Gold continues to lose value, pressured by USD and China dataWorld gold prices fell to $3,279/ounce, down $31 from the previous session's peak. The USD increased slightly along with the decline of crude oil and US stocks, making gold less attractive.

In addition, weak economic data from China raised concerns about falling physical gold demand - contributing to the price decline. On the daily chart, gold is falling from the peak, approaching the EMA34, warning of the risk of a deeper correction if it fails to hold this support level.

Chart Patterns

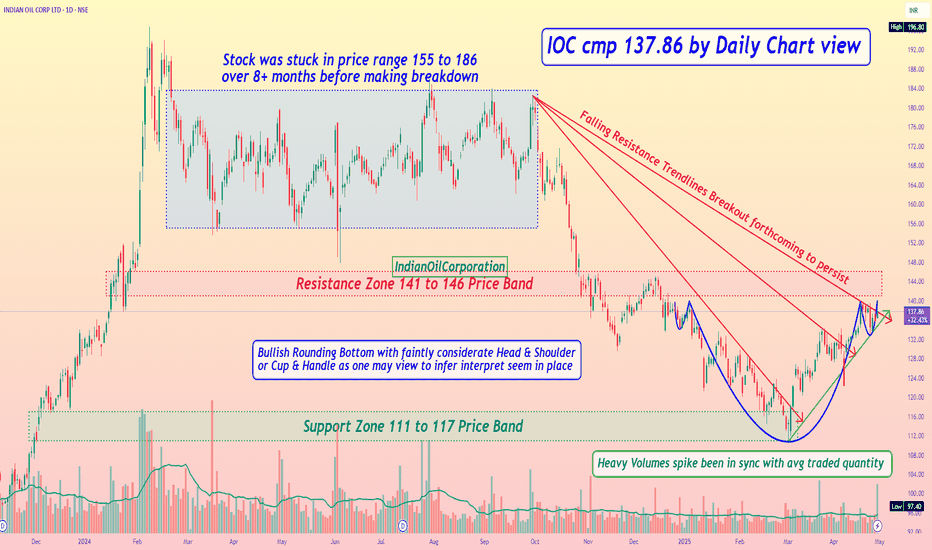

IOC cmp 137.86 by Daily Chart viewIOC cmp 137.86 by Daily Chart view

- Support Zone 111 to 117 Price Band

- Resistance Zone 141 to 146 Price Band

- Heavy Volumes spike been in sync with avg traded quantity

- Falling Resistance Trendlines Breakout forthcoming to persist

- Stock was stuck in price range 155 to 186 over 8+ months before making breakdown

- Bullish Rounding Bottom with faintly considerate Head & Shoulder or Cup & Handle as one may view to infer interpret seem in place

Technical ConceptA "technical concept" refers to a specific idea or principle within a technical field, like engineering, computer science, or a specific industry. It's a fundamental building block that helps explain how something works, what it does, and why it's used. These concepts are often complex and require a certain level of technical understanding.

Advanced Database Trading "Advanced Database Trading" typically refers to using advanced features and techniques within database management systems (DBMS) to handle complex data operations, enhance data management, and improve trading-related applications. This includes leveraging distributed databases, NoSQL systems, and techniques for real-time data processing and analysis.

New gold price range: 3170-3260New gold price range: 3170-3260

As shown in the figure:

The downward trend is obvious, and there is still room below

As the Asian market plummeted after the holiday, the US market was unable to pull up, and it continued to fall today, completely breaking through the range.

The new range is 3170-3260

Technical analysis:

1: As long as the gold price is below 3260, today's strategy only participates in short selling

2: Fully test the new support level of the 3160-3180 range and try to buy the bottom and go long

Today's data is worth paying attention to

I think the data of these two days is bearish on Thursday and bullish on Friday

According to this rhythm, gold is relatively in line with the current range fluctuations

Database Trading part 3Trading data is a sub-category of financial market data. It provides real-time information about stock and market prices as well as historical trends for assets such as equities, fixed-income products, currencies and derivatives. Trading data also includes information about trades historically and over the course of a trading day, such as the latest bid, asking price and time of the last trade.

