XAU/USD Medium-Term Breakdown: Market Structure Shift Confirmed!Gold has officially entered a bearish phase after decisively breaking below a key high-volume support zone around $3225, which now flips into a major resistance level. This wasn’t a minor flush — it was a clean structural break that reflects deeper underlying weakness.

⸻

Key Technical Highlights:

1. HVZ Breakdown – The Trend Flip Signal

The HVZ (High Volume Zone) at ~$3,165 was acting as a base where buyers previously absorbed sell pressure. But the recent breakdown with strong bearish candles confirms that buyers have lost control Still watch today close may15 -2025. Price attempted to hover above it for several sessions, but once it gave in, the breakdown was swift — signaling a shift in control from bulls to bears.

Now, any bounce back into the 3,150–3,165 range is likely to meet aggressive selling — this has now become a sell zone, not a support.

⸻

2. 3111 – The Last Stand for Bulls

The current trading region — around $3,111 —3120 is the final line of defense for buyers. This zone was an earlier demand pocket and acted as the origin of the strong April rally. If bulls can hold this, we may see short-term relief or a retest of HVZ.

But if this zone fails, especially on a candle close with volume, it would trigger another wave of liquidation, as this region is structurally thin and lacks strong historical support.

⸻

3. Projected Path – The Final Flush to $3,014–3,000

Once the 3111 level is broken, gold opens up downside space to the $3,014–3,000 zone — which is the final target as marked on the chart.

This zone is significant for three reasons:

• It marks the origin of the April bullish move.

• It’s a historical accumulation block.

• Psychological round number ($3,000) often acts as magnet for liquidity grabs or rebounds.

It’s also where institutional buyers may reappear to attempt a reversal, provided macro conditions align.

⸻

Momentum & Behavior:

The current momentum favors the bears:

• Lower highs, lower lows are in place.

• Failed breakout attempts above $3,240 only strengthened bearish intent.

• Breakdown below HVZ happened with conviction — not a fakeout.

Also, notice the slow grinding nature of the recent move. This isn’t panic selling, it’s a controlled liquidation, which often leads to a final flush, then sharp bounce — especially if macro triggers (like rate cuts or Fed dovishness) hit the news cycle.

⸻

Conclusion:

• Bias: Medium-term bearish

• Invalidation: Only above $3240 reclaim with volume

• Key Levels:

• Resistance: 3,165

• Pivot: 3,111

• Target: 3,014 / 3,000 zone

The safest approach now? Sell the bounces, not the dips — unless you’re playing the final drop scalps with tight risk.

Breakouttrading

Big Bank BREAKOUT! Canara Bank Ready📉 Breakdown of the Setup:

✅ WTF CT (White Lines): 3+ confirmed touches → clean descending counter-trendline.

✅ Hidden Resistance (Dotted White Line): Clear breakout above key hidden level. Historic reaction zone.

✅ MTF Resistance (Yellow Line): Long-term resistance just above; nearing test zone (confluence resistance area ahead).

✅ Green Zone (Support/Resistance Flip):

Acted as strong support in 2024.

Fake breakdown trap ✔️

Price back above = bullish bias reinstated.

✅ Volume Surge: 124M+ on breakout candle ➕ major bullish close.

#QPOWER - IPO Stock Keep In Watch List📊 Script: QPOWER

Key highlights: 💡⚡

📈 Inverse Head & Shoulders in Daily Time Frame.

📈 Price consolidating near Resistance.

📈 Can Enter on BO with Volume spike.

📈 MACD Bounce

📈 One can go for Swing Trade.

BUY ONLY ABOVE 380 DCB

⏱️ C.M.P 📑💰- 376

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

️⚠️ Important: Market conditions are Okish, Position size 50% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

Gold Analysis >XAU/USD – 4H Chart 12/5/2025Gold is currently respecting the 3330–3350 zone as a strong supply region. This area has repeatedly acted as a ceiling where sellers have stepped in aggressively, preventing further upside momentum. The recent attempt to push higher was again met with selling pressure, confirming this level as a key short-term resistance.

Unless price decisively breaks above 3350 with strong volume, the bias remains mildly bearish. The downside targets the 3230 high volume zone, which is structurally important. This area has previously absorbed heavy orders and acted as a base for bullish continuation moves. If price approaches this level again, it could attract renewed buying interest.

For now, price seems caught in a range between strong sellers at the top and potential buyers waiting lower.

