GOLD FACES KEY RESISTANCE AFTER LAST WEEK'S STRONG DROP🔥 After reaching ATH early last week, Gold saw a significant correction, dropping to 283x before bouncing back from the strong support zone at 2833 - 2835. By the end of the week, Gold retested this level, surging 20 points and closing the weekly and monthly candle at 2857 – a solid position for the BUY side.

🟢 TODAY’S SESSION – GAP OPEN & CURRENT VIEW

At the Sydney & Tokyo open, Gold continued to benefit from last week’s BUY momentum, creating a 15-point GAP and reaching 2870. So far in the Asian session, it has peaked at 2877.

👉 CURRENT VIEW: Gold is likely to drop back to fill the GAP (low liquidity) around 2854 - 2850 before continuing its upward movement. The price is currently reacting in line with this expectation.

⚡️ KEY LEVELS TO WATCH TODAY

📌 Resistance: 2884 - 2895 - 2900 - 2905

📌 Support: 2856 - 2850 - 2845 - 2835

💎 TRADE SETUPS FOR TODAY

🔹 BUY ZONE: 2835 - 2833

🎯 TP: 2840 - 2844 - 2848 - 2854 - 2860

⛔️ SL: 2830

🔹 SELL ZONE: 2904 - 2906

🎯 TP: 2900 - 2896 - 2892 - 2886 - 2880

⛔️ SL: 2910

📢 IMPORTANT NOTES

📆 Today marks the start of a new week and month, so it's crucial to closely monitor price reactions. Key economic reports like ADP and NFP are scheduled this week, so risk management is essential. Stick to TP/SL levels to protect your account!

Fundamental Analysis

BTC#19: “Cryptocurrency Reserves” and trading plants💎 💎 💎 After Trump posted about his plan to put BTC into the national cryptocurrency reserve, BINANCE:BTCUSDT BINANCE:BTCUSD had a meteoric rise back to 93~95x. Let's plan to trade BTC: 💎 💎 💎

1️⃣ **Fundamental Analysis:**

📊 The current market is dominated by “US crypto assets”.

🚀 Trump: Will put BTC into the national reserve, this will help the crypto sector break out. However, it is also important to note that the US lacks budget support and crypto reserves are just empty words at present.

📌 The probability of the Fed keeping interest rates unchanged in March is 93%.

It can be seen that the current cash flow injected into the market is not really significant because interest rates have not yet decreased and the US tariff policy is still waiting to cause an economic war. Current news plays a role in restraining the downward momentum and fear in the recent past.

2️⃣ **Technical analysis:**

🔹 **Frame D**: it can be seen that the price is looking for an important resistance area. Note that the current price structure is decreasing, so the price can still turn around at any time when it touches the diagonal resistance zone.

🔹 **Frame H4**: It is clear that yesterday's increase has not yet had any technical recovery to be able to break through the current resistance zone.

🔹 **Frame H1**: Temporarily, the price is still in an upward trend influenced by yesterday's positive news. The previously broken trendline will act as an important support for the price to break out in the near future

3️⃣ **Trading plan:*

⛔ The current area is no longer ideal for establishing a trading position, if the price still has no recovery, we can consider looking for a SELL position when the price reaches the diagonal resistance area when a price structure appears on a smaller time frame. BUY should only be made if the price recovers and accumulates in the old resistance area and an increasing price structure appears on a smaller time frame.

✅ On the D and H4 time frames, the price structure is still bearish, besides, H1 has increased strongly without any technical recovery due to the influence of positive news. So we can completely wait for a trading opportunity when the price finds an important resistance and support zone.

💪 **Wishing you success in achieving profits!**

GOLD - FALSE BREAKDOWN & PULLBACK BEFORE FURTHER FALLSymbol - XAUUSD

Gold is currently revisiting recent lows within the context of a shifting local trend. The price is testing the 2852 liquidity zone, with the potential for a rebound before continuing its downward movement.