MACD Part 2MACD, short for Moving Average Convergence Divergence, is a popular technical indicator used in trading to identify potential buy and sell signals, as well as trend reversals. It's essentially a momentum indicator that compares two moving averages (usually 12-period and 26-period exponential moving averages) to gauge the strength and direction of a trend.

RSI ExplanationThe Relative Strength Index (RSI) is a momentum indicator used in technical analysis to assess the speed and magnitude of price changes. It helps traders identify potential overbought and oversold conditions in a financial instrument, suggesting when an asset might be nearing a trend reversal. RSI values range from 0 to 100, with readings below 30 often indicating oversold conditions and readings above 70 suggesting overbought conditions'

Bearish Trend Resumption After Brief Move up , Market started losing its strength

when we checked the Relative strength using Ratio chart results ware not supporting for

further rally

We believe Now the suggested pattern for Nifty based on Past data is Zig Zag Pattern connected

by 3 Wave Counter move which we relate as Pattern X and now our forecast for next down ward

trend ideally considered as Zig Zag Move by price & Time

So We made calculation of Primary Zig Zag and placed calculated forecast notation on chart

I hope the visual representation is sufficient to understand the idea

if you have Questions please feel free to ask by commenting on chart

This chart is education purpose only

Good luck

CEAT - Bullish Price actions satisfies following conditions.

1) Supertrend cross over 50 DMA

2) 50 DMA cross over 200 DMA

3) daily vol > 30 DMA Vol

4) ADX > 25

Breakout has already come and hence the stock will rise with all its might. Targets are marked as per Fibonacci retracement

The study is for academic purpose and not a recommendation to investment

ITC LTD // 1week Support and ResistanceAs of May 1, 2025, at 10:20 AM IST, ITC Ltd (NSE: ITC) is trading at ₹403.05. Based on recent technical analysis, here are the key support and resistance levels for the stock on a weekly (1W) chart:

📊 Weekly Support and Resistance Levels

Immediate Support Levels:

₹402.50

₹394.45

₹388.00

Immediate Resistance Levels:

₹409.10

₹417.30

₹423.75

These levels suggest that if the stock price declines below ₹402.50, it may find support around ₹394.45 and ₹388.00. Conversely, if the price rises above ₹409.10, it could encounter resistance near ₹417.30 and ₹423.75.

🔍 Technical Indicators

ADX (Average Directional Index): 29.19 – indicates a trending market.

RSI (Relative Strength Index): 47.4 – suggests neutral momentum.

MACD (Moving Average Convergence Divergence): -4.66 – indicates a negative trend.

CCI (Commodity Channel Index): 2.74 – suggests neutral momentum.

These indicators suggest a neutral to slightly bearish outlook for ITC in the short term.

📈 Summary

ITC is currently trading near its immediate support levels. A break below ₹402.50 could lead to a decline towards ₹394.45 and ₹388.00. On the upside, resistance is observed at ₹409.10, ₹417.30, and ₹423.75. Traders should monitor these levels closely, as a decisive move beyond these support or resistance levels could signal the next directional move.

ICICI Bank // 4hour Support and ResistanceAs of May 1, 2025, at 10:08 AM IST, ICICI Bank Ltd (NSE: ICICIBANK) is trading at ₹1,266.75. Based on recent technical analysis, here are the key support and resistance levels for the stock on a 4-hour (4H) chart:

📊 4-Hour Support and Resistance Levels

Immediate Support Levels:

₹1,266.75 (current price)

₹1,258.00

₹1,248.00

Immediate Resistance Levels:

₹1,278.00

₹1,288.00

₹1,298.00

These levels suggest that if the stock price declines below ₹1,266.75, it may find support around ₹1,258.00 and ₹1,248.00. Conversely, if the price rises above ₹1,278.00, it could encounter resistance near ₹1,288.00 and ₹1,298.00.

🔍 Technical Indicators

ADX (Average Directional Index): 17.73 – indicates a weak trend.

RSI (Relative Strength Index): 55.87 – suggests neutral momentum.

