/

The best trades require research, then commitment.

$0 forever, no credit card needed

Leo Houlding, explorer

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Love in every #TradingView

100M+

Traders and investors use our platform.

#1

Top website in the world when it comes to all things investing.

1.5M+

Mobile reviews with 4.9 average rating. No other fintech apps are more loved.

Short Sunpharma on technical analysis till 1680Siunpharma looks week in daily chart and seems it can fall 1680 zone as per price support on that area where bulls vcan activate and bears will close their position.

📈 Technical Indicators

Moving Averages: Strong Sell

Technical Indicators: Strong Sell

RSI (14): 31.939 (Approaching oversold territ

XAUUSD Ultimate Bullish TargetsBulls - Assemble!

XAUUSD has recently shown a decent pullback. It opens new doors for all traders having a bullish view on Gold. According to my analysis, Gold is mirroring it's previous bull run moves, with a few extra volume bursts (50-100 pips) here and there.

So, the max upside potential for G

Shriram Pistons - Wedge BO NSE:SHRIPISTON Made Beautiful Chart Structure today after Q4 Results with Good Price and Volume action.

Wedge Breakout Pattern History:

The chart displays a remarkable track record of successful wedge breakout patterns, which has become a defining characteristic of this stock's technical behavi

SEQUENT SCIENTIFIC By KRS Charts8th May 2025 / 10:30 AM

Why SEQUENT SCIENTIFIC?

1. Technically it is showing Potential for movement.

2. In Past Already Got More than 50% Returns but important thing is as per Dow Theory it is making Higher Low.

3. In 1D TF multiple Breakouts with Above avg Volume is visible.

4. This

Bullish trap in CESC: Ascending channel.Two points are showing a bullish trap in CESC chart (daily timeframe):-

1. Prices are exhausting in the channel. A volume spike is needed for the channel breakout, which is missing here.

2. Prices made higher highs, but RSI made lower highs, showing divergence. This means there are good chances fo

Google: A compelling buy at the current priceHello,

As Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful." This mindset is particularly relevant right now with Alphabet Inc.

Despite being a company whose products we use daily—and will likely rely on even more in the future—Alphabet's stock r

Massive Breakout Loading? GOKEX Smashes Through Triple TimeframeGOKALDAS EXPORTS LTD (GOKEX) is showing serious strength with a powerful breakout candle currently in play – but the real story is the multi-timeframe technical alignment:

📏 MTF Structure

Yellow Parallel Channel from Monthly shows a long-term structure still intact.

Red Horizontal Resistance marks

Fresh Possible Supply Zones Spotted! | 15-Min Chart Analysis🟣 Nifty 50 Index – Fresh Possible Supply Zones Spotted! | 15-Min Chart Analysis

📅 Date: May 7, 2025 | 🕒 Timeframe: 15-Minute

Hello Traders 👋

Today’s chart highlights two potential supply zones on the Nifty 50 index that could play a crucial role in the short-term price movement. Supply zones are a

Alembic Ltd – Inverted Flag Pattern Forming | Breakout Trade SetAlembic Ltd appears to be forming a classic inverted flag pattern on the daily chart:

Bearish Flagpole: A strong and sharp downward move from ~₹148 to ₹88 established the flagpole.

Bullish Flag (Retracement Channel): Since March, the price has been moving in a parallel rising channel — a typical

IOC - Poised for good up Move?After a big drop of nearly 40 percent from the top, the stock started consolidating and moving up, making a nice rounding bottom type of pattern. It started making higher highs and higher lows and moving past the short-term moving averages. Now, it has also gone past the 200 DMA and also crossing ab

See all editors' picks ideas

Best SMA FinderThis script, Best SMA Finder, is a tool designed to identify the most robust simple moving average (SMA) length for a given chart, based on historical backtest performance. It evaluates hundreds of SMA values (from 10 to 1000) and selects the one that provides the best balance between profitability,

Bitcoin Monthly Seasonality [Alpha Extract]The Bitcoin Monthly Seasonality indicator analyzes historical Bitcoin price performance across different months of the year, enabling traders to identify seasonal patterns and potential trading opportunities. This tool helps traders:

Visualize which months historically perform best and worst for

Market Manipulation Index (MMI)The Composite Manipulation Index (CMI) is a structural integrity tool that quantifies how chaotic or orderly current market conditions are, with the aim of detecting potentially manipulated or unstable environments. It blends two distinct mathematical models that assess price behavior in terms of bo

Dual-Phase Trend Regime Oscillator (Zeiierman)█ Overview

Trend Regime: Dual-Phase Oscillator (Zeiierman) is a volatility-sensitive trend classification tool that dynamically switches between two oscillators, one optimized for low volatility, the other for high volatility.

By analyzing standard deviation-based volatility states and applying

Nasan Risk Score & Postion Size Estimator** THE RISK SCORE AND POSITION SIZE WILL ONLY BE CALCUTAED ON DIALY TIMEFRAME NOT IN OTHER TIMEFRAMES.

The typically accepted generic rule for risk management is not to risk more than 1% - 2 % of the capital in any given trade. It has its own basis however it does not take into account the stocks

NIG Probability TableNormal-Inverse Gaussian Probability Table

This indicator implements the Normal-Inverse Gaussian (NIG) distribution to estimate the likelihood of future price based on recent market behavior.

📊 Key Features:

- Estimates the parameters (α: tail heaviness, β: skewness, δ: scale, μ: location)

of th

Log-Normal Price ForecastLog-Normal Price Forecast

This Pine Script creates a log-normal forecast model of future price movements on a TradingView chart, based on historical log returns. It plots expected price trajectories and bands representing different levels of statistical deviation.

Parameters

Model Length –

Market Sessions & Viewer Panel [By MUQWISHI]▋ INTRODUCTION :

The “Market Sessions & Viewer Panel” is a clean and intuitive visual indicator tool that highlights up to four trading sessions directly on the chart. Each session is fully customizable with its name, session time, and color. It also generates a panel that provides a quick-glance

Elastic Volume-Weighted Student-T TensionOverview

The Elastic Volume-Weighted Student-T Tension Bands indicator dynamically adapts to market conditions using an advanced statistical model based on the Student-T distribution. Unlike traditional Bollinger Bands or Keltner Channels, this indicator leverages elastic volume-weighted averaging

Dynamic RSI Regression Bands (Zeiierman)█ Overview

The Dynamic RSI Regression Bands (Zeiierman) is a regression channel tool that dynamically resets based on RSI overbought and oversold conditions. It adapts to trend shifts in real time, creating a highly responsive regression framework that visualizes market sentiment and directional

See all indicators and strategies

Community trends

Shriram Pistons - Wedge BO NSE:SHRIPISTON Made Beautiful Chart Structure today after Q4 Results with Good Price and Volume action.

Wedge Breakout Pattern History:

The chart displays a remarkable track record of successful wedge breakout patterns, which has become a defining characteristic of this stock's technical behavi

SEQUENT SCIENTIFIC By KRS Charts8th May 2025 / 10:30 AM

Why SEQUENT SCIENTIFIC?

1. Technically it is showing Potential for movement.

2. In Past Already Got More than 50% Returns but important thing is as per Dow Theory it is making Higher Low.

3. In 1D TF multiple Breakouts with Above avg Volume is visible.

4. This

Short Sunpharma on technical analysis till 1680Siunpharma looks week in daily chart and seems it can fall 1680 zone as per price support on that area where bulls vcan activate and bears will close their position.

📈 Technical Indicators

Moving Averages: Strong Sell

Technical Indicators: Strong Sell

RSI (14): 31.939 (Approaching oversold territ

Bullish Momentum with EMA200 and Volume Confirmation📈 CRISIL Technical Analysis | Bullish Momentum with EMA200 and Volume Confirmation

📅 Date: May 08, 2025

📈 Timeframe: Daily

🔍 Stock: CRISIL(NSE)

📊 Price Action Update (Today):

CRISIL surged by +6.59%, closing at 5,010.30, after trading in a range between 4,690.20 and 5,050.00. The stock formed

WELSPUNLIV | Weekly Confluence | Volume-Based Bounce Setup🧿 WELSPUNLIV | Weekly Confluence | Volume-Based Bounce Setup

Welspun Living Ltd | Positional Trade Idea

🔍 Why This Stock?

