Channel Pattern - NIFTYNIFTY

Nifty now trade channel pattern break and trade above .

Next nifty uptrent Target 28500 shortly.

Nifty 2021 oct to 2024 sep trading in channel pattern only. So Pattern support zone recently enter and recover. Pattern continue coming days also.

Next short term target 24500 if hold above 24500 Next target 28500.

Community ideas

HDFC Bank ltd // 3hour Support and ResistanceAs of May 5, 2025, here are the key support and resistance levels for HDFC Bank Ltd. (NSE: HDFCBANK) based on the 3-hour chart:

📊 3-Hour Pivot Points

Level Value (₹)

S3 1,689.18

S2 1,701.12

S1 1,714.03

Pivot 1,725.97

R1 1,738.88

R2 1,750.82

R3 1,763.73

These levels are calculated based on the previous day's high, low, and close prices and are used to identify potential support and resistance zones.

📈 Technical Indicators

Relative Strength Index (RSI): 72.46 (Strong Uptrend)

Stochastic RSI: 0.92 (Strong Uptrend)

Commodity Channel Index (CCI): 130.18 (Strong Uptrend)

Money Flow Index (MFI): 86.61 (Strong Uptrend)

These indicators suggest a strong bullish momentum, indicating potential upward movement if buying interest continues.

📌 Summary

Immediate Support: ₹1,689.18

Immediate Resistance: ₹1,738.88

Medium-Term Outlook: Bullish, with strong momentum indicators and positive moving averages.

Please note that technical analysis is subject to change based on market conditions. It's advisable to monitor these levels regularly and consider consulting with a financial advisor for personalized investment advice.

RR KABEL LTDAs of May 5, 2025, here are the key support and resistance levels for R R Kabel Ltd. (NSE: RRKABEL) based on recent technical analyses:

📊 Classic Pivot Points (1-Day View)

Support Levels:

S3: ₹880.40

S2: ₹901.70

S1: ₹924.85

Resistance Levels:

R1: ₹969.30

R2: ₹990.60

R3: ₹1,013.75

Pivot Point: ₹946.15

These levels are derived from the price range of the previous trading day and are commonly used to identify potential reversal points in the market.

📈 Moving Averages & Indicators

Simple Moving Averages (SMA):

5-Day: ₹915.44 (Buy)

10-Day: ₹911.38 (Buy)

20-Day: ₹907.79 (Buy)

50-Day: ₹891.27 (Buy)

100-Day: ₹896.50 (Buy)

200-Day: ₹1,012.39 (Sell)

Exponential Moving Averages (EMA):

5-Day: ₹918.88 (Buy)

10-Day: ₹913.53 (Buy)

20-Day: ₹906.36 (Buy)

50-Day: ₹898.08 (Buy)

100-Day: ₹928.24 (Sell)

200-Day: ₹1,003.36 (Sell)

The alignment of these averages suggests a bullish short-term to medium-term outlook, with some indicators signaling bearish trends in the long term.

📉 RSI & Momentum Indicators

Relative Strength Index (RSI): 65.27 (Buy)

Stochastic RSI: 68.79 (Buy)

MACD: 7.38 (Buy)

Average Directional Index (ADX): 35.19 (Buy)

These indicators suggest a strong bullish momentum, indicating potential upward movement if buying interest continues.

📌 Summary

Immediate Support: ₹880.40

Immediate Resistance: ₹969.30

Medium-Term Outlook: Bullish, with strong momentum indicators and positive moving averages.

NIFTY Levels for May 5, 2025

NIFTY Levels for Today

Here are the today's NIFTY Levels for intraday. Based on market movement, these levels can act as support, resistance or both.

Please consider these levels only if there is movement in index and 15m candle sustains at the given levels.

The SL (Stop loss) for each BUY trade should be the previous RED candle below the given level. Similarly, the SL (Stop loss) for each SELL trade should be the previous GREEN candle above the given level.

Note: This idea and these levels are only for learning and educational purpose.

Your likes /boosts gives us motivation for continued leaning and sharing ideas.

BANKNIFTY Levels May 5, 2025

BANKNIFTY Levels for Today

Here are the today's BANKNIFTY Levels for intraday. Based on market movement, these levels can act as support, resistance or both.

Please consider these levels only if there is movement in index and 15m candle sustains at the given levels.

