.99 USD) — Often a stronger level of reaction.

0.5 (1,812.28 USD) — Midpoint, psychologically significant.

0.618 (1,819.58 USD) — Golden ratio, often a strong reversal level.

0.786 (1,829.97 USD) — Deep retracement, still common before trend continuation.

1.0 (1,843.20 USD) — Original swing high.

Current Price:

The price is around 1,814.45 USD, which is slightly above the 0.5 retracement level, suggesting a potential resistance or continuation zone.

Nifty 50Nifty 50 on 1 hour time frame seems to be in internal wave 4th

DISCLAIMER :- this chart is only for educational purposes on wave theory practice

Elliott wave is subjective and may vary in counting so only use this for your study purposes, never ever make any of your decisions based on charts shared here as it is only for practice and study

Nifty Intraday Analysis for 30th April 2025NSE:NIFTY

Index closed near 24335 level and Maximum Call and Put Writing near CMP as below in current weekly contract:

Call Writing

25500 Strike – 165.15 Lakh 24400 Strike – 155.19 Lakh

25000 Strike – 121.52 Lakh

Put Writing

24300 Strike – 122.54 Lakh

24000 Strike – 112.38 Lakh

24200 Strike – 93.15 Lakh

Index has resistance near 24500 – 24550 range and if index crosses and sustains above this level then may reach near 24700 – 24750 range.

Index has immediate support near 24150 – 24100 range and if this support is broken then index may tank near 23900 – 23850 range.

Today's gold price focuses on support level: 3260Today's gold price focuses on support level: 3260

Affected by the Asian market closure, today's gold price broke through the triangle convergence oscillation structure and returned to wide range oscillation.

Next, focus on testing 3260. Once the support level is broken,

the gold price is likely to have a directional breakthrough again near 3245.

This is the best position range for long trend bottom-fishing: 3240-3260.

Similarly, this is also the best breakthrough range for short trend.

Once a big drop occurs, the next short target will be around 3180. If the 3260-3240 range can be held and a reversal is formed, then the gold price will most likely return to the 3400-3500 range again in the future.

Therefore, our strategy today is:

Look for opportunities to go long in the 3240-3260 range, stop loss at 3230-3240, target at 3300-3330.

Look for opportunities to short in the 3280-3300 range, stop loss at 3300-3310, target at 3240-3180.

I agree with both views.

After all, the Asian market has been closed for nearly 4 days.

Now, we have to observe the performance of the US market to determine the next move.

Banknifty Intraday Analysis for 30th April 2025NSE:BANKNIFTY

Index closed near 55390 level and Maximum Call and Put Writing near CMP as below in April Month contract:

Call Writing

55500 Strike – 10.89 Lakh

56000 Strike – 8.37 Lakh 57000 Strike – 8.26 Lakh

Put Writing

54000 Strike – 11.95 Lakh

55000 Strike – 9.11 Lakh

55500 Strike – 8.59 Lakh

Index has resistance near 55900 – 56000 range and if index crosses and sustains above this level then may reach near 56500 – 56600 range.

Index has immediate support near 54900 - 54800 range and if this support is broken then index may tank near 54400 - 54300 range.

Finnifty Intraday Analysis for 30th April 2025NSE:CNXFINANCE

Index closed near 26195 level and Maximum Call and Put Writing near CMP as below in April Month contract:

Call Writing

26000 Strike – 0.57 Lakh

26500 Strike – 0.46 Lakh

26400 Strike – 0.35 Lakh

Put Writing

26000 Strike – 1.07 Lakh

25500 Strike – 0.50 Lakh

26300 Strike – 0.32 Lakh

Index has resistance near 26375 - 26425 range and if index crosses and sustains above this level then may reach near 26600 - 26650 range.

Index has immediate support near 26000 – 25950 range and if this support is broken then index may tank near 25825 – 25775 range.

Midnifty Intraday Analysis for 30th April 2025NSE:NIFTY_MID_SELECT

Index closed near 12195 level and Maximum Call and Put Writing near CMP as below in April Month contract:

Call Writing

12300 Strike – 2.04 Lakh

12500 Strike – 2.00 Lakh

12200 Strike – 1.85 Lakh

Put Writing

12000 Strike – 2.94 Lakh

12200 Strike – 1.63 Lakh

12300 Strike – 1.35 Lakh

Index has immediate resistance near 12350 – 12400 range and if index crosses and sustains above this level then may reach 12625 – 12675 range.

Index has immediate support near 12050 – 12000 range and if this support is broken then index may tank near 11850 – 11800 range.

