CHFJPY Short Setup – Bearish Rejection from Supply Zone & Trendl📋 Description:

Pair: CHFJPY

Timeframe: 2-Hour

Bias: Bearish

Strategy Used: Supply & Demand + Break of Structure + Trendline Retest + Price Action Confirmation

🧠 Analysis & Thought Process:

CHFJPY recently broke out of a descending trendline that acted as dynamic resistance for multiple sessions. Post breakout, price aggressively rallied and is now reacting to a major supply zone between 175.400 – 176.200, which is a previous area of strong selling.

Price formed multiple rejection wicks and a bearish engulfing candle at this supply zone. This is a classic liquidity grab and fakeout setup, where price pushes into premium pricing to trap late buyers before reversing.

Additionally, the market has formed a lower high near the resistance, and is respecting an internal bearish structure on lower timeframes. The risk-to-reward setup is favorable, with a small stop and a high-probability target below.

🎯 Trade Plan:

Entry: 175.450 (after confirmation of rejection inside supply)

Stop Loss: 176.200 (above supply zone and liquidity wick)

Take Profit 1 (TP1): 174.500 (minor demand zone)

Take Profit 2 (TP2): 173.300 (major demand zone + imbalance fill)

Final Target (TP3): 171.200 (macro demand zone)

⚖️ Risk-to-Reward Ratio:

TP1: 1:2

TP2: 1:4

TP3: 1:6+

🧩 Confluences:

Rejection from key 2H supply zone

Bearish engulfing candle at zone

Trendline break retest

Market structure shift – forming lower highs

Targeting imbalance fill and demand zone below

⚠️ Risk Management Advice:

Risk 1% of your capital on this trade. Trail stops after TP1 is hit. If price breaks above 176.200 and sustains, setup is invalidated.

Disclaimer: This idea is for educational purposes only. Not financial advice.

Community ideas

Gold Weekly Review and Next Week Analysis

Weekly analysis of spot gold: Multiple factors drive sharp fluctuations, and the market focuses on the Fed's policy signals

Market review: Cooling of risk aversion and strong US dollar suppress gold prices

Spot gold continued its adjustment trend this week, falling 2.28% on a weekly basis to close at $3,240.60/ounce, down about 7% from the historical high of $3,500.05/ounce on April 22. Market fluctuations are mainly driven by the following factors:

Weakened safe-haven demand: Market expectations of easing trade tensions have weakened gold's safe-haven appeal.

Strong US economic data: Non-farm payrolls added 177,000 jobs in March, far exceeding expectations, pushing the US dollar index and US Treasury yields up simultaneously, further suppressing the holding cost of interest-free assets gold.

Expectations of a Fed rate cut have cooled: After the release of employment data, the market lowered the probability of a rate cut in June to less than 50%, and the repricing of interest rate prospects put pressure on gold prices.

In terms of geopolitics, the potential risks of the situation between Russia and Ukraine provide some support for gold prices, but the rebound in risk appetite in global stock markets (especially the US S&P 500 index, which rebounded 17% from its low in April) limits the rise of gold.

Technical analysis: The game between long and short intensifies, and the key range is to be broken

Daily level: Gold price closed near the middle track of the Bollinger Band (US$3239.61/ounce). Although the MACD short momentum has weakened, it still dominates overall.

4-hour level: The Bollinger Band narrowed, and the MACD formed a weak golden cross, indicating that the short-term rebound momentum is accumulating, but no trend signal has been formed yet.

Key range: US$3220-3260/ounce is the core area of the current long and short competition. If it breaks through US$3260/ounce, the upper resistance will be US$3300-3350/ounce; if it falls below US$3220/ounce, it may fall to the support level of US$3150/ounce.

Institutional views diverge: long and short logics intertwined

Bearish view:

Gold is under significant technical correction pressure after hitting its historical high. If the trade situation eases further or US economic data continues to be strong, gold prices may continue to fall.

The Fed's expectation of maintaining high interest rates supports the US dollar, which has long suppressed gold. The technical downward trend has not yet shown a reversal signal.

Bullish view:

Potential weakness in the US economy (such as repeated inflation and subsequent weakening of the job market) may prompt the Fed to turn to easing, and the safe-haven property of gold will be re-focused.

Geopolitical uncertainties (such as escalation of the Russian-Ukrainian conflict) or a deadlock in trade negotiations may quickly boost safe-haven demand.

Next week's outlook: Fed policy and economic data are the focus

May FOMC meeting: The market generally expects the Fed to remain on hold, but Chairman Powell's speech may release new signals about the interest rate path. If the statement is hawkish, gold prices may be under pressure again.

