Strong Bullish Reversal at Support – ₹236 Target in Sight!Hello fellow traders! Hope you’re all doing well.

Today, I’d like to share my technical outlook on PIRAMAL PHARMA (PPLPHARMA).

Key Observations:

1. Rising Channel (Ascending Wedge): The price is currently respecting the lower trendline, which is acting as a key support zone.

2. Bullish Engulfing: A bullish engulfing pattern has appeared near the support line, indicating renewed buying interest.

3. Target: I’m anticipating a potential move toward ₹236, which aligns with the upper boundary of the channel.

4. Stop Loss : A strict stop loss is placed at ₹200 (closing basis). The setup remains valid as long as the trendline holds.

5. Risk-Reward Ratio: This trade setup offers a favorable 1:2 risk-to-reward opportunity.

Disclaimer:

This is a personal analysis and not financial advice. Please do your own research and trade responsibly. Risk management is key.

Thanks for reading!

Looking forward to your thoughts and feedback.

Best regards,

Anantesh

Community ideas

ADITYA BIRLA CAPITAL LTD Company Name: Aditya Birla Capital Ltd (NSE: ABCAPITAL)

Sector: Financial Services

Market Cap: Large Cap | ~₹53,000 Cr

Headquarters: Mumbai, India

Parent Group: Aditya Birla Group

🧾 Business Overview:

Aditya Birla Capital is a diversified financial services player offering a wide range of solutions across:

Lending: Personal, SME, and housing loans through Aditya Birla Finance

Asset Management: One of India's top AMC players via joint venture with Sun Life

Insurance: Life and health insurance products

Wealth & Broking: Wealth management, equity broking, and portfolio management services

💼 Key Strengths:

Strong backing of Aditya Birla Group

Wide distribution network across India

Growing AUM and diversified revenue streams

Focus on digital and retail loan expansion

📊 Stock Insight:

NSE Symbol: ABCAPITAL

52-Week Range: ₹153 – ₹225

Trend: Medium-term bullish with support near ₹209

Support and Resistance Levels (Intraday – 15M):

Immediate Resistance: ₹215.50

(Price tested this level twice, indicating strong short-term selling pressure.)

Next Resistance: ₹218.20

(Gap-fill zone; breakout above this may trigger momentum buying.)

Immediate Support: ₹211.70

(Recent bounce zone and short-term base.)

Strong Support: ₹209.50

(Multiple rejections below this level; buyers likely to defend.)

Trend Insight:

Price is consolidating in a narrow range between ₹211.70 and ₹215.50. A breakout above or below this band may set the next directional move.

Reliance Industries Ltd //15min Support and ResistanceRELIANCE INDUSTRIES LTD – 15-Minute Chart Support & Resistance

Support and Resistance Levels (Intraday – 15M):

Immediate Resistance: ₹2,870

(Recent high and intraday rejection zone)

Major Resistance: ₹2,895

(Near day's high; breakout can lead to strong momentum)

Immediate Support: ₹2,840

(Short-term base and minor bounce level)

Strong Support: ₹2,815

(Previous breakout zone; defended multiple times intraday)

Trend Insight:

RELIANCE is trading in a rising channel, with buyers stepping in around ₹2,840. Sustained move above ₹2,870 may trigger an upside breakout.

KPR MILL LTD KPR MILL LTD – 1-Day Chart Support & Resistance

Support and Resistance Levels (Daily Timeframe):

Immediate Resistance: ₹810

(Recent swing high; needs breakout for bullish continuation)

Major Resistance: ₹835

(Multi-month resistance zone; breakout can lead to a strong rally)

Immediate Support: ₹770

(Recent consolidation base; key for trend sustainability)

Strong Support: ₹745

(Previous breakout level and demand zone)

Trend Insight:

KPR Mill is in a medium-term uptrend, but facing consolidation near ₹810. A sustained close above ₹810 may trigger momentum, while ₹770 acts as a crucial support zone.