NAZARA - Breakout from Long-Term Falling Wedge📊 NAZARA – Breakout from Long-Term Falling Wedge | Strong Weekly Momentum

🕰️ Timeframe: Weekly | 💥 Pattern: Falling Wedge Breakout | 🔥 Sentiment: Bullish

📈 Chart Overview:

Nazara Technologies has broken out of a multi-year falling wedge on the weekly chart, with a strong green candle above key EMAs and Fibonacci confluence zones. Price closed the week above ₹1,100, indicating a shift in long-term momentum and a potential start of a fresh uptrend.

🔍 Technical Highlights:

📉 Falling Wedge Pattern: Multi-year consolidation now broken on strong volume

💥 Breakout Candle: Price closed above trendline resistance and key Fibonacci 50% level

🧠 Volume Surge: Volume confirmation signals institutional interest

📊 EMA Confluence: Price trading above 20/50/100/200 EMAs – bullish alignment

🧱 Support & Resistance Levels:

Level Type Price (₹)

🔼 Resistance 1 1,219.25 (Fib 61.8%)

🔼 Resistance 2 1,678.00 (Previous ATH / Fib 100%)

🔻 Support 1 1,077.55 (Fib 50% – breakout zone)

🔻 Support 2 935.85 (Fib 38.2% + EMA cluster)

🔻 Support 3 820–860 (multi-touch horizontal support & EMA 200)

🔧 Indicators Used:

Fibonacci Retracement – Plotted from swing low ₹477.10 to high ₹1,678.00

EMA 20/50/100/200 – Price is now above all EMAs, showing trend shift

Volume Bars – Confirming strong breakout

Chart Pattern – Falling wedge (typically bullish)

📌 Chart Sentiment & Setup:

✅ Bias: Strongly Bullish

📍 Breakout Level: ₹1,077

🎯 Upside Targets: ₹1,219 → ₹1,320 → ₹1,678

❌ Invalidation: Sustained close below ₹935 with volume

📢 Summary:

Nazara is showing signs of a structural breakout after prolonged downtrend and consolidation. The falling wedge breakout, confirmed by volume and EMA crossover, sets up a long-term bullish outlook. A retest of the ₹1,075–₹1,100 zone could offer a high-probability entry.

🧠 Pro Tip: Wait for a weekly candle close and minor pullback to the breakout level before entry.

⚠️ Disclaimer: This is a technical analysis post meant for educational purposes only. Please do your own research or consult a financial advisor before investing.

🔔 Follow @PriceAction_Pulse for more actionable swing setups, breakout alerts, and chart breakdowns!

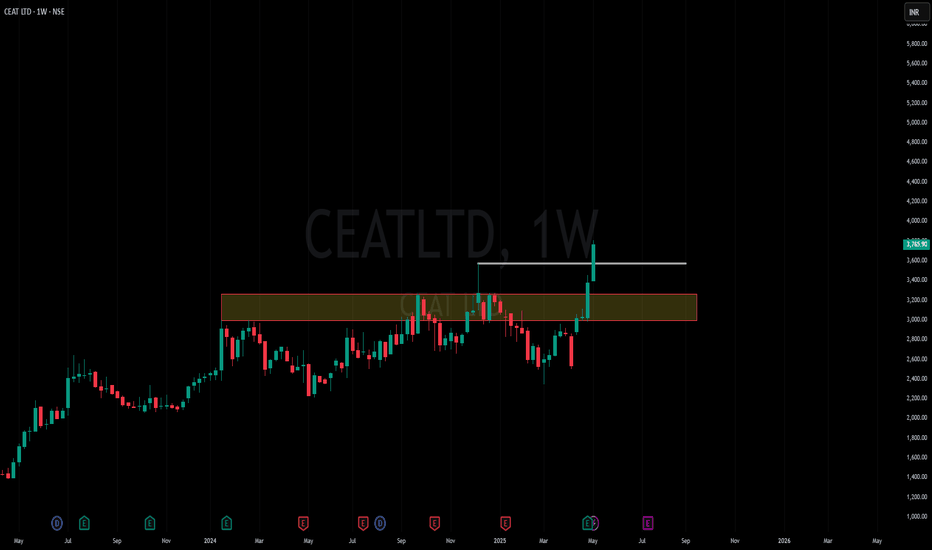

Amazing breakout on WEEKLY Timeframe - CEATLTDCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

High conviction / value buy stock pick - SHRIPISTONCheck this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

Time makes money, GREEDY & EGO will not make money.