The SL (Stop loss) for each BUY trade should be the previous RED candle below the given level. Similarly, the SL (Stop loss) for each SELL trade should be the previous GREEN candle above the given level.

Note: This idea and these levels are only for learning and educational purpose.

Your likes /boosts gives us motivation for continued leaning and sharing ideas.

Daily Market Update – 05 May 2025 (Monday)Daily Market Update – 05 May 2025 (Monday)

Timestamp: 8:54 am

Opening Outlook: NIFTY opens at 24,435 | Previous Close: 24,404

निफ्टी की शुरुआत 24,435 पर हुई, जो पिछले बंद स्तर 24,404 से थोड़ी ऊपर है।

⸻

Global & Domestic Cues | वैश्विक और घरेलू संकेत

• US Markets: The Dow closed marginally higher, while Nasdaq remained under pressure due to continued selling in technology stocks.

US futures indicate a flat to slightly negative bias.

• Asia: A mixed start across Asian indices.

Chinese market futures are trading with a positive bias, suggesting selective recovery hopes.

• India Macro: April GST collections came in strong at ₹1.92 lakh crore, indicating steady consumption trends.

• RBI Policy: The upcoming policy meet is expected to maintain a status quo on rates; market participants will watch for commentary on inflation and liquidity.

⸻

Commodities & Volatility | कमोडिटी और वोलैटिलिटी

• Brent Crude: $59.10/bbl – Prices eased significantly, reflecting lower demand outlook and ample supply.

• Gold:

• 24 Carat: ₹93,954 per 10 grams

• 22 Carat: ₹86,062 per 10 grams

Prices remain stable amid global uncertainties.

• India VIX: 10.84 (-1.7%) – Volatility remains subdued, though event-driven moves are possible in the near term.

⸻

Technical Snapshot – NIFTY | तकनीकी झलक

• Resistance Zone: 24,500 – 24,600

• Support Zone: 24,300 – 24,400

• RSI: Daily – 58 (Neutral to Positive), Weekly – 56 (Stable)

• View: Nifty may remain range-bound with a slight upward bias. Sustained trade above 24,500 could offer momentum, but strength confirmation is essential.

⸻

Sectoral Performance | सेक्टोरियल प्रदर्शन

• IT: Witnessing mild consolidation post last week’s gains; selective profit booking seen.

• Auto & Realty: Showing relative strength supported by favorable monthly data and sentiment.

• FMCG: Trading mixed; focus remains on Q4 earnings commentary.

• Institutional Activity:

• FIIs: Net Buy ₹2,769.81 Cr

• DIIs: Net Buy ₹3,290.49 Cr

• Takeaway: Robust institutional flows continue to support market sentiment.

⸻

Closing Note | समापन टिप्पणी

Markets are expected to trade in a narrow band with stock-specific movements. Investors may adopt a wait-and-watch approach ahead of the RBI policy announcement and key global data. Broader indices remain active, particularly in the mid and small-cap space.

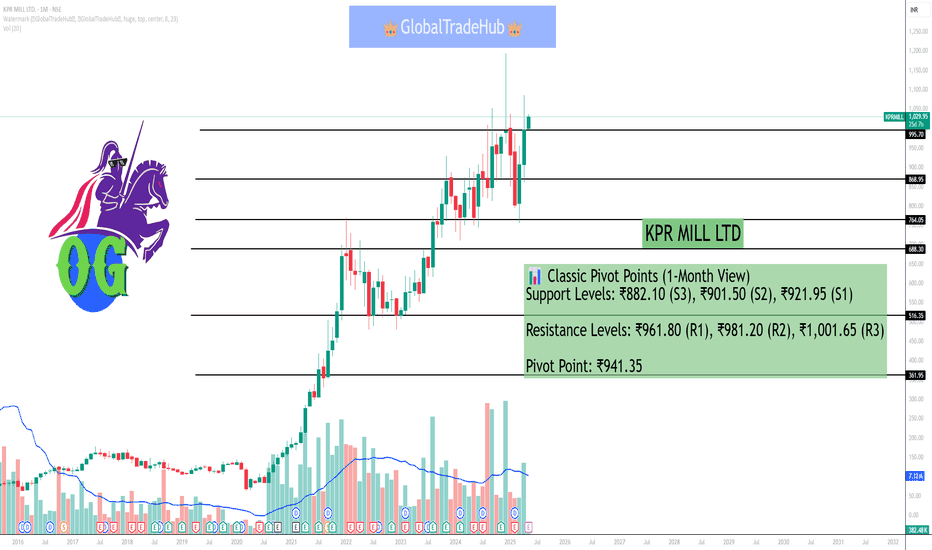

KPR MILL LTDAs of May 5, 2025, here are the key support and resistance levels for KPR Mill Ltd. (NSE: KPRMILL) based on recent technical analyses:

📊 Classic Pivot Points (1-Month View)

Support Levels: ₹882.10 (S3), ₹901.50 (S2), ₹921.95 (S1)

Resistance Levels: ₹961.80 (R1), ₹981.20 (R2), ₹1,001.65 (R3)

Pivot Point: ₹941.35

These levels are derived from the previous month's price range and are commonly used to identify potential reversal points in the market.

📈 Moving Averages & Indicators

Simple Moving Averages (SMA):

5-Day: ₹971.43

10-Day: ₹963.19

20-Day: ₹985.48

50-Day: ₹993.04

100-Day: ₹952.26

200-Day: ₹901.74

Exponential Moving Averages (EMA):

5-Day: ₹925.25 (Buy)

10-Day: ₹933.29 (Buy)

20-Day: ₹952.39 (Sell)

50-Day: ₹968.62 (Sell)

100-Day: ₹951.72 (Sell)

200-Day: ₹904.76 (Buy)

The alignment of these averages suggests a mixed short-term to medium-term outlook, with some indicators signaling bullish trends and others indicating bearish tendencies.

📉 RSI & Momentum Indicators

Relative Strength Index (RSI): 42.56 (Neutral)

Stochastic RSI: 59.15 (Buy)

MACD: 8.04 (Buy)

Average Directional Index (ADX): 32.45 (Buy

These indicators suggest a neutral to slightly bullish momentum, indicating potential upward movement if buying interest increases.

📌 Summary

Immediate Support: ₹882.10

Immediate Resistance: ₹961.80

Medium-Term Outlook: Neutral to slightly bullish, with mixed signals from moving averages and momentum indicators.

Bank NiftyBank Nifty Intraday Outlook - 1H Chart (May 05)

Price is hovering near a key support zone. A breakdown could lead to further downside, but watch for a potential bounce from the recent support area. Plan your trades wisely!!

Key Levels to Watch:

Support: 54,400-54,600

Resistance: 55,500-56,000

Stay disciplined. Trade with logic, not emotion.

Nifty strategy for today Nifty may open around at 24450 according to SGX NIFTY. U. S markets were closed in negative bias on Friday. Nifty may consolidated between 24600 and 23800 until upto closed above 24600 which is above ascending triangle chart pattern. The investors are focused on individual stocks which are announced quartely results recently.

Support levels : 24304,24200

Resistance levels : 24450,24550

ICICI Bank ICICI Bank (1D) Technical View

▲ Pattern Formed:

*Ascending Triangle Breakout - strong bullish continuation pattern

Intraday Buy Entry: *1,435-*1,440

Target Price: *1,465

Stop Loss: *1,422

? Breakout above multi-top resistance zone with strong volume confirmation signals momentum.

Risk-reward is favorable for intraday trade.