NIFTY // 4hour Support and Resistance Index Name: NIFTY 50

Exchange: NSE | Benchmark index of the Indian equity market

Constituents: 50 large-cap companies across 13 sectors

🧾 Overview:

The NIFTY 50 represents India’s top-performing blue-chip companies and acts as a barometer of the overall market health. It covers sectors like financials, IT, FMCG, energy, and auto.

💼 Key Sector Weights:

Financial Services – ~35%

IT – ~13%

Oil & Gas – ~12%

Consumer Goods – ~9%

Auto – ~6%

📊 Current Trend Insight (as of 4H chart):

Index near resistance at 22,620

Holding support at 22,350 indicates buying strength

Sustained breakout above 22,620 could lead to a move toward 22,800+

NIFTY 50 Index – 4-Hour Chart Support & Resistance

Support and Resistance Levels (4H Timeframe):

c

Trend Insight:

NIFTY is forming higher lows, indicating bullish strength. Consolidation above 22,350 strengthens the case for a breakout. Watch 22,620 for momentum entry confirmation.

Best Commodity layoutBest Commodity layout

Crafting Your Optimal Commodity Technical Chart Layout in TradingView

The "best" commodity technical chart layout in TradingView is highly personalized, depending on your trading style, strategy, and the specific commodities you're analyzing. However, a well-structured layout should provide a clear, comprehensive view of price action and key technical indicators to aid in decision-making.

Here's a guide to creating an effective commodity technical chart layout in TradingView, incorporating common practices and versatile tools:

1. Choosing Your Main Chart Type:

Candlestick Charts: This is the most popular choice for most traders. Candlesticks provide detailed information about the open, high, low, and close (OHLC) prices for a specific period, making it easier to identify patterns and market sentiment.

Bar Charts: Similar to candlesticks, bar charts also display OHLC data but in a different visual format.

Line Charts: Useful for a quick overview of the overall trend, typically plotting the closing prices.

Heikin Ashi: These charts can help filter out market noise and make trends easier to identify by averaging price data.

Renko or Kagi Charts: These focus solely on price movement, ignoring time, and can be useful for identifying support and resistance levels.

Recommendation: Start with Candlestick charts for their detailed information. You can always switch to other types for different analytical perspectives.

2. Essential Technical Indicators for Commodities:

While the "best" set of indicators is subjective, here are some widely used and effective ones for commodity analysis in TradingView:

Moving Averages (MAs):

Types: Simple Moving Average (SMA) and Exponential Moving Average (EMA) are common. EMAs react faster to recent price changes.

Use: Identify trend direction, support/resistance levels, and potential crossover signals. Common periods include 20, 50, 100, and 200.

Layout: Add 2-3 MAs of different lengths directly onto your main price chart. For example, a 21-period EMA for short-term trends and a 50-period EMA for medium-term trends.

Volume Indicators:

Types: Volume (displays trading activity) and On-Balance Volume (OBV).

Use: Confirm the strength of price movements. A significant price move accompanied by high volume is generally considered more valid.

Layout: Typically displayed in a separate pane below the main price chart.

Oscillators (for identifying overbought/oversold conditions and momentum):

Relative Strength Index (RSI): Measures the speed and change of price movements. Values above 70 often indicate overbought conditions, while below 30 suggest oversold conditions. Standard period is 14.

Moving Average Convergence Divergence (MACD): Shows the relationship between two moving averages of an asset's price. It consists of the MACD line, signal line, and histogram.1 Used for trend identification and momentum.

1.

medium.com

medium.com

Stochastic Oscillator: Compares a particular closing price of an asset to a range of its prices over a certain period. Also used to identify overbought/oversold conditions.

Commodity Channel Index (CCI): Identifies cyclical trends and can signal overbought/oversold levels.