Economic data:

ISM Services PMI (Monday): If the data exceeds expectations, it will further strengthen the narrative of "US economic resilience" and be bearish for gold.

Initial jobless claims (Thursday): Labor market dynamics are an important reference for the Fed's policies, and data fluctuations may trigger short-term trading opportunities.

Geopolitical and trade risks: It is necessary to pay attention to the development of the situation between Russia and Ukraine and the trend of trade negotiations. Any unexpected escalation may trigger safe-haven buying.

Technical trading strategy:

Break through $3,260/ounce: You can try long with a light position, with a target of $3,300/ounce.

Lose $3,220/ounce: Be alert to further explore the support area of $3,150-3,165/ounce.

Conclusion

The gold market is currently in a sensitive stage of adjustment and direction selection, and macroeconomic policy expectations and technical game jointly dominate price fluctuations. Investors need to pay close attention to the Fed's policy signals and economic data performance, and flexibly adjust their positions to cope with potential risks. In the short-term volatile pattern, it is recommended to focus on range trading, and in the medium and long term, it is necessary to observe the changes in the fundamentals of the US economy and global risk sentiment.

RBL Bank at Multi-Year Lows-Contrarian OpportunityWarren Buffett's philosophy of "buy when others are fearful" resonates with the current scenario of RBL Bank. From its peak of ₹700, the stock has witnessed a steep decline, sparking concerns among investors. However, such situations often present lucrative opportunities for contrarian traders and value investors.

Is the current price an attractive entry point or a falling knife? A deep dive into technical and fundamental analysis can reveal whether it's time to embrace the fear or stay cautious.

Disclaimer: This is educational post and study further if you wishes to invest.

Bandhan Bank - an opportunity for patience investorsBandhan bank - Small size bank with big aspirations

all information as of 31-Dec-24, after market hours

Market Cap 25,616cr

PE 9.19

dividend yield .94%

rising sales , rising profit in last 5 years

stocks falls for many reason but go up for one reason, good fundamental and earing prospect.

Disclaimer - education advice and study further before investing

Asian Paints: A Blue-Chip Opportunity at 3-Year LowsAsian Paints, a stalwart in the Indian Paint market, has dropped to ₹2,300, marking a three-year low. Amidst this decline, the stock exhibits noteworthy indicators:

1. **Relative Strength Index (RSI)**: Currently below 50, signaling potential oversold territory.

2. **Price-to-Earnings Ratio (P/E)**: Historically low at <46, presenting a rare valuation opportunity.

Here’s why I believe this is an attractive long-term investment:

1. **Attractive Dividend Yield**: At the current price, the dividend yield is 1.46%, offering a steady income stream.

2. **Robust Financial Health**: The company boasts negligible debt, ensuring financial stability.

3. **Strong Reserves**: Asian Paints has a reserve of ₹17,928 crore, a solid buffer for future growth.

4. **Cash Flow Strength**: With a cash generation of ₹6,104 crore, the company has ample liquidity for operations and expansion.

5. **Growth-Oriented Investments**: The company is investing ₹2,500 crore in fixed assets, underscoring its focus on long-term growth.

As Warren Buffett says, *"Be fearful when others are greedy, and greedy when others are fearful."* This downturn may present a strategic buying opportunity for patient investors.

---

**Disclaimer**

1. Perform your own analysis or consult a financial advisor before investing.

2. This investment may require a long horizon to yield significant returns.

MAHINDRA LIFESPACE technical analysisMahindra Lifespace Developers Limited (NSE: MAHINDRA LIFESPACE DEVLTD), current price: INR 350.10. The company is a real estate and infrastructure development firm under the Mahindra Group, specializing in residential and commercial projects, integrated cities, and industrial clusters.

Key Levels

Support Level: INR 294.65

Swing Level: INR 373.10

Possible Upside Levels: INR 662.85, INR 767.30, INR 900.30

Technical Indicators

RSI: The Relative Strength Index (RSI) is currently at 38.91, indicating that the stock is approaching oversold territory, which may suggest a potential buying opportunity if the trend reverses.

Volume: The trading volume is 498.52K, showing a significant increase in activity, which could indicate heightened investor interest and potential volatility.

Sector and Market Context

Mahindra Lifespace Developers Limited operates within the real estate sector, which has shown mixed performance due to varying market conditions, regulatory changes, and economic factors. The overall market trends indicate cautious optimism with gradual recovery post-pandemic, but the sector remains sensitive to interest rate changes, government policies, and economic growth indicators. The stock’s performance should be monitored in relation to these broader market trends and sector-specific developments.

Risk Considerations

Economic Downturn: A slowdown in economic growth could negatively impact the real estate sector, affecting demand for residential and commercial properties.