The real deal is when to purchase and where to purchase the stock.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

High conviction / value buy stock pick - WELSPUNLIVCheck this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

Time makes money, GREEDY & EGO will not make money.

The real deal is when to purchase and where to purchase the stock.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

High conviction / value buy stock pick - MIDHANICheck this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

Time makes money, GREEDY & EGO will not make money.

The real deal is when to purchase and where to purchase the stock.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

High conviction / value buy stock pick - MAYURUNIQCheck this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

Time makes money, GREEDY & EGO will not make money.

The real deal is when to purchase and where to purchase the stock.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

High conviction / value buy stock pick - EPLCheck this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

Time makes money, GREEDY & EGO will not make money.

The real deal is when to purchase and where to purchase the stock.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - DCBBANKCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - BELCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - PARASCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - GVT&DCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Smart money buying in YES BANK.YES Bank Breakout Alert

YES Bank has recently shown a strong breakout supported by high trading volume, following news that Japan's Sumitomo Mitsui Banking Corporation has received RBI approval to acquire a 51% stake in the bank.

From a technical standpoint, the chart structure indicates a bullish trend on higher time frames. If this breakout holds as genuine, the stock has the potential to test ₹22.50 and ₹28 levels in the near term — representing an upside of approximately 40% from current levels.

Solar Industry (NSE) at Make-or-Break Level ? NSE:SOLARINDS

Summary:

📈 Key Levels

Breakout: Cleared resistance at 13,300 with a strong bullish engulfing candle.

Pattern: Bullish Flag & Pole (pole size: 3,777.80 points) suggests a measured move target of 17,077.80.

Trend: Price above 20/50/200 EMAs on daily, weekly, and monthly timeframes.

Risk: Overbought RSI (14) and bearish MACD crossover hint at potential consolidation.

________________________________________________________________________________

Technical Analysis

1. Bullish Structure Confirmed 🚩

Bullish Engulfing Candle : Broke above critical resistance at 13,300 (near all-time high), signaling bullish momentum.

Flag & Pole Pattern: The "pole" (3,777.80-point rally) followed by a consolidation "flag" suggests a potential repeat of the uptrend post-breakout. Historical symmetry often sees targets equal to pole size.

2. Trend Alignment ✅

Multi-Timeframe Support: Price trades above all key EMAs (20, 50, 200) on daily, weekly, and monthly charts, confirming a strong bullish bias.

3. Divergence Alert ⚠️

RSI (14): Overbought at 70+ warns of short-term exhaustion.

MACD: Bearish crossover on daily charts adds caution.

---------------------------------------------------------------------------------------------------------------------

Trade Setup

Entry Zone:

Aggressive: Current price (above 13,300).

Conservative: Retest of 13,300 as support.

Targets: 17,077.80 (measured move: 13,300 + 3,777.80).

Stop Loss: 13,000 (low of the bullish engulfing candle) or 12,640 (prior swing low) for wider risk tolerance.

Risk Management

Position Size: Risk ≤1-2% of capital.

Confirmation: Watch for a daily close below 13,000 to invalidate the setup.

Conclusion

The Solar Industry (NSE) is at a critical juncture: bullish momentum clashes with overbought signals. While the Flag & Pole pattern and EMA alignment favor a rally to 17,077+, traders must respect the RSI/MACD divergence. A decisive hold above 13,300 could fuel the next leg up, but a breakdown below 13,000 may trigger profit-taking.

Key Action: Monitor price action above 13,300 for confirmation!

📊 Chart Attached | Like/Follow for updates!

Disclaimer: This is not financial advice. Always conduct your own analysis.

#NSE #SolarStocks #TechnicalAnalysis #BreakoutAlert

KPRMILL - Daily - Cup and Handle - BreakoutPattern: "Cup and Handle" pattern

Cup/Rounding Bottom: Formed from approximately late 2024/early 2025 to late April 2025, with the low around 755.50.

Handle: A small consolidation (handle) has formed in early May 2025, right at the neckline.

Neckline: The resistance or neckline of this pattern is around 1,083.00 - 1,084.40. The price is currently testing or attempting to break out above this neckline.

Volume: A significant volume spike is visible on the most recent candle, which is attempting the breakout. This is a positive sign.

Target: The depth of the cup (approximately 324.15 points) projected from the neckline gives a potential target of around 1,408.50.