Layout: Oscillators are usually placed in separate panes below the main chart. You might choose 1 or 2 that best suit your strategy (e.g., RSI and MACD).

Volatility Indicators:

Bollinger Bands: Consist of a middle band (typically an SMA) and two outer bands representing standard deviations. They help identify volatility and potential price breakouts or mean reversion.

Keltner Channels: Similar to Bollinger Bands but use Average True Range (ATR) for the outer bands. Can be used for breakout and trend-following strategies.

Average True Range (ATR): Measures market volatility. Useful for setting stop-loss orders.

Layout: Bollinger Bands and Keltner Channels are overlaid on the main price chart. ATR is usually in a separate pane.

Trend-Following Indicators:

Ichimoku Cloud (Ichimoku Kinko Hyo): A comprehensive indicator that defines support/resistance, identifies trend direction, and provides trading signals. It includes several components like the Kumo (Cloud), Tenkan-sen, and Kijun-sen.

Donchian Channels: Plots the highest high and lowest low over a set period. Useful for identifying breakouts and trend direction.

Layout: Ichimoku Cloud and Donchian Channels are overlaid on the main price chart.

Recommendation for a Balanced Layout:

Main Chart: Candlesticks, 2-3 EMAs (e.g., 21, 50, 200), Bollinger Bands or Keltner Channels.

Pane 1 (below main): Volume.

Pane 2 (below main): RSI (14) or MACD.

Pane 3 (optional): CCI or ATR if your strategy heavily relies on them.

3. Drawing Tools:

Effective use of drawing tools is crucial for technical analysis:

Trendlines: Connect swing highs or lows to identify the direction and strength of trends.

Support and Resistance Levels: Horizontal lines drawn at key price levels where the price has historically struggled to break above (resistance) or fall below (support).

Fibonacci Retracement and Extension Levels: Help identify potential support/resistance levels and price targets based on Fibonacci ratios.

Channels: Parallel trendlines that can define a price range.

Chart Patterns: Use tools to identify patterns like head and shoulders, triangles, flags, and pennants.

Layout Tip: Keep your most frequently used drawing tools easily accessible in the TradingView drawing panel.

4. Multi-Timeframe Analysis & Multi-Chart Layouts:

Analyzing commodities across different timeframes can provide a broader market perspective. TradingView allows you to set up multi-chart layouts (the number of charts available depends on your subscription plan).

Common Setup:

Chart 1 (Long-Term): Weekly or Daily chart to identify the major trend.

Chart 2 (Medium-Term): 4-hour or Daily chart for more detailed trend analysis and identifying key levels.

Chart 3 (Short-Term): 1-hour or 15-minute chart for entry and exit signals.

Synchronization: TradingView allows you to synchronize symbols, crosshair, interval, and drawings across multiple charts in a layout, which can be very efficient.

5. Customization and Saving Your Layout:

Appearance: Customize chart colors (background, candles, grids), scales, and lines to your preference for better visual clarity and reduced eye strain. Access these via Chart Settings (the gear icon).

Saving Layouts: Once you have a setup you like, save it as a chart layout in TradingView. You can create multiple layouts for different commodities, strategies, or analytical purposes.

Indicator Templates: Save combinations of indicators as templates for quick application to new charts.

Tips for the "Best" Layout:

Keep it Clean: Avoid cluttering your chart with too many indicators. Focus on a few that you understand well and that complement your strategy.

Consistency: Use consistent settings for your indicators across different charts and timeframes.

Practice: The "best" layout is one that works for you. Experiment with different indicators and setups on a demo account or through backtesting to see what yields the best results for your trading style.

Stay Informed: Be aware that some commodities (e.g., agricultural products) can be influenced by seasonal patterns or specific reports (like USDA reports for crops, EIA for oil). While not a direct part of the "chart layout," integrating this knowledge with your technical analysis is crucial. TradingView has features to display key events like earnings reports or dividends, which can be relevant. Some community scripts on TradingView even offer overlays for planting and harvesting seasons for agricultural commodities.