On Friday, gold traded near its two-week lows, falling below the 2900 mark in Asian markets, ending an eight-week streak of gains. The precious metal is facing downward pressure due to a strengthening U.S. dollar, fueled by President Trump’s renewed tariff threats and developments in the U.S. economy. Trump has confirmed a 25% tariff on goods from Mexico and Canada, effective March 4, along with an additional 10% tariff on Chinese imports. Meanwhile, weaker-than-expected U.S. GDP data 2.3% for Q4 and rising jobless claims further bolster the U.S. dollar.

Market participants are awaiting the release of the PCE core price index to assess the Federal Reserve’s potential monetary policy actions and their implications for gold prices.

Resistance levels: 2869, 2877, 2885

Support levels: 2852, 2834

A false break at the 2852 support level could lead to a short-term rebound towards the imbalance zone 2869-2877 or the liquidity zone 2885 before a continuation of the downward trend. Both the fundamental and technical outlook remain weak, suggesting that gold may attempt to test and potentially break through the recent lows.

Eicher Motors Date 02.03.2025

Eicher

Timeframe : weekly

Technical Remarks

1 Currently under right-angled ascending broadening wedge

2 Neckline confluence with 60 weekly exponential moving average + 23.6% retracement

3 Trade shorts only once breakdown mentioned above zone (point #2)

4 Target for wave 4 would be 38.2%, 3947

5 Remember as trade confirmation rsi should remain below mean reversion then momentum will be high

Some Fundamental Highlights :

1 Company is almost debt free.

2 Company has been maintaining a healthy dividend payout of 34.6%

3 Current earnings were including an other income of Rs.1,813 Cr

4 Good promoter holding with 49% followed by FIIs 25% & DII 16%

5 Healthy ROCE of 30%, PE at 29 & healthy OPM at around 26%

Latest FEB Month Sales

FEB CV TOTAL SALES 8,092 UNITS VS 7,424 UNITS (YOY)

Regards,

Ankur

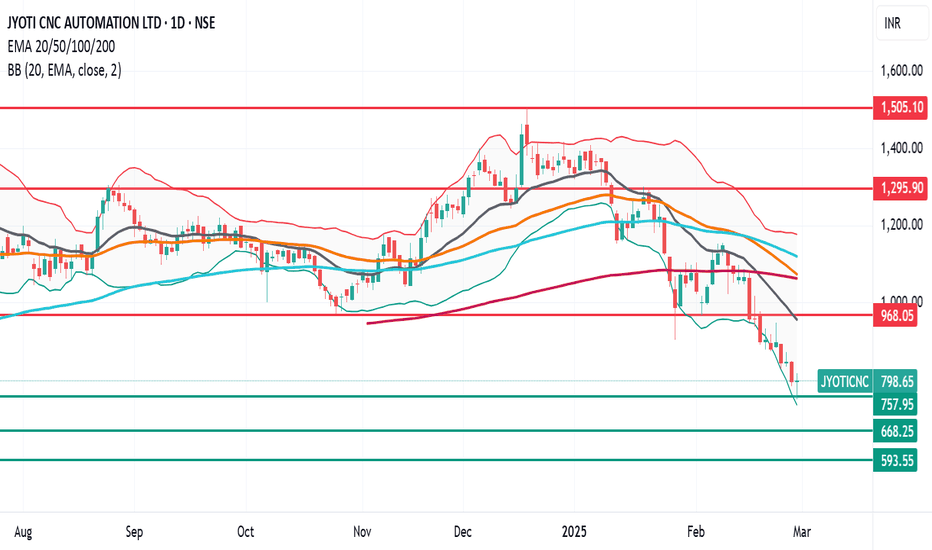

Stock Analysis: Jyoti CNC AutomationIntroduction:

With a market share of 10%, Jyoti CNC Automation is one of the leading manufacturers of metal-cutting computer numerical control (CNC) machines in India.

Fundamentals:

Market Cap: ₹ 18,163 Cr.;

Stock P/E: 59.2 (Ind. P/E: 32.21 ); 👎

ROCE: 21.2% 👍; ROE: 20.8% 👍;

PEG Ratio: 1.02 ; (Seems to be overvalued vs the market average)

3 Years Sales Growth: 36% 👍;

3 Years Profit Growth: 58% 👍;

Cons: Stock is trading at 12.2 times its book value. 👎

Technicals:

Jyoti CNC Automation is trading below all important moving averages like 20EMA (Black line), 50EMA, (Orange line), 100EMA (SkyBlue line) and 200EMA (Pink line).