Gold (XAU/USD) Intraday Buy Setup with High Reward-to-Risk Ratio1. Entry Point Zone: Around 3,271.79 USD

This is identified as a potential buy entry area, marked in purple.

2. Stop Loss: Below the entry point at 3,257.71 USD

Risk management level in case the trade moves against the setup.

3. Target Point One: Between 3,313.75 and 3,317.07 USD

A short-term take-profit level, likely based on previous resistance.

4. Final Target (EA Target Point): Around 3,373.04 USD

A more ambitious take-profit, possibly based on a major resistance level or Fibonacci extension.

5. Trade Range:

Risk: 3,271.79 - 3,257.71 = 14.08 USD

Reward to First Target: ~42 USD

DLF - Commencing 5th wave up 770 to be tested firstAs per the EW counts, I believe that the 4th has ended now and the script is in it's early stages of the 5th wave up.

Here is the count on larger TF period

For this series, as per the harmonic pattern, 770 looks very much possible.

Lets track.

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views. If you like my analysis and learnt something from it, please give a BOOST. Feel free to express your thoughts and questions in the comments section.

Bitcoin Bybit chart analysis April 29Hello

It's a Bitcoinguide.

If you have a "follower"

You can receive comment notifications on real-time travel routes and major sections.

If my analysis is helpful,

Please would like one booster button at the bottom.

This is the Nasdaq 30-minute chart.

There will be an indicator announcement at 11 o'clock in a little while.

After the 4-hour chart MACD dead cross was imprinted yesterday

Today, two things are clear

*Red finger strong rise or purple finger major rebound.

The main issue was whether the 6-hour chart MACD dead cross occurred

After writing the analysis, looking at the overall movement

The purple finger seems strong today.

Let's apply it to Bitcoin as it is.

This is a 30-minute Bitcoin chart.

At the bottom left, I connected the long position entry point of $93,046 that I entered in the analysis article on the 25th.

Bitcoin and Tether dominance are moving sideways.

Bitcoin is slightly more advantageous in terms of MACD signals or Ichimoku Kinko Hyo,

but it is not strange if one side skyrockets or plummets.

While moving sideways, I was watching Nasdaq,

and I paid attention to the Nasdaq movement.

*Red finger movement path

One-way long position strategy

1. 94242.4 dollar long position entry section / green support line breakaway stop loss price

2. 96005.1 dollar long position 1st target -> Top 2nd target -> Final Good

The 1st section at the top is the rising wave position

If you touch it first, the possibility of success of the strategy increases.

If the strategy is successful, it would be good to use it as the final long position re-entry.

Depending on the adjustment coming out of Nasdaq, it can be pushed up to section 2

Roughly, it is the support line of the Bollinger Band 6-hour chart.

If the rebound fails in Nasdaq

Bottom -> Please note that it can be pushed to section 3.

Up to this point, please use my analysis as a simple reference and use.

Thank you.

BTC/USD) Short Setup: Triple Top Formation Targeting 86,023 USD You’re seeing a potential Head and Shoulders structure (or at least a triple top) — with the orange circles marking failure to break higher around $95K.

The neckline (support) is slightly diagonal down toward the $94K region.

A breakdown is anticipated once the neckline fails.

2. EMAs Interaction:

30 EMA (red) is currently flattening, showing weakening momentum.

200 EMA (blue) is far below, around 88,181 USD, acting as a major support zone — and it aligns with the projected EA TARGET POINT.

EMA compression usually precedes a strong move.

3. Zones and Key Price Levels:

Entry Point: ~95,145.60 USD → high-probability short sell.

Stop Loss: ~96,000–96,957 USD → protects against unexpected breakout.

Target: ~86,023 USD → aligns with past accumulation zone and EMA200.

4. Risk/Reward Ratio:

Potential reward is about 9–10%.

Risk (from entry to stop) is about 1–2%.

Excellent Risk/Reward (>4:1).

5. Momentum and Volume (implied, not shown):

Given the topping pattern and lack of higher highs, buying momentum is weakening.

If volume increases on a breakdown, confirmation will be strong.

📊 Strategic Points:

Aspect Analysis

Trend Still bullish, but topping signs visible

EMA Behavior Short-term EMA flattening, long-term EMA rising slowly

Pattern Formed Triple Top / Head and Shoulders

Risk/Reward Very good (>4:1)

Recommendation Short bias around entry level, with strict stop-loss

⚡ Quick Trading Plan:

Entry: Short at ~$95,145

Stop Loss: ~$96,000–96,957

Target: ~$86,023

Silver (XAG/USD) Falling Wedge Breakout –Bullish Setup Targeting📉 Pattern: Falling Wedge

🔵 Price was consolidating inside a falling wedge (🔽), which is typically a bullish reversal pattern.