#ICICIBANK

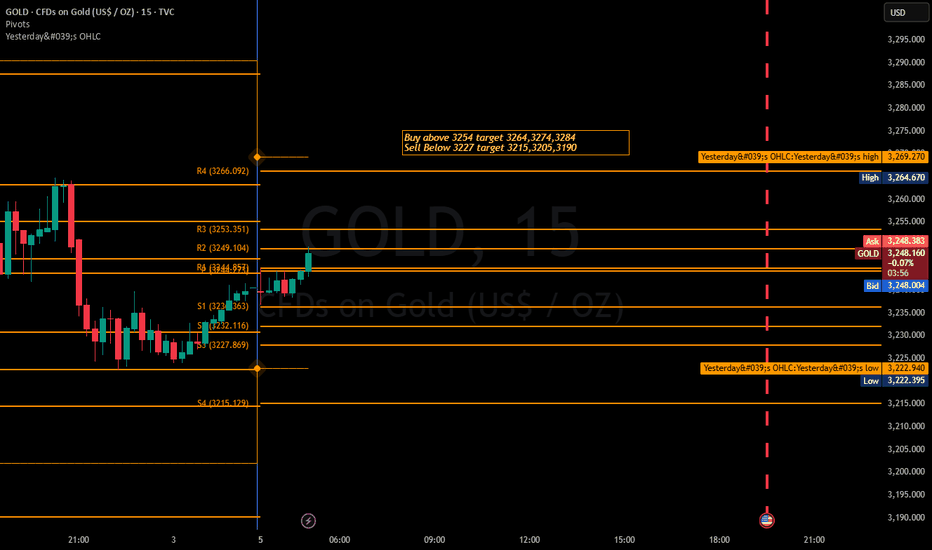

Gold Trading Strategy for 05th May 2025Gold Intraday Trade Setup (Based on 15-Minute Candle)

Buy Setup (Long Position)

Entry Trigger: Buy Gold above the high of the 15-minute candle, with confirmation of a close above ₹3254.

Targets:

• Target 1 – ₹3264

• Target 2 – ₹3274

• Target 3 – ₹3284

Stop Loss: You may consider a stop loss just below ₹3245 (or a level based on your risk tolerance and support area).

Sell Setup (Short Position)

Entry Trigger: Sell Gold below the low of the 15-minute candle, with confirmation of a close below ₹3227.

Targets:

• Target 1 – ₹3215

• Target 2 – ₹3205

• Target 3 – ₹3190

Stop Loss: You may consider a stop loss just above ₹3235 (or a level based on your risk tolerance and resistance area).

Key Notes

Always wait for the candle close confirmation above/below the mentioned levels before entering the trade.

Adjust position sizing according to your risk management plan.

Monitor for significant economic events or news releases that can impact Gold prices during intraday trades.

Disclaimer

This analysis is for educational and informational purposes only. Trading in commodities, including Gold, involves significant risk and may not be suitable for all investors. Please conduct your own research, consider your financial situation, and consult a qualified financial advisor before making any trading decisions. The author does not guarantee any profits and is not responsible for any losses incurred from trading decisions based on this information.

NASDAQ Eyes Higher Highs Bullish Reversal in Play 📈 NASDAQ Outlook: Bullish Momentum Builds Up

✅ Breakout Confirmed: Price action has broken above the descending channel, signaling a reversal from the previous downtrend.

📊 EMA Crossover: The 50 EMA is crossing above the 200 EMA (a golden cross), historically a bullish indicator.

🔼 Momentum Strong: Price is accelerating above EMAs with a steep upward trajectory, suggesting buyers are in control.

🔮 Potential Target: With sustained momentum, price could aim for the 21,000+ region in the short term.

If the price sustains above the 19,500 zone, dips could be considered buying opportunities in the current bullish structure.

"EUR/AUD Bearish Channel with Key Support Ahead"📉 Market Structure Analysis (Bearish Bias)

Current Trend:

The pair is trading within a well-defined descending channel, indicating a bearish trend. Price action is forming lower highs and lower lows, adhering to the channel boundaries.

Moving Averages (EMA):

EMA 50 (Red) at 1.77491 is above the price, acting as dynamic resistance.

EMA 200 (Blue) at 1.73338 is close to current price, likely to act as a support area in the short term.

The bearish crossover between the 50 EMA and current price supports the continuation of downward momentum.

🔍 Key Zones:

Weak Resistance Zone:

Located around 1.7740 – 1.8000, previously a support area, now acting as resistance.

Price rejection from this zone multiple times indicates sellers' strength.

Support Zone:

Located around 1.6950 – 1.7100, where demand may return.

This zone coincides with the lower boundary of the descending channel, making it a likely reaction zone.

📊 Forecast / Expectation:

The chart projects a bear flag / corrective pullback before another leg downward toward the support zone.

If price breaks and sustains below the EMA 200, it will likely accelerate bearish pressure.

The descending channel suggests potential continuation to the downside unless price breaks out of the upper boundary with momentum.

✅ Trade Implications:

Bearish Setup:

Look for short opportunities on intraday pullbacks near the resistance or EMA 50.

Bullish Invalidations:

A breakout above the descending channel and sustained move above 1.7800 would invalidate the bearish outlook.