By following these guidelines and experimenting to find what suits your individual needs, you can create a powerful and effective commodity technical chart layout in TradingView. Remember to regularly review and refine your layout as your trading strategies evolve.

Setup – Watch This Triangle Breakout! 🔺 Nifty50 Triangle Breakout – Big Move Loading? 📊

📆 30th April | 15-Minute Chart

Nifty is tightly squeezed inside a symmetrical triangle, and a breakout or breakdown looks imminent!

🔍 Levels to Watch:

📈 Breakout Above: 24,371.60 → Possible Level: 24,395.20+

📉 Breakdown Below: 24,313.55 → Possible Level: 24,290.40-

📊 Volume is compressing – this usually signals a powerful move ahead.

Wait for clear candle confirmation with volume before entering. 🔔

💬 Patience pays. Trade the breakout, not the noise!

Rising Wedge Breakout or Trap?📈 Nifty 50 – Rising Wedge Breakout or Trap? 🔍

🗓️ 2nd May 2025 | 15-Min Chart Analysis

The Nifty 50 has been respecting a rising wedge pattern over the past few sessions. Today, we witnessed a sharp bounce from the lower trendline with a strong bullish candle and volume spike — just enough to test the upper boundary of the wedge!

💡 Key Observations:

Price touched the upper trendline resistance – caution advised 🚨

Volume spike hints at possible breakout attempt or smart money exit

Watch closely: A breakout with volume = bullish continuation 📈

A rejection here = possible reversal 📉

🔔 My Take:

Momentum is strong, but the structure looks fragile. If it breaks out and sustains above the wedge, we could see a 100–150 point move. Else, a reversal towards 24,300 or below is also on the cards. Stay alert.

📊 Always trade with proper risk management.

📌 What’s your view? Breakout or fakeout? Drop your thoughts below!

Falling Wedge Breakout with Bullish Momentum | 15-Min Chart🏦 BANK NIFTY – Falling Wedge Breakout with Bullish Momentum | 15-Min Chart

📅 Date: May 5, 2025

📈 Timeframe: 15-Minute

🔍 Instrument: Nifty Bank Index (NSE)

📌 Technical Overview:

Bank Nifty is currently showing signs of a short-term bullish reversal on the 15-minute chart. The index formed a classic falling wedge pattern, which is typically seen before upward price moves. A recent breakout attempt is seen from the wedge structure, supported by steady green candles and slight volume recovery.

🧩 Chart Pattern:

The Falling Wedge is marked by two converging green trendlines.

Inside the wedge, the price made lower highs and lower lows, forming a compact structure.

The breakout leg is forming with strength and is approaching a tested supply zone around 55,350–55,450.

🔍 Key Price Levels:

Support Zone: ~54,800 (Lower boundary of the wedge)

Immediate Resistance: ~55,350 (Tested supply zone)

Current Market Price (CMP): 55,001.65

If the price sustains above 55,070 and breaks out with volume, we may see bullish continuation toward 55,350–55,600.

📊 Volume Analysis:

Volume remained low during the wedge formation – a healthy sign.

A volume breakout confirmation is awaited.

Keep an eye on a green volume bar spike as price crosses wedge resistance.

🧠 Observational Bias:

As long as price holds above 54,800, the short-term bias remains bullish.

A successful retest of the breakout zone or a strong close above 55,070 with volume may offer a high-probability intraday opportunity.

📌Note: Traders can wait for a confirmation candle (close above wedge) before entering.

Risk management is key—keep stop loss below 54,800.

Everything seems to be built in BSE Share prices. Lets wait ~#bseindia shares on 🔥!

Posted blockbuster earnings yesterday — outshining even NSE! 📈

Stock’s flying high with no resistance in sight,but wait..