🟡 Multiple touchpoints along the trendline confirm the structure.

Support Zone: 🔵

Area: 31.95 – 32.10

✅ Price tapped into this strong demand zone

🔥 Big bullish wick shows rejection – buyers stepping in!

EMA 70: 🔴

🧭 Acting as a potential dynamic resistance at 33.04

Watch for a clean breakout above it to confirm momentum.

Trade Setup:

Entry: ✅ Current area (~32.44) looks like a good long entry after bounce.

Stop Loss: ❌ Below 31.95 (under the blue zone)

Target: 🎯 33.68510 (Previous high)

📈 Huge upside potential if wedge breakout confirms!

Summary:

📉 Pattern: Falling Wedge

🔵 Strong Support Zone

✅ Bullish Rejection

🎯 Target: 33.68

❌ Stop Loss: Below 31.95

⚠️ Watch EMA 70 for resistance

🟢 Bias: Bullish – looking for breakout!

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in PARAS

BUY TODAY SELL TOMORROW for 5%

Option TradingOption trading involves buying or selling contracts that give the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a specific price (strike price) by a certain date (expiration date). It allows traders to speculate on future price movements of an asset without actually owning it.

TCS at Confluence of Resistance / EMA / ST/ GAP/ AVWAP / FIB

Between 3500-3550, TCS could face strong resistance on multiple fronts and they are listed below.

Daily SuperTrend

GAP Zone

50 DEMA at 3540 (retesting it after a long time, expect a rejection)

Fib retracement of 61.8% of the recent swing

Avwap from the recent swing (at 3530)

100% (abc pullback) from the swing low (at 1498)

Daily chart with Harmonic pattern, suggests that one more low at 3000 odd levels is due. The same is being observed as per the EW counts

Here is the chart with possible path/count/target destinations

Finally, this is a first bounce after a sharp correction; expect first bounces to be sold in to, similarly, first dip will be bought in to.

In all likelihood, I am not expecting TCS to go up much from here.. expecting a meaningful decline before resuming the upmove.

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views. If you like my analysis and learnt something from it, please give a BOOST. Feel free to express your thoughts and questions in the comments section.

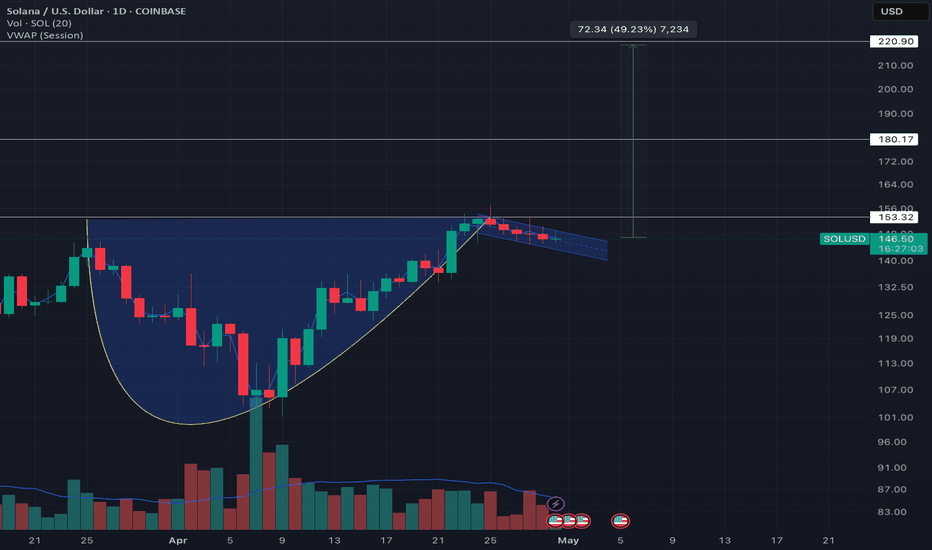

Solana Might Rally Towards $220 Solana is currently forming a classic cup and handle pattern on the daily chart, which, when confirmed, is a strong bullish continuation setup.

The cup formed over several weeks with a rounded bottom and volume decreasing midway through the base, which aligns with traditional pattern behavior.

The current handle is consolidating as a downward-sloping bull flag. Volume is gradually tapering off during the handle — again, a textbook characteristic suggesting sellers are losing steam.

A daily candle close above ~$153.30 on solid volume would confirm the breakout.

That level also aligns with previous local highs, making it a key resistance zone.

Once confirmed, the pattern implies a measured move target near $220, derived from the depth of the cup.

Stop-loss could be a close below the previous local lows.

What do you think of this setup? Would you enter on the breakout or wait for a retest?