Price bounced strongly from the ₹110–₹120 support zone, which has held for over a year.

Bullish engulfing candle on daily TF, aligning with a weekly reversal.

Massive volum

Bullish trap in CESC: Ascending channel.Two points are showing a bullish trap in CESC chart (daily timeframe):-

1. Prices are exhausting in the channel. A volume spike is needed for the channel breakout, which is missing here.

2. Prices made higher highs, but RSI made lower highs, showing divergence. This means there are good chances fo

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

Kiroloskar Brothers - An Interesting ChartSharing an interesting Chart here. As you can see the stock had a massive drop of nearly 40 percent from its high and it was pushed below the 200 DMA. Then we saw some strength coming in and it started consolidating for the last two months and it was moving in a range. Now we can see that the buy wa

Arman Fin Serv Short Term TradeThe stock has been in consolidation since the last six months,

the area around yellow horizontal lines being the support and resistance zones,

In the last two months, a small rising trendline is visibkle within this area

Currently, the consolidation's resistance zone as well as the trendline has be

APPOLLO MICRO SYSTEM LTD Apollo Micro Systems Ltd – 1D Timeframe (As of May 9, 2025)

📌 Support & Resistance Levels (1-Day Chart Analysis):

Resistance Levels:

₹137.00 – Intraday high; strong near-term resistance

₹145.00 – Previous swing high and psychological level

₹157.00 – 52-week high, major resistance zone

Support Le

See all stocks ideas

May 8

BIOCONBIOCON LIMITED.

Actual

2.81

INR

Estimate

1.39

INR

Today

ESCORTSESCORTS KUBOTA LTD

Actual

20.81

INR

Estimate

20.96

INR

Today

JSLJINDAL STAINLESS LTD

Actual

8.18

INR

Estimate

8.20

INR

Today

IIFLIIFL FINANCE LTD

Actual

—

Estimate

—

Today

MAYURUNIQMAYUR UNIQUOTERS LTD

Actual

—

Estimate

—

Today

TITANTITAN COMPANY LTD

Actual

9.79

INR

Estimate

9.73

INR

Today

SJSSJS ENTERPRISES LTD

Actual

—

Estimate

—

Today

DBCORPD.B.CORP LTD

Actual

—

Estimate

—

See more events

Community trends

Bitcoin At Big Resistance level so What Next?#BTC/USDT Update – Price at Critical Resistance

The chart structure remains unchanged from our previous update.

🔸 After entry, price dipped ~5% below our zone, but has now printed a strong bullish candle, signaling potential upside momentum.

🔸 However, Bitcoin is currently trading at the upper boun

XAUUSD Ultimate Bullish TargetsBulls - Assemble!

XAUUSD has recently shown a decent pullback. It opens new doors for all traders having a bullish view on Gold. According to my analysis, Gold is mirroring it's previous bull run moves, with a few extra volume bursts (50-100 pips) here and there.

So, the max upside potential for G

Ethereu ETHUSDT Price Outlook: Key Resistance at 2005–2055 Level"On the Daily Time Frame, the levels 2005.00 and 2055.21 are key resistance zones. If the price approaches this area, there is a high probability of rejection. Should the market show bearish confirmation on the 1-hour time frame from this region, it may indicate a potential move lower—possibly to hu

Bitcoin 101000 Target hit ,next 104800 and 107500 , How to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early