Resistance levels: 968, 1296, 1515

Support levels: 757, 668, 593

Bank Nifty Weekly Analysis: Key Levels & Trend OutlookWeekly Recap:

The Bank Nifty closed the week at 48344.70, posting a decline of -1.30%.

Key Weekly Levels for Next Week

Price Action Pivot Zone:

The crucial range to watch for potential reversals or trend continuation is 48,236 - 48,455

Support & Resistance Levels:

Support Levels:

S1: 47,907

S2: 47,470

S3: 46,956

Resistance Levels:

R1: 47,907

R2: 47,470

R3: 46,956

Market Outlook:

Bullish Scenario: If Bank Nifty sustains above 48,455, it could see buying interest, potentially pushing towards R1 at 48787 and higher levels.

Bearish Scenario: A breakdown below 48,236 could trigger further downside pressure, targeting S1 at 47,907 and lower support levels.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Please conduct your own research before making any investment decisions.

Nifty 50 Weekly Analysis: Key Levels & Trend OutlookWeekly Recap:

The Nifty 50 closed the week at 22,124.70, marking a significant decline of -2.94%. The bearish momentum dominated the market, pulling the index lower as selling pressure intensified.

Key Weekly Levels for Next Week

Price Action Pivot Zone:

The crucial zone to watch for any potential reversals or trend continuation is between 22,054 - 22,198.

Support & Resistance Levels:

Support Levels:

S1: 21,828

S2: 21,532

S3: 21,211

Resistance Levels:

R1: 22,422

R2: 22,722

R3: 23,007

Market Outlook:

Bullish Scenario: A sustained move above 22,198 and strength beyond 22,422 could attract buyers, driving Nifty towards R1 at 22,422 and possibly higher.

Bearish Scenario: If 22,054 fails to hold, the market could witness further selling, driving Nifty towards S1 at 21,828 and possibly lower.

APL Apollo Tubes Ltd Stock Analysis**GlobalTradeHub Stock Analysis**

**APL Apollo Tubes Ltd (APLApollo)**

**Fundamental**: A leading player in the Indian steel pipe industry, APL Apollo has consistent growth driven by infrastructure demand.

**Technical**: Bullish trend with moving averages supporting upside. RSI is neutral, indicating room for further growth.

**Support Levels**: ₹1,000, ₹950

**Resistance Levels**: ₹1,150, ₹1,200

Let me know if you'd like to analyze another stock!

Action Construction Equipment LtdDate 28.02.2025

Action Construction

NSE: ACE

Timeframe : Day Chart

Company Information :

Action Construction Equipment Ltd is engaged in the business of manufacturing and marketing of hydraulic mobile cranes, mobile tower cranes, material handling equipment like forklifts, road construction equipment like backhoe loaders, compactors, motor graders and agriculture equipment like tractors, harvesters, rotavators, etc.

Some Key Values :

PE Ratio = 32.1

ROCE = 42.3 %

ROE = 30.6 %

Book Value = 116

OPM = 14%

Promoter =65.41 %

DII = 1.70 %

FII = 11.90 %

Public = 20.86 %

Strengths

1 Company is almost debt free.

2 Company has delivered good profit growth of 42.6% CAGR over last 5 years

3 Debtor days have improved from 30.5 to 20.6 days.

Weakness

1 Stock is trading at 9.06 times its book value

Regards,

Ankur

Is Cholamandalam Finance Ready for a Breakout?Cholamandalam Financial Holdings Limited (CFHL), a prominent entity within the Murugappa Group, stands as a testament to India's dynamic financial services sector. Established in 1978, CFHL has evolved into a comprehensive investment company, holding significant stakes in various financial services and risk management enterprises.