Regulatory Changes: Government policies, such as taxation or real estate regulations, could influence the company’s operations and profitability.

Interest Rate Fluctuations: Rising interest rates could increase borrowing costs for both the company and potential buyers, potentially dampening demand.

Market Sentiment: Investor sentiment and market volatility could lead to unpredictable stock movements, influenced by broader market trends and news events.

Analysis Summary

Mahindra Lifespace Developers Limited shows potential for recovery with key support and swing levels identified. The RSI indicates the stock is nearing oversold territory, which may present a buying opportunity if the trend reverses. Increased trading volume suggests heightened investor interest, but caution is advised due to potential risks such as economic downturns, regulatory changes, and interest rate fluctuations. Investors should monitor sector and market trends closely and consider risk factors before making investment decisions.

5th may Nifty50 Predictions & trade zone#Nifty50 #option trading

🚀 If you like my trading plan and levels, don't forget to boost the post

99% working trading plan (Opning Possibility Gapup 110point +)

👉Gap up open 24412 above & 15m hold after positive trade target 24512, 24680+

👉Gap up open 24412 below 15 m not break upside after nigetive trade target 24220, 24120

👉Gap down open 24212 above 15m hold after positive trade target 24412 , 24512

👉Gap down open 24212 below 15 m not break upside after nigetive trade target 24120, 23790,

👉 Trade NIFTY 08 May 24550 PE @216 to 390+

💫big gapdown open 24212 above 1st positive trade view

💫big Gapup opening 24512 below 1st nigetive trade view

📌 Trade plan for education purpose I'm not responsible your trade

More education follow social media and boost my idea

📌 koi bhi trade leval se 20 point ke sl ke bhina karan nahi hi

📌 koi trade app activate tabhi karana hota hi level pe 2 candle uper ya niche closing aati hai to

📌 leval par Ane pe turant trade plan na kare ...

📌 Full risk apaki hi hi meri na

Bank Nifty Levels for 05/05/2025Timeframe Conflicts:

4H & 15M (Bullish): Indicate a medium-term and short-term uptrend.

1H (Bearish): Suggests a short-term pullback or consolidation.

Interpretation: The overall trend may remain bullish, but the 1-hour bearish signal warns of potential volatility or profit-taking. Traders should watch for a breakout above 55957 to confirm bullish momentum or a drop below 54723 and 54176 for a reversal.

Key Levels:

Support Levels:

54723 (immediate support)

54176 (major support).

Resistance Levels:

55957

56098

Conclusion:

Short-Term (1H): Cautious due to bearish momentum; watch 54723 & 54176 for direction.

Medium-Term (4H/15M): Bullish bias persists if supports hold.

Trade Idea:

Long above 55957

Short below 54723 & 54176 targeting 51893.

Latest gold price range: 3230-3270Latest gold price range: 3230-3270

Important news:

The non-farm payrolls data released on Friday was strong: the next rate cut by the Fed may have to wait until July at least.

If the employment data is strong again in the future, the timing of the rate cut may be further delayed.

After the release of the non-farm data last night, the gold price fell as expected, but then quickly bottomed out and rebounded, continuing to fluctuate.

At present, the gold price is under pressure at the 3270 line and has fallen back, so the area near 3270 will still be the key turning point for gold bulls and bears next week.

If the gold price is under pressure at 3270 next week and does not break, it will fluctuate at most, and the gold bulls will not reverse directly and easily for the time being.

From the 4-hour chart analysis, the non-farm market has basically ended, and the upper side continues to pay attention to the suppression of the 3270 line, with a focus on 3300.

From a technical point of view, the gold daily line shows a bottoming rebound trend, and the price forms a short-term support in the 3230 line area.

Upper pressure: 3270-3300

Lower support: 3220-3230

Operation strategy:

1. It is recommended to short gold near 3260-3270 next week, stop loss 3270, target: 3240-3230-3220.

2. Long gold near 3220-3230, stop loss 3210, target: 3240-3260. If it breaks through, continue to hold;

BTC/USD 4H Chart Setup – Bullish Breakout Targeting $104K1. Trend Direction

⬆️ Uptrend Detected

* Price is forming higher highs and higher lows

* Trading inside a bullish channel

* Breakout potential above the top trendline.

2. Key Zones

🟦 Support Zone: $95,252.31

* Labeled as RBS + RBR ZONE

* Strong buy area → previous resistance turned support

* Perfect area to catch a bounce

📏 Support Line & Trendline

* Trendline keeps price supported along the climb

* Acts as a launch pad for the next move.