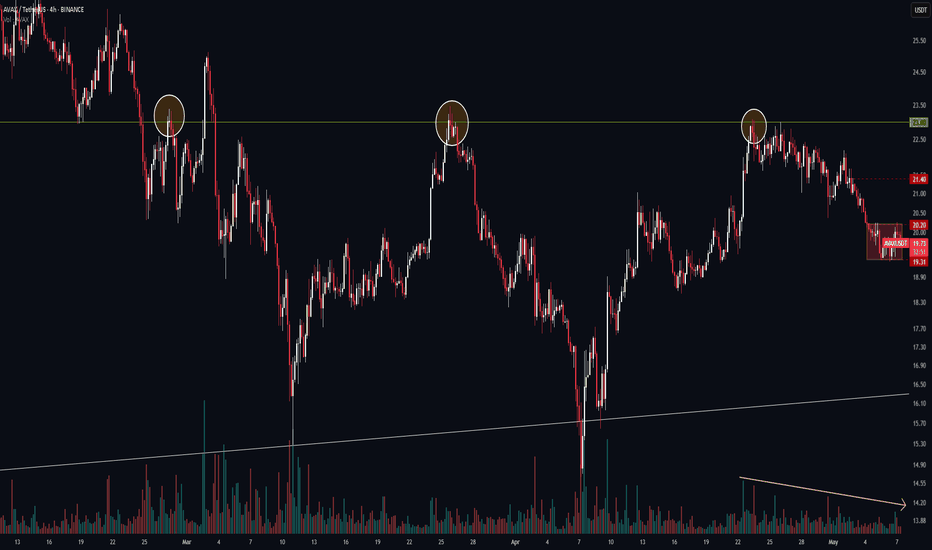

Range Ending? MWC Correction Might Be Running Out of SteamBINANCE:AVAXUSDT 4H Timeframe Analysis 🔍

🧠 Cycle Breakdown:

• HWC (High Wave Cycle / Higher Timeframe Cycle): Ranging 🔁

• MWC (Medium Wave Cycle / Mid-Timeframe Cycle): Bullish 🔼

• LWC (Low Wave Cycle / Lower Timeframe Cycle): Bearish 🔽

Right now, the HWC has little to no influence, so we focus on

Bitcoin Bybit chart analysis May 2 Hello

It's a Bitcoinguide.

If you have a "follower"

You can receive comment notifications on real-time travel routes and major sections.

If my analysis is helpful,

Please would like one booster button at the bottom.

Here is the Bitcoin 30-minute chart.

There will be an indicator announcemen

Bullish View for BTC! Expecting to break the trendline and continue its moves towards the upside easily till 100k.

However, failing to cross above 85k will invalidate this trade.

⚠️ Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Views are personal. Please, do your due

Bitcoin 4H Technical Analysis Bullish Continuation Toward $111kCurrent Price Context:

BTC/USD: $103,696.63

EMA (70): $96,211.07

Trend: Bullish 📈

---

Key Zones & Analysis:

1. RBR Zone (Demand Zone) 💙

Price Range: $95,435.39 – $97,986.81

This area is a bullish support zone where price previously consolidated before the breakout.

Potential entry/buy zo

See all crypto ideas

Ind–Pak Tension Sparks Panic! Gift Nifty Crashes 436 Points Now!Tension across the India–Pakistan border isn’t just making headlines — it’s shaking the markets too.

As per recent reports, there’s been a rise in military activity and geopolitical instability, which triggered a massive reaction in Gift Nifty.

Overnight, Gift Nifty tanked 436 points (~1.8%), with

Gold Trading Strategies, May 8-9📊From the current trend, gold is still running in the fifth wave of rising structure started from 2832. The overall trend remains bullish, and it is only a matter of time before the 3500 high is refreshed. Despite this, there was a significant dive in the Asian session today, indicating that the ris

Crude wTI levels 2nd support or resistance important in pullbackHow to take trades using Harmonic pattern projection Trade setup is explained below :-

Entry : 1st SL point : 0% is recent top or bottom.

Trailing D: 15.1% is work as trailing SL of buy or sell trade if hit then we have to book profit

.If price goes below 2nd D 22.5% to 24.5% range then early

Gold Trading Strategy for 09th May 2025🌟 GOLD INTRADAY TRADE PLAN 🌟

(Based on 15-Minute Candle Strategy)

📈 Buy Setup (Bullish)

➡️ Buy above the high of the 15-minute candle

✅ Entry Trigger: Candle closes above 3339

🎯 Targets:

• 3407 🥇

• 3417 🥈

• 3427 🥉

🛡️ Stop Loss: Below 15-min candle low

📉 Sell Setup (Bearish)

➡️ Sell below the low o

XAUUSD/GOLD 1H SELL PROJECTION 08.05.25Bearish setup on XAUUSD (Gold vs. USD) with a strong indication for a potential short/sell opportunity based on several technical signals:

Key Observations:

Three Black Crows Pattern:

Clearly marked and highlighted on the chart.