Financial Performance

In the fiscal year 2023-2024, CFHL reported consolidated revenue of ₹258,035.2 million, reflecting a significant increase from ₹181,458.7 million in the previous year. The net income for the same period stood at ₹17,725.2 million, up from ₹12,902.3 million in 2022-2023. Total assets as of March 31, 2024, were valued at ₹1,769,176.7 million, with total liabilities amounting to ₹1,666,759.4 million.

Shareholding Structure

The shareholding pattern of CFHL is as follows:

Promoters: 46.45%

Foreign Investors:17.07%

Institutional Investors:22.94%

Government Holding:0.46%

Non-Promoter Corporate Holding:2.11%

Public and Others:10.97%

Technical Analysis

From December to February, the price remained in a consolidation phase and formed a double bottom pattern. The breakout from this pattern occurred on **27/02/2025**. If the price closes and sustains above 1644 on the daily timeframe, we can anticipate a strong upward movement towards 1981.

R1 (First Resistance):1744

R2 (Second Resistance):1863

R3 (Third Resistance):1981

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investors are advised to conduct their own research or consult with a financial advisor before making investment decisions.

GOLD - BULLISH STRUCTURE SHAKING - WHAT'S NEXT?Symbol - XAUUSD

CMP - 2910

Gold has transitioned from a locally bullish trend to a neutral, sideways market. Despite this shift, bullish forces continue to defend key support levels. What can we anticipate for the precious metal in the near term?

Investor sentiment has gravitated back toward safe-haven assets amid concerns surrounding President Trump's tariff policies and disappointing U.S. economic data. On Tuesday, gold experienced a pullback from its record high of $2,956 due to profit-taking and a decline in Chinese imports. However, a weaker-than-expected U.S. consumer confidence index facilitated a recovery in gold prices.

The upward movement in gold is currently constrained by a strengthening U.S. dollar and rising bond yields, but ongoing trade war concerns continue to fuel demand for the metal.

Key resistance levels: 2921, 2929, 2942

Key support levels: 2905, 2888

As a result, gold is likely to remain within a sideways trading range. There is potential for a short-term decline to retest support in the 2905-2888 range before resuming upward movement. Alternatively, a breakout above resistance levels could signal further gains.

If the bulls manage to sustain trading above the 2921-2929 zone, the metal could resume its upward trajectory.

GOLD - BREAKDOWN OF RISK ZONE 2880 MAY TRIGGER TREND CHANGESymbol - XAUUSD

Gold is deviating from its recent trend and is now testing the panic and risk zone at 2880 as part of a corrective phase. A retest of this level would increase the likelihood of a potential trend reversal.

The recent loss in gold's upward momentum can be attributed to the uncertainty surrounding President Trump's tariff plans and ongoing economic challenges in the United States. Conflicting statements from the president are providing support for the dollar, while rising bond yields are exerting downward pressure on gold prices.

Market participants are closely monitoring the upcoming US GDP data. Should the results fall short of the forecasted 2.3% there is potential for gold to appreciate. Additionally, speeches from Federal Reserve officials will be crucial, but the key factor remains President Trump's remarks, which could significantly influence market sentiment.

From a technical standpoint, the market structure is currently bearish, suggesting that a continuation of the decline is likely after a brief corrective phase.

Support levels: 2878, 2888

Resistance levels: 2890, 2907

A false breakdown of the aforementioned support levels, following a significant decline, could lead to a correction. Initially, the price may move toward the 0.5 Fibonacci retracement level, and after a brief pullback, the 0.7 Fibonacci level could be tested. However, market participants should closely observe the price action at these levels.

If gold continues its downward movement, attention will be focused on the 2880 level. Conversely, if the price struggles to move lower and begins testing resistance, there is a possibility that, amidst heightened risks, the market could shift back into a growth phase.

EURUSD - PRE BREAKOUT CONSOLIDATION - ASCENDING TRIANGLESymbol - EURUSD

CMP - 1.0485

The EURUSD pair continues to display bullish signals, suggesting the potential for sustained upward movement. However, significant resistance lies ahead, and the market is currently undergoing a pre-breakout consolidation phase. The U.S. dollar is experiencing a corrective phase, influenced by economic data, domestic political developments, and indications from both President Trump and Federal Reserve Chairman Jerome Powell regarding the possibility of an imminent interest rate cut.