Support: The neckline around 1,083.00 - 1,084.40 will act as support if the breakout is successful. The low of the cup (755.50) is major support.

Resistance: The immediate resistance is the neckline itself. Once cleared, the target of 1,408.50 becomes the next significant resistance.

Interpretation: KPR Mill is at a crucial juncture, attempting to break out from a large bullish pattern. The high volume on the breakout attempt is encouraging. A sustained close above the 1,084.40 level would confirm the breakout and suggest a move towards the 1,408.50 target

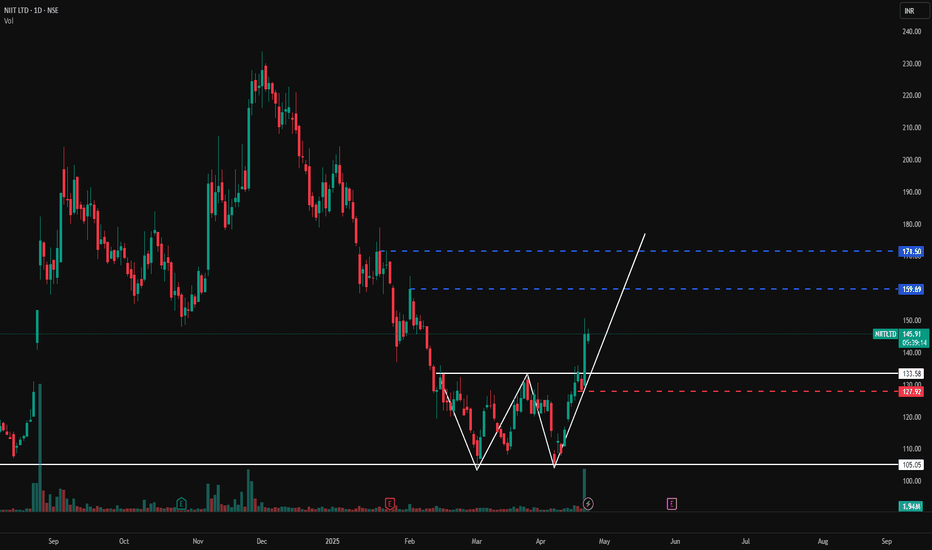

NIIT LTD - Bullish Reversal Setup📊 NIIT LTD – Bullish Reversal Setup

🕰️ Timeframe: 1D | 🧩 Pattern: Double Bottom

🔍 Technical Chart Overview:

NIIT is showing a strong Double Bottom reversal pattern on the daily chart — a classic signal of potential trend reversal from bearish to bullish.

After bouncing from the major support zone near ₹105, the price has broken out above the neckline (around ₹133.5) on strong volume, indicating bullish conviction.

🔑 Key Technical Levels:

🔵 Resistance Levels:

₹159.70

₹171.50

🔴 Support Levels:

₹133.50 (neckline retest zone)

₹127.90 (minor support)

₹105.00 (base support)

📈 Breakout Confirmation:

Price has broken above the neckline with a high volume spike, confirming the double bottom breakout.

Next targets lie in the ₹159–₹171 range, aligning with previous supply zones.

📊 Volume & Price Action Notes:

Recent bullish candles with above-average volume

Potential retest of neckline could offer a favorable risk-reward entry

🧠 Bias: Bullish (as long as price holds above ₹133.5)

📌 Chart Indicators Used:

📉 Volume Spike confirmation

🔃 Double Bottom Pattern

🔍 Key S/R Levels marked

📍 Entry/Target Path projection with arrow

⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Please DYOR before making trading decisions.

📈 Follow for more actionable chart patterns | PriceAction_Pulse

💬 Drop a comment if you're tracking NIIT!

Authum Investment & Infrastructure Ltd**AIIL:**

A one-day breakout has occurred, accompanied by a significant spike in volume. You can consider adding to your position at the current level of 1732 until the retest is complete. Start by adding 50% now, and if the price falls to 1680, add another 15%.

The support level is at 1626.50 based on the daily close, while the resistance levels are at 1854.10, 1924.95, and 1986.80.

Adani energy Solution is on bullish breakout.Adani energy Solution is in bullish Momentum mode.

It gave marubozo candle with higher volume on dated 27.03.2025.

It also traps the retail investors with operator candle on date 07.04.2025.

Stock is in Demand zone as per chart It may test 1090 (20%) and 1255(36%) gain soon.

Amazing breakout on WEEKLY Timeframe - ERISCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!