This is a classic bearish reversal pattern indicating strong selling

Gold falls after FED news, cautious buying powerWorld gold prices retreated to $3,370/ounce, down more than $25 from last night's peak. The H4 chart shows a sharp decline that broke through the EMA34, currently testing the EMA89 - a signal that profit-taking pressure is increasing after the previous strong bounce.

The FED kept interest rates unc

GOLD – BREAKOUT OR TRAP BEFORE THE WEEKEND?📊 GOLD – BREAKOUT OR TRAP BEFORE THE WEEKEND?

The gold market is showing significant liquidity sweeps this Friday. In the early Asian session, price pushed down to the 327x region, collecting liquidity, before swiftly rebounding. On the M30 chart, multiple Fair Value Gaps (FVGs) have formed and bee

(XAU/USD) Bearish Trade Setup – Targeting $3,222 with 1:6 Risk/R(Sell) setup.

Entry Point: Around 3,409.33 - 3,408.41 USD.

Stop Loss: 3,437.87 USD.

Target (Take Profit): 3,222.53 USD.

Risk/Reward Ratio: Approximately 1:6, which is favorable.

📉 Price Action & Trend Analysis:

A rising wedge (or channel) appears to have formed and broken to the downside — a be

See all futures ideas

good morning trader date 08-05-2025 exit buy posotion because of market change character

1)one trade are loss

2)yellow horizontal line is exit position buy side but but this not give a time to exit that why lot of pipes loss there 😊

tip: somtime i also loss and mistake please not down and dont repeat again

NZDCAD - CAUGHT IN THE MIDDLE, INTRA-RANGE TRADINGSymbol - NZDCAD

NZDCAD continues to exhibit strength within a broadly neutral trading range, supported in part by a corrective pullback in the US dollar. However, the sustainability of this momentum remains uncertain as market participants await key upcoming events, including the FOMC meeting and a

Buy Trade - AUD/JPYGreetings to everyone!

Place a buy trade on AUD/JPY and check out my chart for the ideal entry, stop-loss & target placement.

Remember :-

* Move your SL to breakeven once the trade reaches 1:1.4 R.

* Aim for a minimum reward of 1:1.5 R.

* Don't risk more than 3% of your total margin.

Let's exe

USDJPY Cup & Handle – Eyes on 147.883Entry Point: 143.525 (unchanged)

Stop Loss: 141.847 (unchanged)

Target Point One (TP1): 145.063 (unchanged)

Final Target (TP2): Now refined to 147.883 instead of 147.894 — a small, precise update.

📈 Pattern and Structure:

Cup-and-handle formation still intact, indicating a continuation pattern.

USDCHFMULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest yo

EURUSD NEXT POSSIBLE MOVEVANTAGE:EURUSD

EUR/USD Intraday Analysis – Key Zones to Watch

The market structure for EUR/USD on the 15-minute chart presents a well-defined range with key trading zones.

🔸 Sell Zone – The price is currently trading near this zone, indicating potential short opportunities if bearish pressure i

Gbpaud will go down ? currently runninng under resistance.Gbpaud will go down ? currently running under resistance. that's why I'm interested in selling

and in 1h timeframe there is a small bearish move

daily closed candle is rejection ?

i don't have confidence in this pair. I'm just following the trend

AUDNZD 2H Chart Analysis – Trendline Break + Supply Zone Rejecti🧾 Market Context:

Pair: AUDNZD

Timeframe: 2H (2-Hour)

Overall Bias: Bearish

Setup Type: Trendline Break → Lower High Formation → Supply Zone Retest → Bearish Continuation

📊 Technical Breakdown:

🔸 1. Trendline Break:

A steep ascending trendline has been broken decisively, marking a clear end of b

See all forex ideas

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.