MACD (Moving Average Convergence Divergence): 11.45 – indicates a positive trend.

CCI (Commodity Channel Index): 88.61 – suggests the stock is in an uptrend.

These indicators suggest a neutral to slightly bullish outlook for ICICI Bank in the short term.

HDFC Bank ltd // 2hour Support and ResistanceAs of May 1, 2025, at 9:58 AM IST, HDFC Bank Ltd (NSE: HDFCBANK) is trading at ₹1,765. Based on recent technical analysis, here are the key support and resistance levels for the stock on a 2-hour (2H) chart:

📊 2-Hour Support and Resistance Levels

Immediate Support Levels:

₹1,746

₹1,732

Immediate Resistance Levels:

₹1,797

₹1,812

These levels suggest that if the stock price falls below the immediate support at ₹1,746, it may find the next support at ₹1,732. Conversely, if the price rises above the immediate resistance at ₹1,797, it could encounter the next resistance at ₹1,812 .

📉 Technical Indicators

ADX (Average Directional Index): 24.08, indicating a trending market.

MACD (Moving Average Convergence Divergence): Bearish crossover detected, suggesting downward momentum.

Parabolic SAR: Positioned at ₹1,714.70, indicating a bearish trend.

Super Trend: At ₹1,728.41, confirming bearish sentiment.

Bollinger Bands: Price is below the middle band (₹1,707.66), indicating potential for further downside .

MAX FINANCIAL SERVICES LTDAs of May 1, 2025, at 9:35 AM IST, here are the key daily support and resistance levels for Max Financial Services Ltd. (NSE: MFSL) based on recent technical analysis:

🔹 Support Levels

S3: ₹1,011.58

S2: ₹1,020.37

S1: ₹1,030.43

🔹 Resistance Levels

R1: ₹1,049.28

R2: ₹1,058.07

R3: ₹1,068.13

These levels are derived from the Classic pivot point method, calculated based on the price range of the previous trading day.

📊 Technical Indicators

RSI (14): 50.14 (Neutral)

MACD: 1.57 (Sell)

ADX (14): 22.20 (Neutral)

Williams %R: -51.44 (Buy)

CCI (14): 68.41 (Neutral)

ROC: 3.45 (Buy)

These indicators suggest a neutral to slightly bullish trend, with the stock trading near its 20-day moving average and showing mixed momentum signals.

📈 Moving Averages

20-day EMA: ₹1,073.42

50-day EMA: ₹1,109.36

100-day EMA: ₹1,118.91

200-day EMA: ₹1,086.00

The stock is trading below its 50-day and 100-day EMAs, indicating a potential resistance zone around ₹1,109.36.

Note: These levels and indicators are based on historical data and are subject to change with market conditions. It's advisable to monitor the stock's price movements and consult with a financial advisor before making any trading decisions.

PIL ITALICA LIFESTYLE LTDAs of May 1, 2025, at 9:20 AM IST, here are the key daily support and resistance levels for Pil Italica Lifestyle Ltd (NSE: PILITA) based on recent technical analysis:

🔹 Support Levels

S1: ₹14.71

S2: ₹14.40

S3: ₹14.02

🔹 Resistance Levels

R1: ₹15.40

R2: ₹15.78

R3: ₹16.09

These levels are derived from the Classic pivot point method, calculated based on the price range of the previous trading day.

Technical Indicators:

RSI (14): 66.92 (Uptrend)

MFI: 88.87 (Strong Uptrend)

CCI (14): 262.93 (Strong Uptrend)

EMA (20): ₹13.37 (Neutral)

EMA (50): ₹12.94 (Uptrend)

EMA (100): ₹12.72 (Uptrend)

EMA (200): ₹12.27 (Uptrend)

These indicators suggest a bullish trend, with the stock trading above key moving averages and strong momentum indicators.

Please note that these levels are based on historical data and are subject to change with market conditions. It's advisable to monitor the stock's price movements and consult with a financial advisor before making any trading decisions.