Conclusion:

This chart presents a technically clean bearish setup. The confluence of a descending channel, EMA rejection, and defined resistance/support zones suggests the EUR/AUD may continue lower, especially if it loses the 1.7300 level decisively.

XAU/USD Market Outlook – Key Levels & Scenarios (May 2025)📊 Market Overview

Asset: XAU/USD (Gold vs. USD) – likely

Timeframe: 🕒 4H or Daily

EMAs:

🔴 50 EMA = 3,281 (short-term trend)

🔵 200 EMA = 3,179 (long-term trend)

🧱 Key Zones

🔺 Main Resistance Zone (🚫 Supply Area)

📍 ~3,320–3,400

🔍 Observation: Strong rejection zone with multiple failed attempts. 🚧 Price struggles to break and hold above here.

⚖️ Mid Support & Resistance Zone

📍 ~3,200–3,250

🧭 Current Action: Price is consolidating here. This is a key decision zone. A bounce or breakdown will likely decide the next big move. 🤔

🟦 Main Support Zone

📍 ~2,980–3,030

🛑 Observation: Major demand zone. If price falls here, it might attract buyers 👥 for a potential rebound.

📉 EMA Analysis

🔴 50 EMA is above 🔵 200 EMA → Trend still technically bullish ✅

🟡 BUT: Price is currently below 50 EMA, showing short-term weakness ⚠️

⚡️ 200 EMA is nearby (~3,179): Acting as dynamic support — a critical bounce zone! 🛡️

🔮 Scenarios

🐂 Bullish Path

✅ If price bounces from 3,200 support zone and reclaims 🔴 50 EMA:

🎯 Target: Retest of 3,320–3,400 🔺 zone

📈 Confirmation: Strong candle closing above 3,281 🔴 EMA

🐻 Bearish Path

🚨 If price breaks below 3,200 & 200 EMA:

🕳️ Expect drop towards 2,980–3,030 🟦 zone

📉 Confirmation: Candle closes below 3,179 with weak retest

✅ Conclusion

📍 Key Level to Watch: 3,200

⚖️ Market Sentiment: Neutral → Bearish bias unless price reclaims 50 EMA

🔒 Risk Tip: Avoid longs until price confirms bullish structure again 🔐

GBP/USD Short Trade Setup: Reversal from 1.34370 with Target at Entry Point:

Marked at 1.34370, where the analyst anticipates a reversal or price rejection.

Stop Loss:

Positioned above at 1.34975, covering a 2.62% risk margin. This is a protective level in case the price moves against the trade.

Target (Take Profit):

Set at 1.31015, just above a strong support zone around 1.30818. This is where the analyst expects the price to eventually fall.

Resistance Point:

Noted around 1.33007 – 1.32859, acting as an intermediate level of interest and possible price reaction zone.

(BTC/USD) 1H Trade Setup – Key Entry, Stop Loss & Dual TargetEntry Point: 95,431

Stop Loss: 95,264

Target Points:

Upside (Target 1): 100,674 (Potential gain: +5.36%)

Downside (Target 2): 86,614 (Potential loss: -7.57%)

Trade Setup:

Risk-Reward Ratio:

Approx. 1:0.7 (Not ideal; the reward is smaller than the potential loss)

Support Zones:

Highlighted in purple beneath the entry zone — this indicates a historically strong support area.

Resistance Zones:

The upper purple zone marks the next significant resistance around 100,000–100,795.

Technical Indicators:

50 EMA (Blue Line): Indicates mid-term trend support, currently holding price action.

Price Action: BTC appears to be retracing toward support after a bullish rally.

Interpretation:

The setup implies a long (buy) position with a very tight stop loss.

The price is nearing a support zone, and if it holds, there's potential for an upward move to the target at 100,674.

However, if price breaks below 95,264, a sharp drop to 86,614 is anticipated.

BBTC Analysis for Swing TradingHere in this chart (H3), we can see candlesticks pattern gives a break of structure (BOS) toward upside direction. After taken out the inducement, price is trading at the premium zone. Now, we have to wait for the price to come down till the discount zone or hit the order block. In these both cases we can take the long entry after the confirmation (ChoCh or flip in M15 chart) in lower timeframe.

If anyone don't have a clear idea about ChoCh and flip entry module, do comment so I can make a proper tutorial video in this topic.

Trade wisely, Grow fast.