💡 Fundamentally? Looks pricey vs NSE & global peers

⚡ Valuation driven by growth hype

🧱 Key support zones:

• ₹6000–6100 (short-term)

• ₹5450–5600 (next level)

• ₹4400–4600 (long-term)

📉 Already rallied big pre-results — upside may be capped

🔍 Smart move? WAIT for a dip before buying in!

#BSE #StockMarketIndia #Trading #Nifty #InvestingTips #StocksToWatch #learntradingwithsudhir

VRL LOGISTICS By KRS Charts19th March 2025 / 11:13 AM

Why VRLLOG?

1. Fundamentally, Good Stock Net profit is the proof further stock is at 45% Discount then its High and Net income is High compared to its price.

2. Technically, Stock has Completed its Correction Wave C with significant Shakeout before going for Breakout as we can see in above chart.

3. On Monthly and Weekly TFs VRLLOG is on its All-Time biggest Support.

4. Reversal is more convicted because 1st Shakeout was Huge for Buyers and 2nd There is potential for Inverted H&S is about to Formed with more upsides from here.

Targets are pinned in Charts with Stop Loss 1D closing Basis.

OIL India - 470 on the cards?The Shark pattern suggests 470 levels.

Price is bouncing off from 0.618% fib level.

Price action wise, it signifies double bottom breakout

Trading well above 50 DEMA comfortably.

Can potentially target 200 DEMA and AVWAP from the highs

Daily close above 412-420 could give us further confirmation for this view.

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views. If you like my analysis and learnt something from it, please give a BOOST. Feel free to express your thoughts and questions in the comments section.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Round Bottom Breakout in THYROCARE

BUY TODAY SELL TOMORROW for 5%

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Round Bottom Breakout in POLYMED

BUY TODAY SELL TOMORROW for 5%

Massive Breakout Loading? GOKEX Smashes Through Triple TimeframeGOKALDAS EXPORTS LTD (GOKEX) is showing serious strength with a powerful breakout candle currently in play – but the real story is the multi-timeframe technical alignment:

📏 MTF Structure

Yellow Parallel Channel from Monthly shows a long-term structure still intact.

Red Horizontal Resistance marks the previous MTF peak – now under threat.

🔻 WTF Pressure

Pink Counter-Trendlines acted as significant resistance on the Weekly – both pierced.

⚡ DTF Precision

White CT Line (Daily) finally broken with conviction.

Dotted White Lines reveal multiple hidden resistances — all cleanly taken out by today's surge.

📊 Volume & Candle Strength

Volume spiking, price up over 16% intraday — just waiting on confirmation at close.

🧠 Watch Closely: A close above today’s highs could flip this into a full-blown A+ breakout setup.

Technical TradingTechnical trading is a broader style that is not necessarily limited to trading. Generally, a technician uses historical patterns of trading data to predict what might happen to stocks in the future. This is the same method practiced by economists and meteorologists: looking to the past for insight into the future.

Falling Wedge Breakout + AB=CD Bullish Pattern | Daily Chart📈 KEI INDUSTRIES LTD – Falling Wedge Breakout + AB=CD Bullish Pattern | Daily Chart

🗓️ Date: May 07, 2025

💹 Timeframe: Daily

🏢 Stock: KEI Industries Ltd (NSE)

📊 Chart Analysis Overview:

KEI has broken out of a Falling Wedge pattern, a classic bullish continuation/reversal signal, backed by strong volume surge and a completed AB=CD harmonic leg — indicating the bulls are stepping in with conviction.

After weeks of corrective move, the price respected the wedge’s support, formed higher lows, and has now convincingly breached the upper trendline.

🔎 Pattern Breakdown:

✅ Falling Wedge: Identified with red trendlines showing price compression.

✅ AB=CD Harmonic: Blue legs marking symmetrical retracement and projection.

✅ Breakout Confirmation: Bullish candles closing above the wedge resistance with momentum.