Gold Still Dropping What I’m Watching This Week....Following my last update, gold price action continues to align with the bearish short-term outlook I projected. The weekly close on April 27, 2025, as seen in the chart, confirmed the bearish sentiment with a red candlestick, well below the recent highs and the golden Fibonacci zone (3380-3408). This reinforces that sellers remain in control.

Today, gold is still trading , below the golden Fib zone, which continues to act as a resistance. The price has not yet tested the first support level at 3150-3165, but the downward trajectory suggests it may approach this zone soon. If this support holds, we might see a temporary bounce; however, a break below 3150-3165 could accelerate the decline toward my target of 3000, as indicated by the chart projected path.

The weekly close below the recent swing highs and the failure to reclaim the golden Fib zone strengthen the bearish case. For the short term, I expect gold to continue its downward movement unless a significant reversal pattern emerges.

Nifty 50 Index // 15min Support and ResistanceAs of May 1, 2025, at 9:04 AM IST, the Nifty 50 index is trading at approximately 23,630. Based on recent intraday analysis, here are the key 15-minute support and resistance levels:

🔹 Support Levels

S1: 23,263

S2: 23,189.88 (61.8% Fibonacci retracement)

S3: 23,100.20 – 23,127.45

🔹 Resistance Levels

R1: 23,349.20 – 23,421.25

R2: 23,496.15 – 23,795.20

R3: 23,645.05 – 23,726.85

These levels are derived from recent intraday analysis and are subject to change with market conditions. It's advisable to monitor the stock's price movements and consult with a financial advisor before making any trading decisions.

SARLAPOLY - Cup & Handle Breakout With Fibonacci Confluence📊 SARLAPOLY – Cup & Handle Breakout with Fibonacci Confluence

🕰️ Timeframe: 1D | 📐 Pattern: Cup Formation + Trendline Breakout

🔍 Technical Overview:

SARLAPOLY has completed a Cup pattern and given a strong breakout above the descending trendline resistance, accompanied by a massive volume spike.

The breakout aligns well with the 61.8% Fibonacci retracement level (~₹100.94), increasing confidence in the breakout's validity.

🔑 Key Technical Levels:

🔵 Resistance / Upside Targets:

₹117.88 (Fib 78.6%)

₹120.00

₹123.68

₹125.00

₹127.90

₹132.25 (100% Fib retracement)

🔴 Support Zones:

₹101.13 (recent breakout level / Fib 61.8%)

₹94.66 (previous resistance zone – now support)

₹91.27 (Fib 50%)

₹69.07 (23.6% Fib + structure support)

📊 Volume & Indicators:

📈 Breakout Volume Surge – Volume confirmation indicates institutional interest and breakout strength.

🧮 Fibonacci Retracement – Plotted from swing low (₹50.30) to swing high (₹132.25), gives clear confluence zones.

🔺 Trendline Breakout – Downward sloping trendline broken cleanly, confirming bullish intent.

☕ Cup Formation – Classic rounding bottom visible, suggesting accumulation phase is complete.

🧠 Bias: Bullish

📉 Watch for a retest around ₹100–₹101 zone as a potential re-entry point with SL below ₹94.66 for positional swing.

⚠️ Disclaimer: This is an educational analysis and not financial advice. Always do your own research before making investment decisions.

📈 Follow @PriceAction_Pulse for more price action setups, breakout alerts, and swing trade ideas!

💬 Comment below if you’re watching SARLAPOLY for the next leg up 📊

UNITED SPIRITS LTD As of May 1, 2025, here are the key support and resistance levels for United Spirits Ltd (NSE: UNITDSPR) based on the latest technical analysis:

🔹 Support Levels

S1: ₹1,322.63

S2: ₹1,297.97

S3: ₹1,271.98

🔹 Resistance Levels

R1: ₹1,373.28

R2: ₹1,399.27

R3: ₹1,423.93

These levels are derived from pivot point calculations and are commonly used by traders to identify potential price reversal zones.

Please note that these levels are based on historical data and are subject to change with market conditions. It's advisable to monitor the stock's price movements and consult with a financial advisor before making any trading decisions.