3. EMA 70 (📉 Red Line)

* Current value: $93,636.88

* Price is above EMA, showing strong bullish pressure

* EMA acts as dynamic support.

4. Trade Setup

🎯 Target Point: $104,000

🟦 Target Zone: $103,918.60 – $104,747.91

🔥 Entry Zone: $95,252.31 (marked blue box)

⚠️ Stop Loss: $94,091.28

* Positioned safely below support

* Good Risk/Reward Ratio.

5. Extra Cues

📅 Economic event icons near May 3–6 → Potential volatility ahead

⚡ Pullback in progress → May offer a buying opportunity.

Conclusion

🚀 Bullish Setup!

* Watch for a bounce from the blue demand zone

* Targeting $104K breakout

* Strong support + momentum = solid long opportunity.

Sell INDUSTOWER @384 with Target 340 and SL 39503th May 2025 / 1.50 PM

Sell INDUSTOWER @384 with Target 340 and SL 395

1. Stock made clear false BD

2. Entered in the parallel channel again

3. Good volume on 02 May 2025

4. Expecting correction from here till 340.

Expected Targets and SL are mentioned in Chart

Note: Short term aggressive price downside possible

Stock Analysis: Wonder Electricals LtdIntroduction:

Wonder Electricals Ltd is a fully integrated end-to-end manufacturer and supplier of Ceiling fans, Exhaust fans, Pedestal fans and brushless DC (BLDC) fans. Wonder Electricals is a leading Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM) for fans in India, supplying to 10+ top brands and exporting to the Gulf and neighboring countries.

Fundamentals:

Market Cap: ₹ 2,106 Cr.;

Stock P/E: 151 (Ind. P/E: 66.82); 👎

ROCE: 15.9% 👍; ROE: 15.9% 👍;

PEG Ratio: 2.8 👎 (Stock price valuation is relatively overvalued related to its earnings growth)

3 Years Sales Growth: 23% 👍

QoQ Sales Growth of more than 50%

3 Years Compounded Profit Growth: 29% 👍

3 Years Stock Price CAGR: 111% 👍

Four Factor Model:

Quality Factor: 52/100

Growth-Factor: 100/100 👍

Valuation Factor: 35/100

Technical Factor: 25/100

Overall Score: 61/100

Technicals:

The stock price is above 200 EMA.

Current price is 84.46% away from 52 week low and 21.42% away from 52 week high

The stock is trading below 20 EMA(Black Line), 50 EMA (Orange Line) and 100 EMAs (Blue Line).

Resistance levels: 148, 130

Support levels: 165, 180, 187, 200

Verdict: Average Financial Strength, High Growth Trend Stock Priced at High Valuations

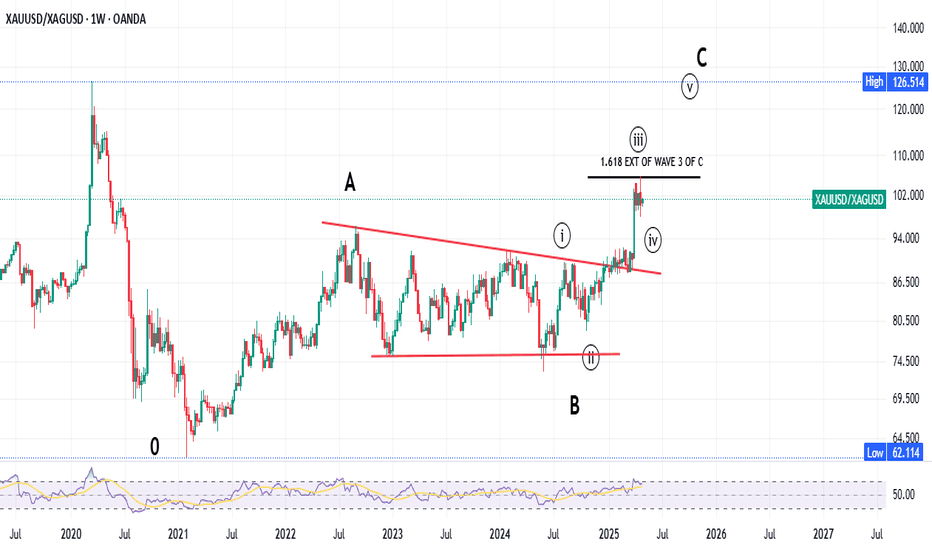

GOLD going to outperform SILVER in short termYes, for past many months GOLD has outperformed SILVER and this is likely to happen in course of next few weeks and months.

That implies:

1. If both of them falls then, SILVER will fall more than GOLD

2. If both rises than GOLD will rise more than SILVER

We are in a ABC Correction and after it is completed than SILVER will outperform GOLD massively