📌 Key Technical Levels:

🔴 Support Zone: ₹2,424 (Previous swing low & harmonic completion)

🟢 Resistance Ahead: ₹3,324 (Recent price ceiling)

⚡ CMP: ₹3,318.50

A clean close above ₹3,324 could ignite the next leg of momentum, possibly toward ₹3,500–₹3,650 in coming sessions.

📈 Volume Insight:

Breakout is supported by a noticeable volume expansion — suggesting participation by smart money and institutional interest.

📰 March Quarter Results – Strong Fundamentals:

📈 Consolidated Net Profit:

🟢 ₹226.5 Cr — up 34.5% YoY (vs ₹168.5 Cr last year)

📊 Revenue:

🟢 ₹2,914.8 Cr — up 25.1% YoY (vs ₹2,329.9 Cr)

This earnings momentum adds a fundamental tailwind to the ongoing technical rally.

🧠 Market Bias & Strategy:

As long as the price holds above ₹3,000 and respects the breakout structure, the trend favors bullish momentum traders.

📍 Lookout for a pullback-to-retest near ₹3,200–₹3,250 as a potential entry zone with low-risk, high-reward setup.

🔔 Disclaimer: This analysis is for educational purposes only, not investment advice. Always do your own research or consult your advisor before trading.

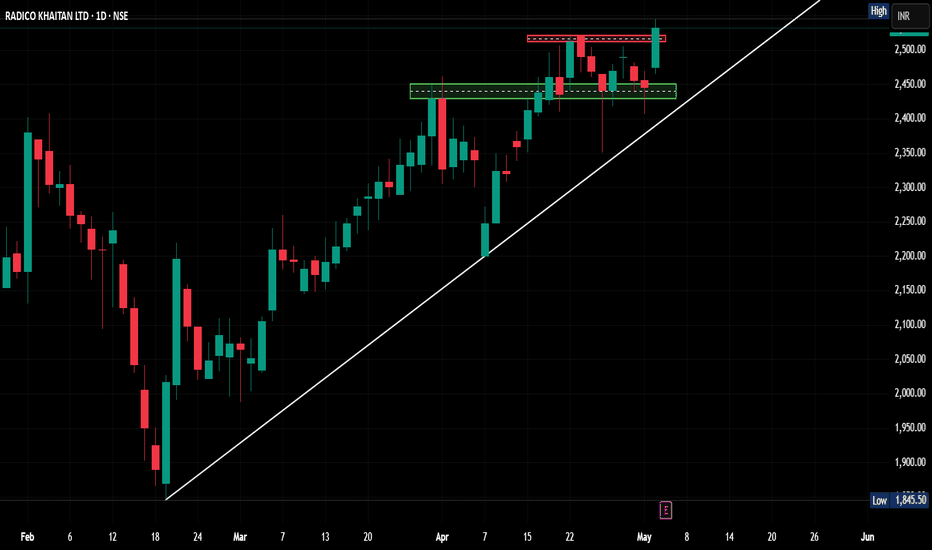

Radico Looking Great NSE:RADICO Made Beautiful Chart Structure today before Results tomorrow.

Keep in the Watchlist.

NO RECO. For Buy/Sell.

Disclaimer: "I am not SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.

“Positional Swing Volume Breakout: A Strategic Trade Setup” Poly Medicure Ltd. on the NSE (POLYMED)

>>>Stock Price: The latest closing price is ₹2,882.70 , reflecting a 15.50% increase.

>>>High/Low: The stock hit a high of ₹2,919.80 and a low of ₹2,495.60 within the observed period.

>>>Trading Indicators: The Stochastic indicator is showing values 96.23 and 89.66, suggesting strong momentum.

>>>Exponential Moving Average (EMA): The 20-day EMA is at ₹2,409.40.

>>>Trading Volume: The 20-day trading volume is 2.58M shares.

>>>Market Cap: The company’s market capitalization is ₹769.73K INR.