The euro is benefiting from the weakening dollar, though the duration of this trend remains uncertain, particularly in the context of the ongoing trade tensions between the U.S. and Europe.

From a technical perspective, the current chart suggests a bullish outlook. An ascending triangle is forming within the prevailing uptrend, generally indicative of market optimism. Key focus is placed on the pattern’s base, with resistance located at the 1.0530 level.

Support levels: 1.0450, 1.0400

Resistance levels: 1.0530

Should the dollar continue its downward trajectory, the pair is poised for potential growth. A retest of the trend support level, possibly marked by a false breakout, could occur before a decisive breakout. A successful breakout and sustained consolidation above the 1.0530 resistance level may trigger further upward movement.

NIFTY fall & probability observation1) On Aug 5th, 2024 - Nifty's low (23,893.70).

2) On Nov 12th, 2024 - Nifty broke Aug 5th low and fell (-2.64%).

3) On Nov 21st, 2024 - Nifty's low (23,263.15).

4) On Jan 13th, 2025 - Nifty broke Nov 21st low and fell (-2.10%).

5) On Jan 27th, 2025 - Nifty's low (23,786.90).

As per the above observations of NIFTY chart data, Every time when nifty broke the previous low It fell an average of (-2%).

> The fall % difference between the (Aug 5th, 2024 to Nov 12th, 2024) is (-2.64%) - (-2.10) = 0.54%.

> Observing, Assuming and Applying this % difference data with the Jan 27th, 2025 low (23,786.90),

That is, (2.10% - 0.54%) = 1.56%

23,786.90 - 1.56% = 22,431.

-> FIB Retracement - Marking the Nifty's election day's (Jun 4th, 2024) low of 21,281.45 and Nifty's All Time High (Sep 27th, 2024) 26,277.35, The next level (0.786) of fib retracement comes around 22,350.

-> The above observation data collides with Fib Retracement.

Final Comment: If nifty breaks the level of (22,786.90), The next support would be 22,400 to 22,350. If it breaks further, Nifty may test the most major support of 21,800.

Bajaj Electricals Ltd (BAJAJELEC) Stock Analysis**GlobalTradeHub | Bajaj Electricals Ltd (BAJAJELEC) Stock Analysis**

**Fundamental Analysis:**

Bajaj Electricals, a leading player in consumer durables and lighting, benefits from strong brand value and expanding distribution. Growth in the home appliances sector and government infra projects support revenue. Key risks include rising input costs and competitive pressure from other brands.

**Technical Analysis:**

The stock is facing resistance near ₹1,250. A breakout could push it toward ₹1,350. Strong support is at ₹1,150; a breakdown may lead to ₹1,050. RSI around 58 suggests moderate bullish momentum.

**Key Levels:**

- **Resistance:** ₹1,250 / ₹1,350

- **Support:** ₹1,150 / ₹1,050

**Conclusion:**

Bajaj Electricals has strong fundamentals and brand presence. A breakout above ₹1,250 may trigger further upside, while dips to support zones could offer buying opportunities. ⚡📈

Bayer CropScience Ltd (BAYERCROP) Stock Analysis**GlobalTradeHub | Bayer CropScience Ltd (BAYERCROP) Stock Analysis**

**Fundamental Analysis:**

Bayer CropScience, a leader in agrochemicals and seeds, benefits from strong R&D, a wide product portfolio, and rising demand for high-yield solutions. Consistent revenue growth and a strong balance sheet support long-term stability. Risks include weather dependency, regulatory changes, and rising input costs.

**Technical Analysis:**

The stock is testing resistance near ₹5,250. A breakout could push it toward ₹5,500. Strong support is seen at ₹4,900, with further downside risk if breached. RSI near 60 indicates bullish momentum but not overbought yet.

**Key Levels:**

- **Resistance:** ₹5,250 / ₹5,500

- **Support:** ₹4,900 / ₹4,700

**Conclusion:**

Bayer CropScience remains a strong agrochemical player. A breakout above ₹5,250 may trigger further upside, while dips to support levels can be potential buying opportunities. 🌱📈